This article covers a few key updates to Equal that are important to review. The team continues to execute throughout the bear market into this upswing around the holidays. For transparency I have farmed and owned Equal all year.

Equal Recap

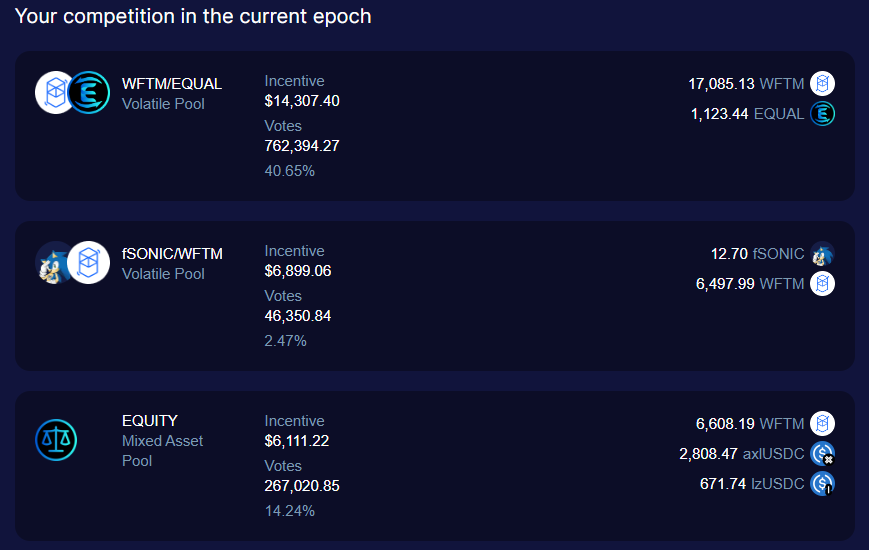

Equal is a perpetual decentralized exchange (Dex) on both the Fantom, and Base (From Coinbase) blockchains. The application focuses on consistent and fair fee structures for swaps, as well as allows projects to directly incentivize liquidity providers through what is known as bribes. The team has pointed out that very low fees does the community a disservice unless the volume is extremely high. Therefore the Dex charges .2% for volatile pairs, and .02% for stable pairings. For our initial analysis article, check it out [here].

With this consistent fee structure, the network can support the liquidity needed to keep slippage on the lower end long term. Why pay .001% swap fee if your going to pay 3-5% in slippage, its a real problem in a lot of crypto ecosystems. Equalizer provides a unique NFT locking mechanism for those who choose to utilize the token. Equal can be locked into this NFT and staked long-term for chosen rewards which are voted on a weekly basis.

This allows ecosystem projects to provide rewards (bribes) which can be farmed with the veEqual NFTs. Over time, the voting power for these NFTs drops to prevent single whales from hoarding all of the rewards. This expands on the Uniswap system since the token is not simply used for governance. The token utility is that of a low circulating supply bond type investment that provides rewards over time, but also incentives continually max locking the token.

Equalizer Updates

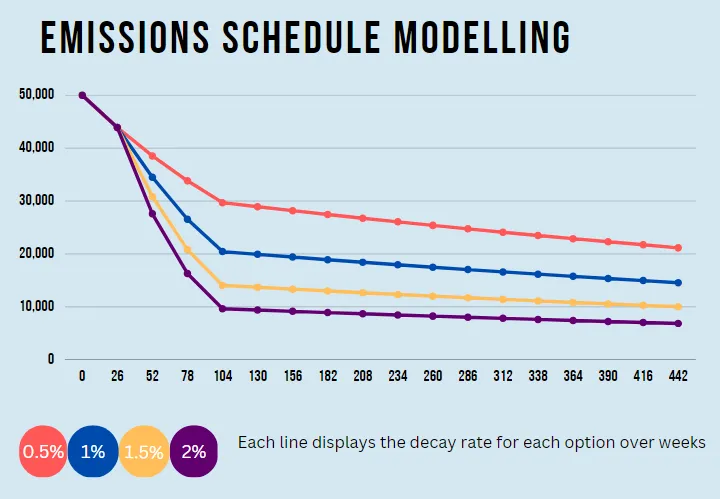

Perhaps the most bullish change that the team has made is the update on emissions decay. This medium [article] covers the changes in detail. Essentially a previous .5% emission has been increased to 2% per week. This change cuts the emissions by 39% for 73 weeks following the update in June. This reduction of inflation rewards existing lockers and promotes less dilution of shareholder value. Below is an image of the differences between decay rates, a massive difference between .5% and 2% is noted.

Adding to this, the network has agreed to part with an additional 2% of emissions to the treasury, and 1% to the main WFTM/Equal pairing on a weekly basis. Treasuries are important as they allow future incentives and partnerships which are key to expansion of the ecosystem. This year the team has also expanded to another blockchain, Base. This Coinbase owned layer-2 will likely draw institutional interest over-time as regulations become more clear in the ongoing legal battle.

The base token, “SCALE” is very similar to Equal in characteristics so I will not go over it in detail in this article. The important detail is that the team has stood by the no rebase model which allows all participants to obtain a nice slice of the rewards if they lock a veNFT. In my first writing on Equal I did receive a little flack because I referred to a lot of the products on Equalizer as perpetual like products. The team had confirmed this was the correct way of thinking as the value perpetually changes over time similar to futures.

