Thorchain has built a decentralized cross-chain infrastructure and is secured by its native token RUNE. The network currently integrates 8 popular blockchains, and has a suite of products focusing on ease of use.

What is Thorchain?

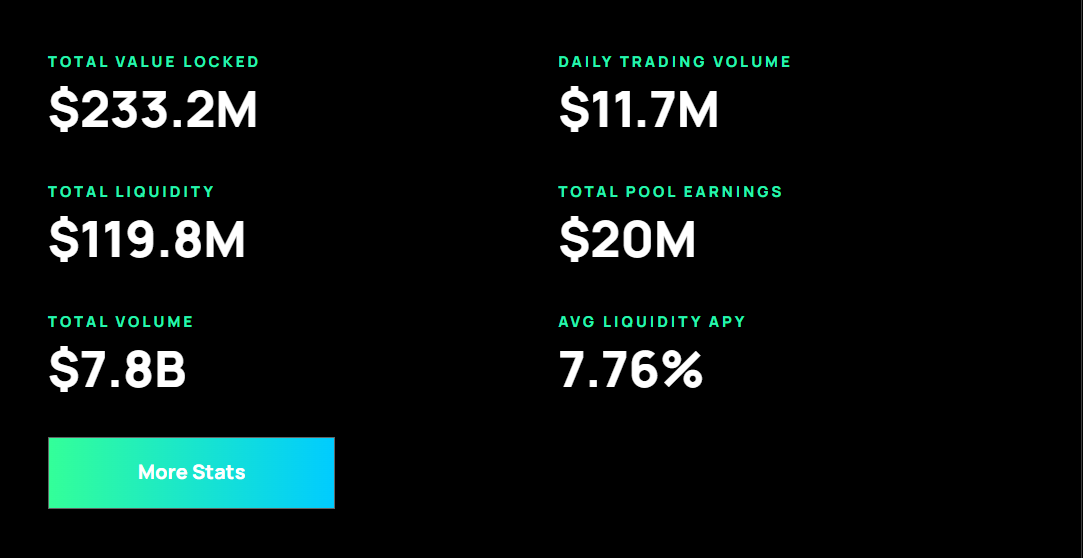

Thorchain is a tried and tested multi-blockchain network that allows value transfer with native asset finality. What this means is that users can swap BTC on the Bitcoin blockchain, for ETH on the Ethereum blockchain, or AVAX on the Avalanche blockchain etc. Rather than finalizing a swap in a wrapped asset, the end users receives the native token on the blockchain of interest. The infrastructure allows not only cross-chain swaps, but also dual liquidity, vaults that provide yield, and Dex aggregation [1].

The only requirement for a cross-chain swap is the network fee on the initial blockchain. Swaps maintain self-custody smart contract language and liquidity on the network is transparent and always visible. The network also has “saver vaults” which allow users to deposit layer-1 assets to receive more of that asset as yield over time. This single-asset liquidity avoids impermanent loss that dual token liquidity commonly suffers from. The final piece of the picture is where the RUNE token comes in.

RUNE is needed for node operators to participate in the network directly. The bond in RUNE tokens must be more valuable than the assets that are secured by each given node. This single-asset liquidity model, with open source code, provides a relatively safe environment for real-yield on blue-chip digital assets.

