Akash is a cloud based solution built within the Cosmos ecosystem. The network allows users to own, rent out, and buy cloud cloud space in a decentralized way.

Akash: Cloud Infrastructure

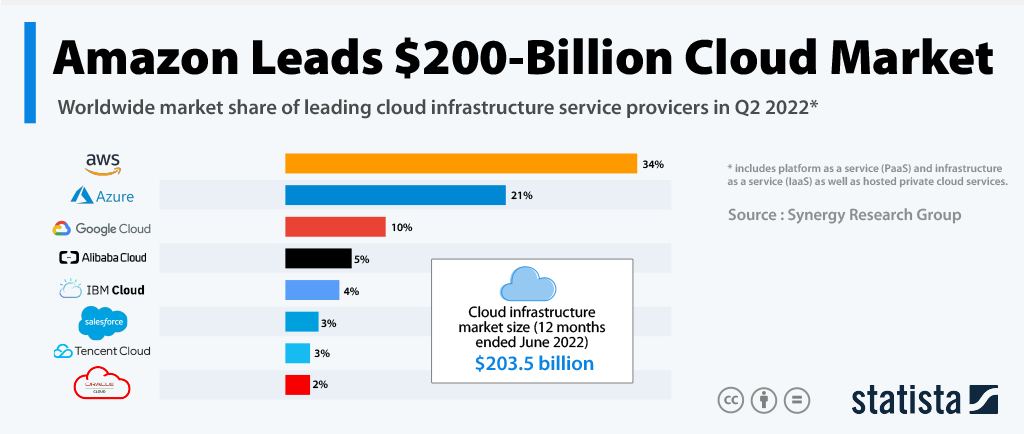

Looking at the picture below, it is apparent that the current cloud market is not only massive, it is very centralized. Three companies own 65% of the current market, allowing these titans to set the price. Akash offers a solution to this problem. The network allows users to access cloud storage in a readily scalable manner, often offering up to 85% less expensive cloud storage. How do they do this? [1]

Users of the network can own segments of cloud infrastructure, and sell out their unused storage space. Both the purchaser of the storage and the owner of the cloudspace benefit from the ecosystem. Users can purchase their own cloud, and rent out their excess storage space. Not only is the method more efficient, but it helps build a peer to peer ecosystem based around the AKT token.

AKT Token

If you have read my thesis on Injective[here], I believe AKT will provide a similar monetary system for the Cosmos. Since the ATOM token has done little to provide a token of value to the Cosmos, competition is on the rise. The AKT token allows users to vote on the future of the network. Users can also stake tokens for security and to earn rewards. The token incentivizes network participants, and provides a system of value and exchange. Proof-of-Stake mechanisms allow validators to secure the network on a large scale.

Smaller investors can delegate their stake of AKT to a chosen validator for a given yield, validators charge a small fee for this reward. Users holding tokens in their wallet can vote on inflation rates, and future improvements to Akash. Since I believe AKT will behave much like Injective in that it will become a reserve currency within the Cosmos, this is very bullish indeed. Since Cosmos is the go to interoperability network, meaning any chain building on Cosmos inherently has access to all of the other chains built on Cosmos, the network effect is potentially very large.

Since Cosmos already boasts a total market cap of almost 70 billion dollars leading into a potential bull market, both AKT and INJ have extreme potential. As artificial intelligence and technology as a whole evolve, more and more compute space and cloud infrastructure will be needed. Being able to rent out cloud space to large players in the emerging technology markets will be incredibly lucrative.

Akash Network

The Akash team points out that the network can reach the untapped potential of nearly 8.4 million data centers globally [2]. These data centers alone have massive reserves of unused cloud space ready to be brought into the ecosystem. Private users can also create smaller data centers in basements and office spaces to participate in the network. Since Akash can run any cloud-native application, this saves time for users and developers alike.

When it comes to security the network functions a lot like Bitcoin, since more staked AKT is proportionate to higher levels of security. More tokens staked also leads to higher AKT value over time. Many upgrades were introduced during the AKT 2.0 proposal, these changes focus on bringing further value and utility to the token. Mainly, maker and taker fees, a system for stable coin payments to start a new hosting setup, and an updated incentivized distribution pool.

These pools allow the network to vote for other tokens that can be utilized as incentives for network participants. All fees denominated in non-AKT tokens are immediately swapped to AKT and then burned from existence. This adds a deflationary metric that expands with network usage, a popular strategy among fundamentally sound networks. In part two I will analyze the AKT token using my scoring system to evaluate how strong the token economy for AKT. Thanks for reading, stay safe out there!