The Avalanche ecosystem is revolutionizing the blockchain industry with the launch of its groundbreaking Spruce Network and Evergreen Subnets, both designed to cater to institutional blockchain deployments. This development has garnered attention from prominent institutional partners, such as T. Rowe Price Associates, WisdomTree, Wellington Management, and Cumberland, and is poised to accelerate institutional adoption of blockchain technology and DeFi applications.

Avalanche subnets have created a powerful way for a low risk entry into the blockchain space. With major players such as Goldman Sachs, JP Morgan and others already having well established roles in the blockchain industry it was only a matter of time until one network emerged as a home for major institutional adoption.

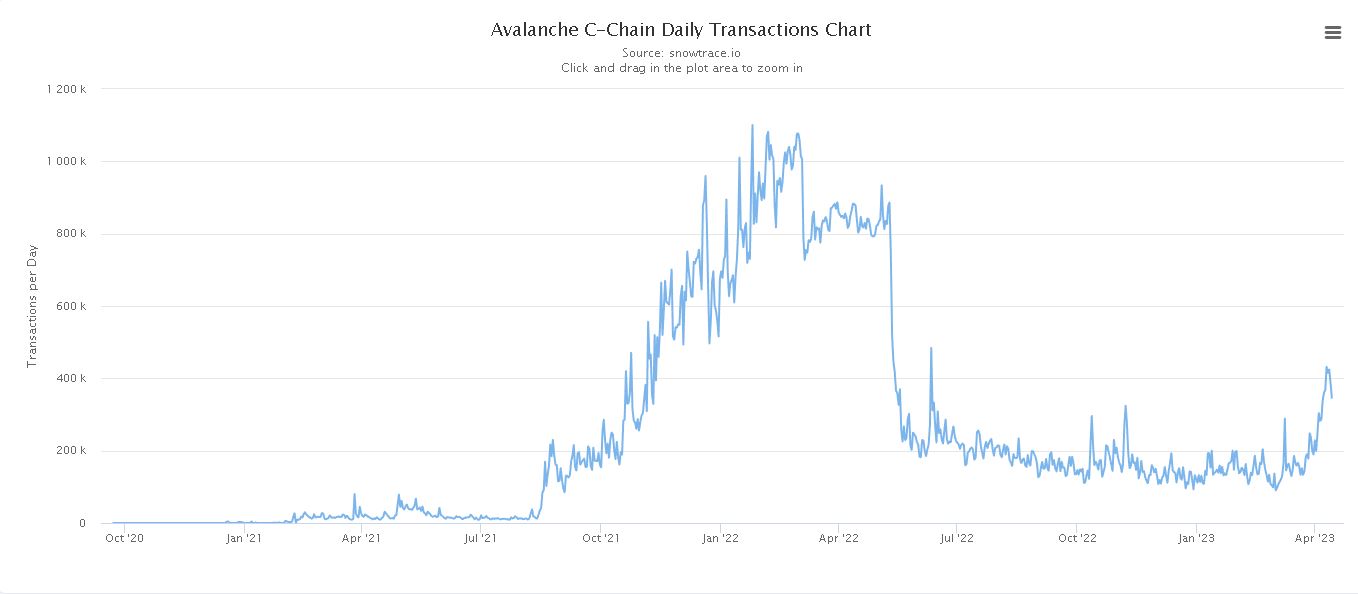

Since the end of March, Avalanche has seen major increases in transaction volume across the network.

