This article summarizes the midnight madness and regulation that concluded with a massive fine for the Kraken exchange, and a ban on staking as a service for Americans. Once again, our regulators have decided that a proactive and guided approach is not in the cards.

Regulation: Staking as a Service Banned for Kraken Exchange

On the 8th, the CEO of Coinbase Exchange, Brian Armstrong, sent out a cryptic tweet regarding a potential FUD event [tweet]. On the night of the 9th his suspicions were confirmed with the American Securities and Exchange Commission announcing a 30 million dollar fine, and subsequent ban on staking for the Kraken exchange. Staking as a service, when utilized by a reputable, licensed, and insured entity can be a great way for investors who are not comfortable with self-custody to achieve crypto exposure.

For those who are not familiar, to stake with a network correctly, you will need a compatible wallet. Once this wallet is established you will need to have cleared assets on an exchange to send to said wallet. Once the funds arrive, you need to make sure you have the correct token for chain-based gas fees. If you do not have the gas fee token, you will not be able to interact with smart contracts. Staking a token goes through a verified smart contract to return a reward over time to the investor.

As an example, say you have done your research on Polygon’s MATIC token and you want to help secure the network with staking. You will need to have cleared MATIC on an exchange, as well as some Ethereum in your already established crypto wallet. Once you have this completed you will need to connect your wallet to the Polygon Ethereum main net. After connection, the user will allow a smart-contract to stake tokens for a yield over time. All stakers delegate their tokens to a validator who keeps the network decentralized and secure.

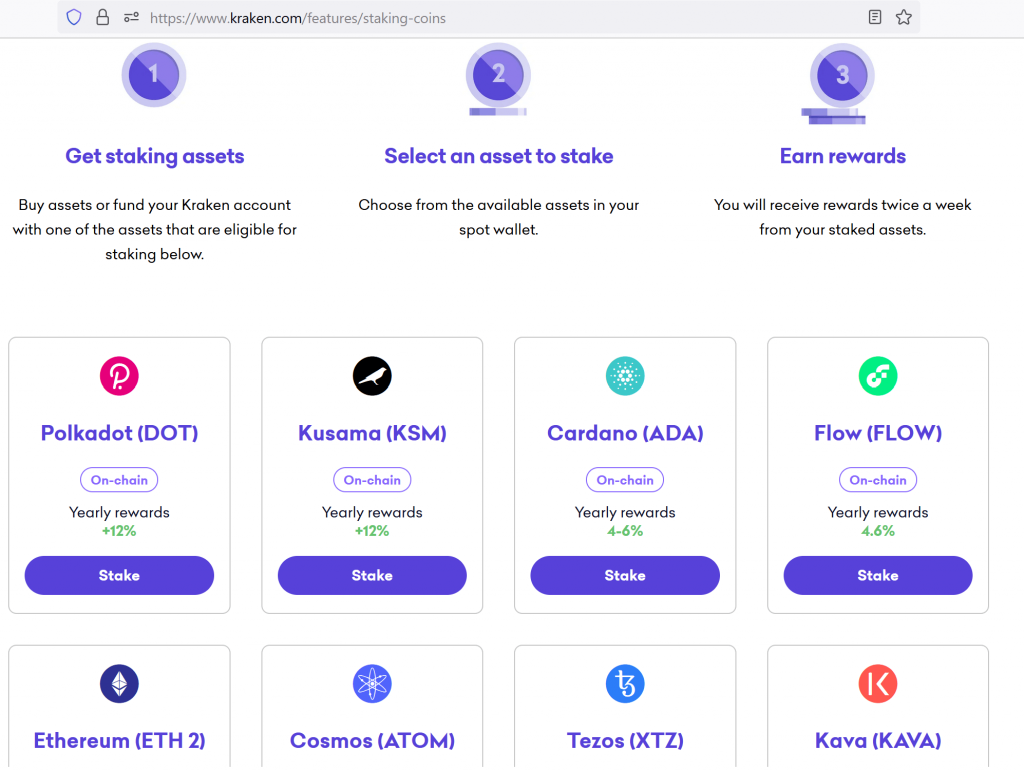

In order to avoid all of these hassles many newer crypto investors chose to stake on the Kraken exchange. Kraken previously allowed most of their tokens to be staked and unstaked freely without the frontend user having to experience the headaches of staking directly on the network. Kraken was able to do this because they have a large pool of liquidity that allows users to immediately receive their funds at a whim.

What the SEC could have done to embrace innovation would be to proactively work with well-established exchanges. They could have provided forward guidance and direction about what safe staking as a service should be. Exchanges could show proof of reserves, have insurance, and issue well thought out disclaimers to investors. Instead, true to SEC form, they chose to rule through litigation using 80 year old court case studies.

Not only was this uncalled for, several workers at the SEC disagreed with the decision, including Hester Pierce [1]. On top of this regulation the SEC is actively attacking stablecoin issuers rather than providing guidance and insight. There us a lot of turmoil to come, this is a mixture of FUD and actual negative events. The one thing that makes the least sense to professionals in the market is the sell off of Bitcoin.

Do remember that Bitcoin has been stated by Gary Gensler to be a commodity, and currently is the only digital asset safe from negative regulation. Bitcoin also uses a proof-of-work model and cannot be staked, the network does not use staking. Selling your Bitcoin because of staking and stablecoin news is the opposite of what should be occurring.

Only Bitcoin can hedge against bad policy and government overreach. We also predict that users will flock to decentralized liquid staking such as Lido Finance for Ethereum. These same users will likely start using centralized exchanges less often and Uniswap and derivatives instead. Please remember that none of this is financial advice. I believe Bitcoin dominance will rise in the coming weeks and most altcoins will be decimated for a while, hedge your risks! For a safe strategy to approach your savings this year check out our article on Money Markets [here]. Stay safe out there!