This article compares the Vanguard Money Market accounts to the traditional savings accounts. With record breaking inflation, 2023 has brought us higher yields, and the cost of debt has risen in tandem.

What is Money Market?

I would like to start that I am by no means a bond purchaser under normal circumstances, or any asset similar to bonds. With inflation over 6%, short-term bond yields far outweigh sitting in stagnant non yielding cash. According to FDIC, the average interest rate of savings accounts with a balance under 100,000$ is a measly 0.06%. We tried buying short term-bonds a few months ago since the yearly rate was over 4%. The downside of this strategy is that as the FOMC increases rates, your bonds become inferior every month [1].

This is where Money Market comes in. Vanguard is our ideal pick here since they have the lowest management fees and have a long history of quality and customer satisfaction. Vanguard accounts can be treated exactly like a savings account. Users can open an account, whether it be a personal trading/investing account a 401k, or a savings account. Users who opt for the trading account, will automatically have any cash they put into the account settle within a Money Market account.

This means that any investments that are sold over-time automatically settle at the over 4% interest rate. Remember, you are taxed on your yield in your savings account, so you might be taxed on this yield as well. This depends on which fund you select and the holdings within the fund along with your individual state tax laws. Please seek out a professional for advice regarding this potential tax.

Money Market managers typically invest the settled account money into less risky types of investments. Examples include repurchase agreements, US Bills, CDs, commercial paper, and Treasuries. There is a distinction between Money Market accounts and Money Market funds themselves. Money Market Funds are insured by the FDIC and are only offered by accredited financial institutions.

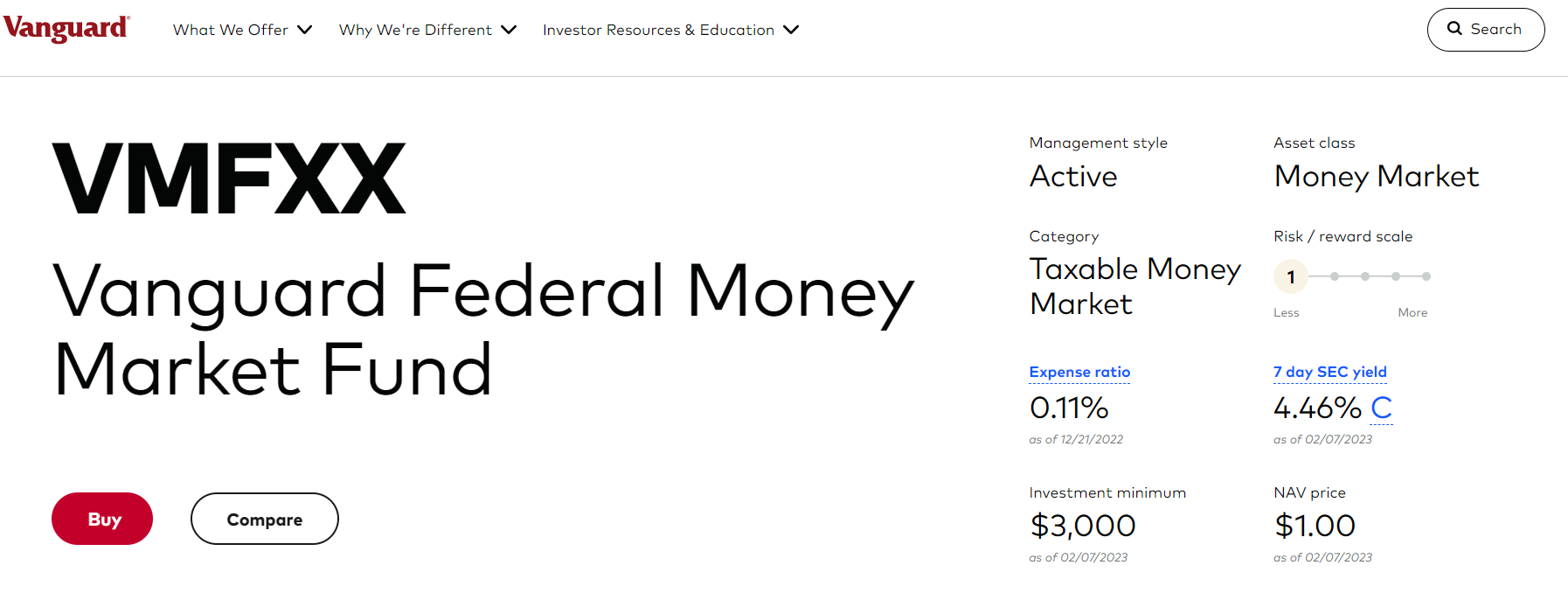

Money Market funds offer a low barrier to entry, sometimes as low as 3,000$, this is similar to many popular Vanguard mutual fund minimums. I use the VMFXX that comes with a personal investment account. You can easily convert these accounts into 401ks that have other tax advantages as well, just realize there will be a large penalty if you withdraw before retirement age.

Money Market Risks

Risks are variable depending on who you speak to. Larger investors would consider a management fee a risk, the fee is 0.11% for the manager who handles the account itself. Vanguard usually has the lowest fees of any fund manager/institution. Another risk of these funds traditionally has been that some institutions invested in a more risky manner than they should have. More risky strategies involve purchasing debt from non-governmental institutions, and lending money to for profit companies. When opening an account it is important to look into which company holds the fund, as well as which assets are within the fund itself.

There have been a few occasions in history when certain institutions such as Lehman have lost investors cents on the dollar due to engaging in risky practices. This particular fund is of the government category. This means that 99.5% of the fund has to always be held in cash, US government securities, other cash like assets that are federally insured [2]. Please remember that none of this is financial advice, we are here to share our story on the path to financial freedom and wealth. Since a lot of what we preach and teach is not taught in school we view it as something the world needs a little more of. Stay safe out there!

For an article on adding leverage to your trades check out our beginner article on options [here].