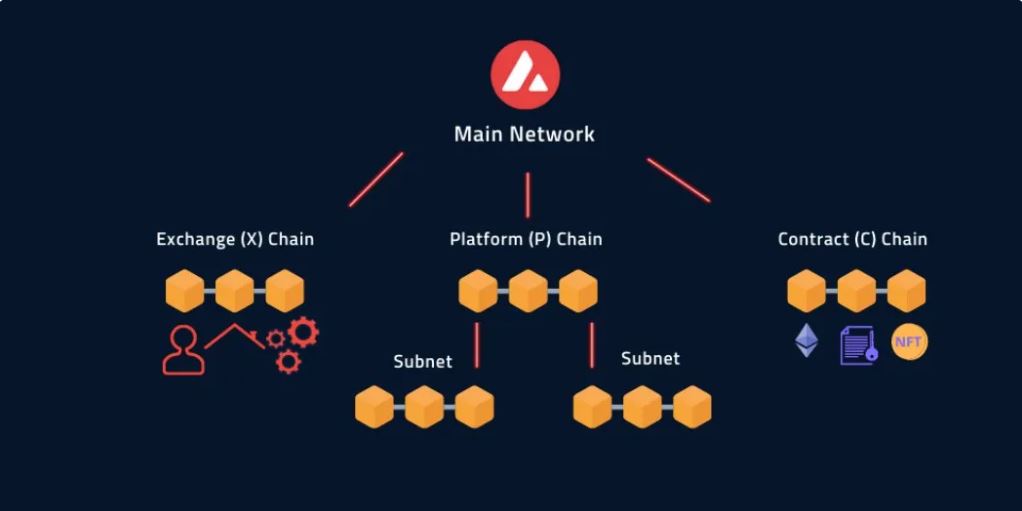

With high volume, nearly all major blockchains suffer from increased fees and slower transaction times. Avalanche subnets eliminate this by creating specialized, private networks that are occupied only by onboarded projects. For more information on Avalanche subnets and other developments please check out https://www.coinbusters.io/growth-of-avalanche-and-avax-through-subnets/

Spruce Network: A Gateway for Institutional Partners

The Evergreen Subnet, “Spruce,” serves as a testnet for institutional partners to explore a variety of applications and assets in order to measure the benefits of on-chain trade execution and settlement. With a low-risk, low barrier-to-entry approach, Spruce enables buy- and sell-side institutions to engage with public blockchain infrastructure using valueless tokens. This allows participants to experience the full functionality of Avalanche’s Subnet architecture without putting capital at risk.

Institutional partners will utilize DeFi applications on Spruce to execute foreign exchange (FX) and interest rate swaps, while also actively researching and developing other areas. Future phases of Spruce will see the inclusion of additional third-party applications, assets, and processes, such as tokenized equity and credit issuance, trading, and fund management. These institutions will play a crucial role in providing ongoing feedback regarding Subnet architecture, integrations, and capabilities to ensure a successful and scalable mainnet implementation.

One of the biggest hurdles for adoption within this space, particularly for institutions is simply getting started. Costs to establish core expertise within the web3 space is limited. Coupling this, with the typical costs for hardware (servers, equipment, etc.) and transitions would be slow or impractical for most. The low fee and decentralized nature in the world of Avalanche subnets is a major improvement for removing this barrier. This test environment allows for investing strategies and technical applications to be deployed without risking real capital.

As with anything that seeks to straddle the world of cryptocurrency and traditional finance, having credibility and well established industry partners is paramount. Avalanche continues to onboard big names like Amazon https://aws.amazon.com/blogs/startups/building-application-specific-blockchains-with-aws-on-avalanche/ and many others.

With application specific subnets and the ability to communicate (message) between them, scaling is easy.

Evergreen Subnets: Addressing Challenges for Institutional Adoption

Evergreen Subnets are EVM-based chains featuring a permissioned validator set and a custom gas token to power transactions. Spruce, as a type of Evergreen Subnet, aims to tackle the issues associated with permissioned DeFi that hinder broader institutional adoption of public blockchain infrastructure. The use of Avalanche subnets such as these provide further benefit in their ability to scale and communicate between other subnets seamlessly.

By issuing non-transferable tokens (NTTs) to institutions’ wallets upon onboarding, Spruce ensures that participants have passed KYC/KYB checks. Moreover, wallet addresses are embedded in an allowlist, which monitors access at the chain level. Smart contract deployers integrating key infrastructure and applications also undergo the onboarding process for their activity on Spruce.

According to a 2022 BIS Triennial Survey, around one-third of deliverable FX turnover, approximately $2.2 trillion, is at risk daily, up from $1.9 trillion in 2019. The implementation of on-chain FX and cross-border payments offers potential benefits such as payment vs. payment transactions, atomic settlement, and reduced counterparty risk. These advantages present a promising future for Spruce and Evergreen Subnets in the realm of digital finance.

Conclusion

As more institutions continue to recognize the importance of tokenization and blockchain in financial services, Spruce and Evergreen Subnets will provide an excellent platform for exploring the efficiencies and benefits of on-chain trading and settlement. This collaboration creates a secure, controlled, and exciting opportunity for the world’s financial institutions to experiment in an EVM-based testing environment.

The introduction of the Spruce and Evergreen Subnets is yet another bullish development for the Avalanche ecosystem. By addressing the challenges associated with institutional adoption of public blockchain infrastructure, these innovations pave the way for a new era of digital finance. As more institutions join the initial cohort of partners, the potential for widespread adoption and integration of blockchain technology in traditional financial markets will become increasingly evident. With Spruce and Evergreen Subnets leading the charge, the future of institutional adoption on Avalanche looks brighter than ever.