After surviving two crypto bear markets, I have developed a strategy for taking profits during bullish trends. Since I believe we are entering a crypto bull market next year, this strategy is aggressive and provides some security with major upside.

Risk Categories

For those who are new to entering a crypto bull market you have to realize that all of this is considered high risk, none of this is financial advice. Over 85 % of crypto market participants stated they did not take profits during the last bull market, they watched their gains drop to 70, 80, or sometimes 90+ % losses. I should also point out there is definitely context as to when you may or may not have entered so I will break that down as well. Let us make three risk categories. Low risk (just kidding you’re in crypto its high risk), for this level its probably best to just average into the majors and look away until Bitcoin at least crosses 60k.

For this low risk category, do your own research, maybe buy into Bitcoin and 2-4 other large cap tokens (Top 10-30 tokens by market cap). On this risk tier you do not need to make a complicated strategy, simply sell 50% of your gains into cash, stable coins or Bitcoin when Bitcoin reaches 60k. Remember the goal of most of this is to either accumulate a bunch of cash, or more Bitcoin than just holding Bitcoin outright. Your risk is also weighted by when you got in this year (2023). If you started buying in Q1 your risk is reduced by a 50%, Q2 25% and Q3 10%. Anything after October heavily increases your risk.

For both the medium risk and high risk market participants I will draw out my 33% profit taking strategy. Medium risk participants have less Bitcoin on the books and are knee deep in a variety of large cap and medium cap altcoins (less than 2 billion market cap). High risk is those who are willing to hunt for small and micro cap tokens, these are the most risky but provide the major upside you hear about, those stories of people flipping 500$ into 2 million, the probability is low. This is the exact reason I have developed this simple strategy, and I stand by it.

Profits & The 33% Rule

Looking at the 3ull chart above, a perfect example is drawn out. This is an actual setup I played out in real time on Trading View. The dotted green line was my initial entry, I took my Avax tokens that were on an uptrend and just as they started to lose steam I bought into 3ull on chain. After a week or two, my initial investment reached my golden number, a 5x. I sold 33% of my total tokens, this fully covered my initial investment. You have multiple options here, I chose to swap back into Avax, but stable coins or Bitcoin are fine here as well.

Lets outline an example. A 1000$ initial investment buying in at .0017, the first sell of 33% at .0087 fully covers the initial 1000$ plus another 650$ or 65%. My next profit take is a 2x from the first sell target, or a 10x in total. This token has not reached this second price target yet. This target of .0174, I sell another 33% of my total tokens, not 33% of the remaining tokens. So this provides another 3,377.6$ of profit and I have my final 33% of tokens remaining. With an initial 1000$ investment we are up 5027$. We let the rest ride until euphoria hopefully.

This strategy allows me to accrue one of my core investments, Avax. This can be used on any chain and in any ecosystem. I choose to accumulate these core altcoins because I have spent years doing research to develop my large cap list which I have shared publicly multiple times. The final 33% I let run during the majority of the impending bull market, if the second profit take or third go to zero my initial investment is safe and I have a 65% profit. You simply cannot make these gains in the stock market, this is why crypto is so important. The chart below is not in order of holdings value.

Profit Taking Core Investments

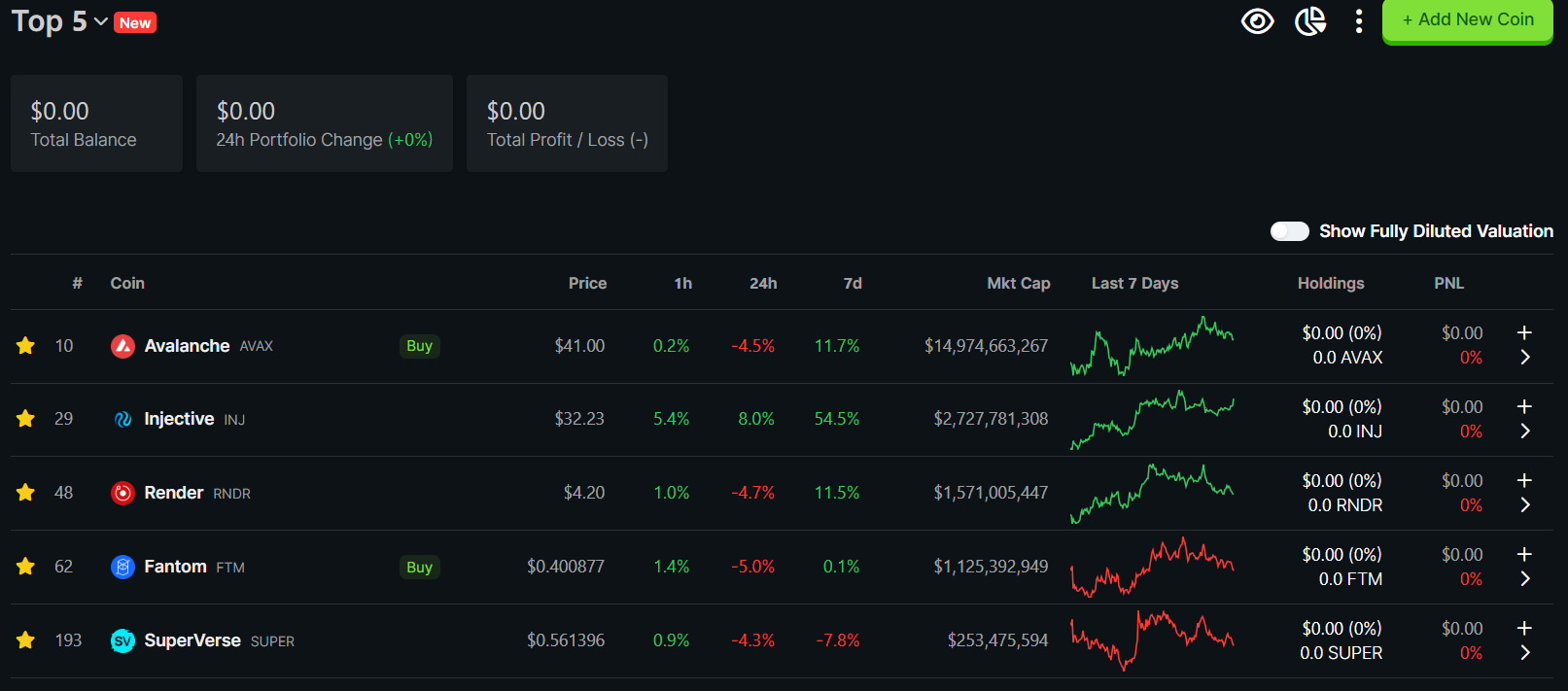

What do I do with my core holdings? For those who are not aware my top five investments heavily outweigh all of my other holdings in the altcoin world. I choose to take profits into these five tokens for the most part as I believe they hold key narratives for the future. I do not plan on selling any of these tokens until Bitcoin reaches new all-time-highs.

I tend to use my 33% strategy on the layer-1 chains you see here plus Arbitrum since it easily connects to Avalanche through Trader Joe. When the Bitcoin market gets overheated I will cash out, wait for the next massive Bitcoin crash and buy as much Bitcoin and mutual funds as possible. This is my personal strategy, I do this to enhance my total Bitcoin and cash holdings. Never realizing profit is a sure fire way to get rekt in these markets, and there is no regret worse than watching a 25k investment go to 500k then back to 50k. Stay safe out there fam! Follow my trading view [link] for momentum/narrative trades and keep reading for fundamental investment articles. For another article on profit taking from MoC check it out [here].