Enter Equity

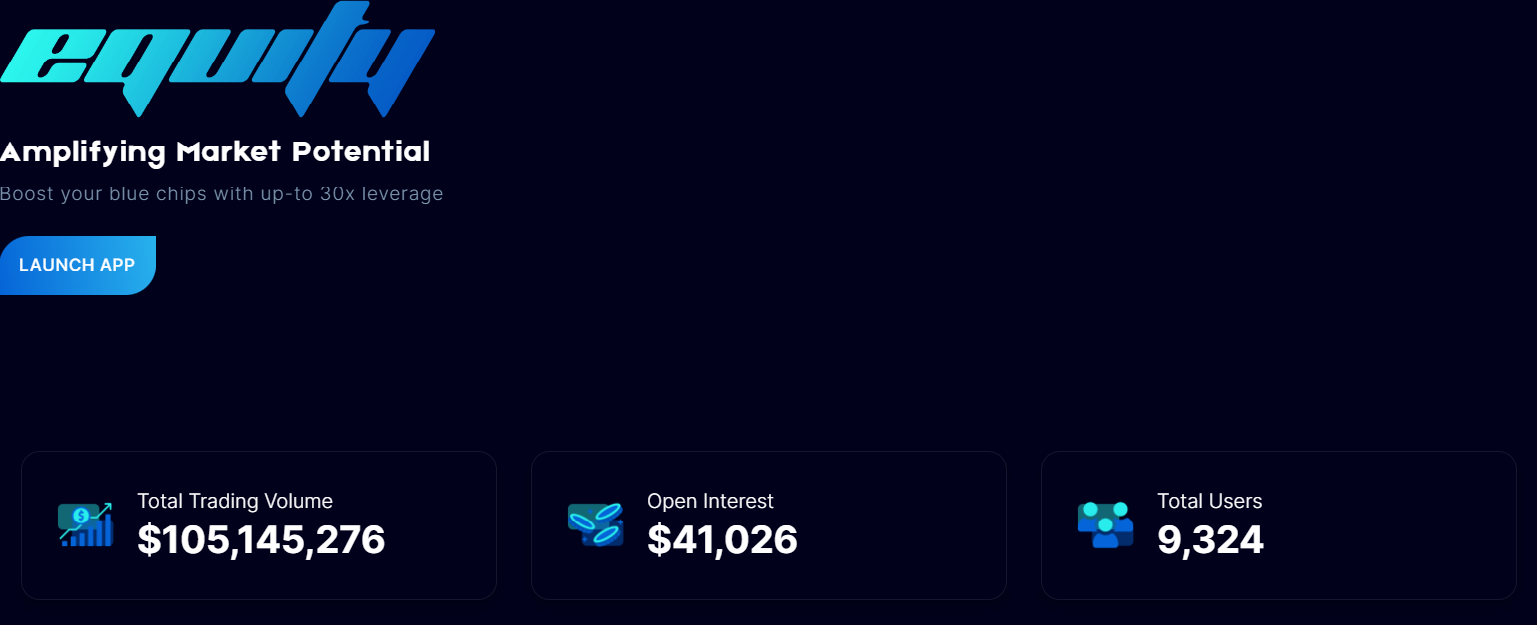

Equity is the newest addition to the ecosystem and aims to provide the following. It is both a product and a token.

“Equity rewards our veEQUAL NFT holders with the fees stemming from Four Sources: [1]

- Market-making (Liquidity Provisioning)

- Spot Trading (Simple Exchange)

- Flash Loans (Instant repayments)

- Derivatives Trading (Perpetual Swaps)”

This GLP (From GMX) like product allows users to provide liquidity to the pool with a single-sided mechanism. This prevents dual-token impermanent loss which is the main risk from standard liquidity providing. For example, say you are bullish on FTM and the Equal ecosystem. You can provide FTM to the pool receiving Equity and staking it. If the ecosystem value grows from fees and or FTM price rises, the value of the initial investment rises.

During this rising value, fees are collected. Since traders on average tend to lose most trades, losing trades are bullish for Equity holders. This does not come without risk as large whales winning can temporarily reduce most of the rewards, this happens on GMX every once and a while too. Imagine this is a public company, this is how Binance and other perpetual market companies make money. Instead of being private, Equity holders can take home a slice of the revenues created by the trading on the platform. These revenues are what is known as “real yield” since the yield comes in the form of the underlying traded assets, not simply by inflating an ecosystem token.

Now why not just go with GMX? I do hold GMX, and am bullish on the token as well as the Arbitrum ecosystem. From an analytics standpoint, the Equal ecosystem is simply better mathematically. Perp trading on Arbitrum is very expensive because Ethereum layer-2s simply cannot compete with Fantom scaling. If we can see a rise in liquidity on Fantom during this impending bull market, I think the projects on Equalizer will continue to perform very well.

I have spoken to the team and interacted on discord a few times and the community is great, the tokenomics have increased, I stay bullish. My update on the Equal token scoring is now a 8/10 (up from 7/10) only hampered by no FTM listing on Coinbase. I foresee a 50 million dollar market cap by summer if BTC behaves itself, this is another 10x from here. Remember, none of this is financial advice, stay safe out there!