This article introduces Hammond Power Solutions, a small cap Canadian transformer manufacturer. A thesis regarding the electrification and electric vehicle market is presented as well.

What is Hammond Power Solutions?

Hammond Power Solutions (we will call it HPS) is one of the largest manufacturers of dry-type Transformers. Transformers help adjust electrical power from large to small scales, allowing huge powerplants to be reduced to powering individual homes. HPS is stationed in Canada but has a global presence throughout North America, Mexico, South America, and has also expanded into Africa, India, Europe and more. The company now has 9 warehouses in Canada and the US and sells products in an ever-expanding market. HPS offers custom transformers and has been in operation for over 100 years [1].

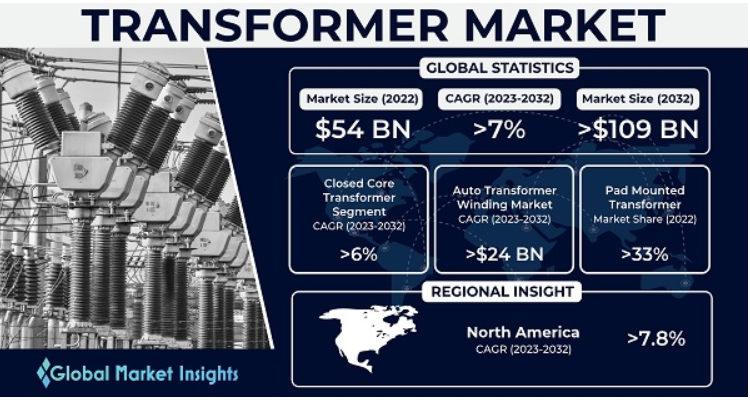

The transformer market is expected to grow two-fold from 54 billion in 2022, to 109 billion in 2032 [2]. This growth presents an enormous opportunity for investors if they can find the right place to park their money. Why is this market growing so quickly? The answer is electrification, as economies grow more modern, greater power grids are needed to compensate for that growth. As the demand for high-quality transformers grow, a look into their historical use is needed.

Transformers Are Needed

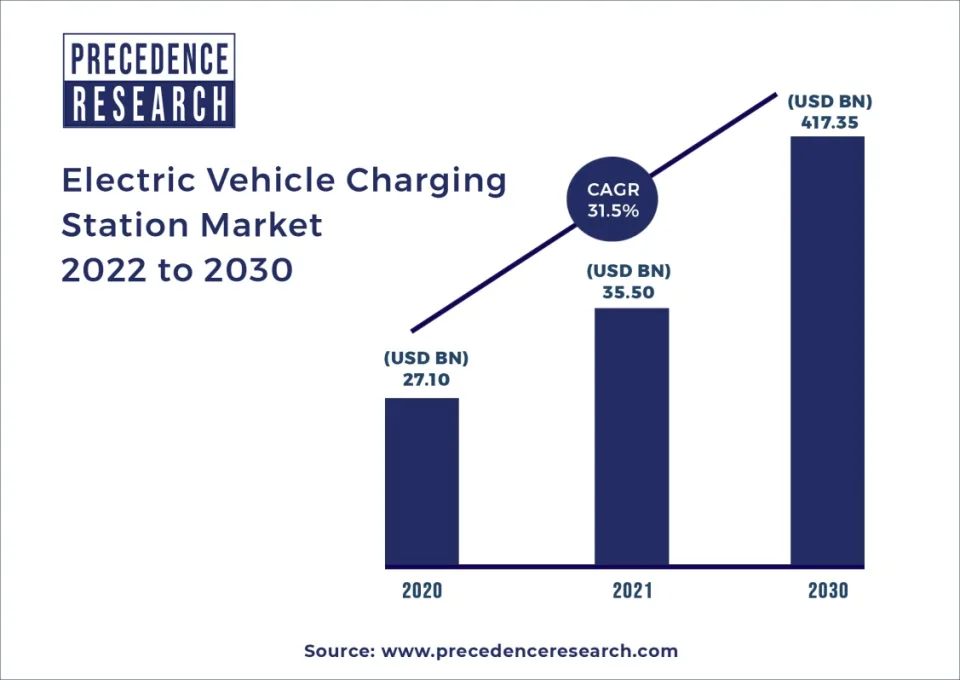

According to Bowers Electrical Ltd, the average life expectancy of transformers used to be 20-40 years [3]. In the past a transformer for an area was a once or twice in a lifetime investment for many companies or municipalities. Traditionally transformers take the nighttime hours to cool down after a long day of heat generation through heavy loads and usage. This cool down time is being reduced as our grid expands and nighttime electrical usage increases. The electric vehicle market is a large culprit of this increased usage on previously off hours.

With the electric vehicle charging station market expected to grow from 27 Billion in 2020, to over 400 Billion in 2030, this need for transformers is already upon us [4]. Enter Hammond Power Solutions, HPS provides a solution from an ever-growing company that is still in its public infancy. HPS stock is currently only available over the counter which means you either need to be a large investor calling a broker firsthand, or you need to pay a premium fee to partake.

HPS Thesis

With my ever-growing interest in Canadian small caps, Hammond finds itself in a great spot for driving this key narrative. Not having to pick the next Tesla or involve myself with investing in non-profitable and speculative businesses, this indirect route presents an infrastructure play for the future. This also allows investors to potentially skip the charging station market which has poor stock performance lately. Canadian small caps present a unique opportunity in that many large investors are not allowed to purchase these small companies.

They also start off not listed on the NYSE or other major exchanges. This allows the savvy investor to average in very early into high quality companies before they catch on. Keep in mind many of these stocks are low liquidity and not easily accessed. Canada also tends to prevent non-profitable companies from going public, they have a lot more scrutiny than American markets which are filled with vaporware tech companies and non-sustainable models. This equates to higher overall quality of small cap companies over time.

The most recent financial results for HPS have been outstanding to say the least. Record sales were just recorded for Q3 with a 20.5% growth year-over-year. The company also boasted a 25.2% increase in net income, a strong EPS increase, and an order backlog increase of 11%. These results show a strong demand for Hammond products and the company continues to be run like a well-oiled machine.

In my time researching longer timeframe to hold stocks, the HPS management team continues to stand out. The stock price has grown favorably with the positives mentioned above, and the company now its at a market cap of over 500 million. This market cap is the sweet spot for me personally as this is a 4x from a 2-billion-dollar market cap, stocks tend receive notice from larger institutions when they break the billion dollar threshold as well. In Part II I will review the stock in more detail and elaborate on some of the complexities.

Check out this [article] for another thesis on electrification.