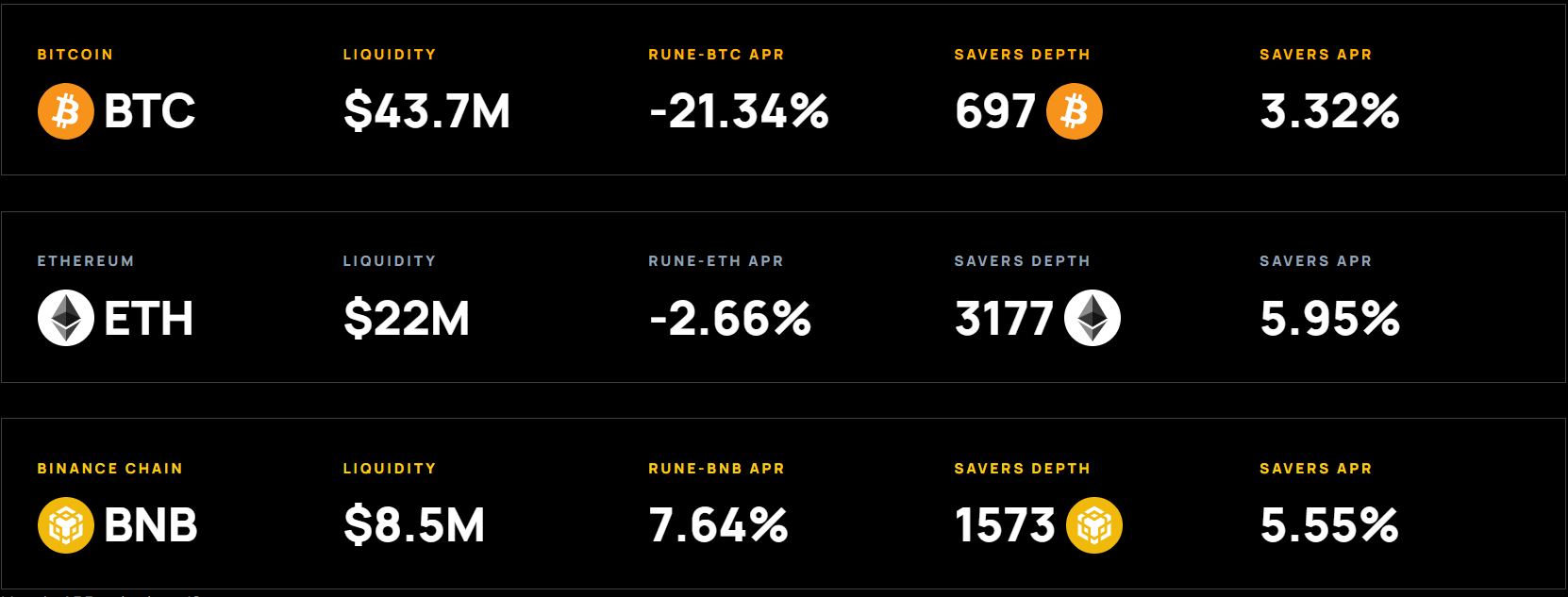

Thorchain Economics

Since the network has been around for going on four years, the code has been heavily audited and has been vested. Users who want a reliable yield on an asset they are already bullish on have trusted the network as a solid option. This yield comes from a percentage of the cross-chain swaps. At the end of each block, 50% of the fees are used to purchase assets and reward then to savers.

Since these savers are not forced to have RUNE exposure, the yield is what is known as real-yield, or yield that is in blue-chip digital assets derived from protocol revenue. Many tokens fail to provide a strong economy because the reward comes from native token inflation, RUNE does not fall into this trap. Savers can withdraw their assets at any time without the need to take a risk of a long-term lock period [2].

Thorchain does also have standard dual token LPs which carry higher risk, but also higher reward. LPs must pair with RUNE as a settlement asset. This means that RUNE is the middle-layer asset for all swaps. If you were to trade BTC for ETH, it would first swap to RUNE to carry out the cross-chain portion of the transaction. RUNE uses the proof-of-stake consensus that Cosmos is famous for. For an article on the important of Cosmos for interoperability, check it out [here]. RUNE nodes are incentivized when the network is under bonded, if it is over-bonded LPs are incentivized to provide more assets to the pool [3].

Expanding Ecosystem

The network has 41 applications/services in the ecosystem, these include Dexs, wallets, DeFi services and more. Popular wallets such as Trust wallet and Ledger have integrated with the network. The ecosystem has multiple DAOs, aggregators, and exchanges. An analytics platform has been built and tested over the years. We have been following Thorchain for years and are continuing to search for the value tokens within the Cosmos.

If you have read our articles on Injective you will know we swapped some ATOM for INJ, and we are looking to do the same for RUNE. Both tokens do a better job at creating value within the Cosmos than ATOM does currently. In our next article we will analyze the RUNE token and give it a score based on several factors. Please remember, none of this is financial advice, stay safe out there!