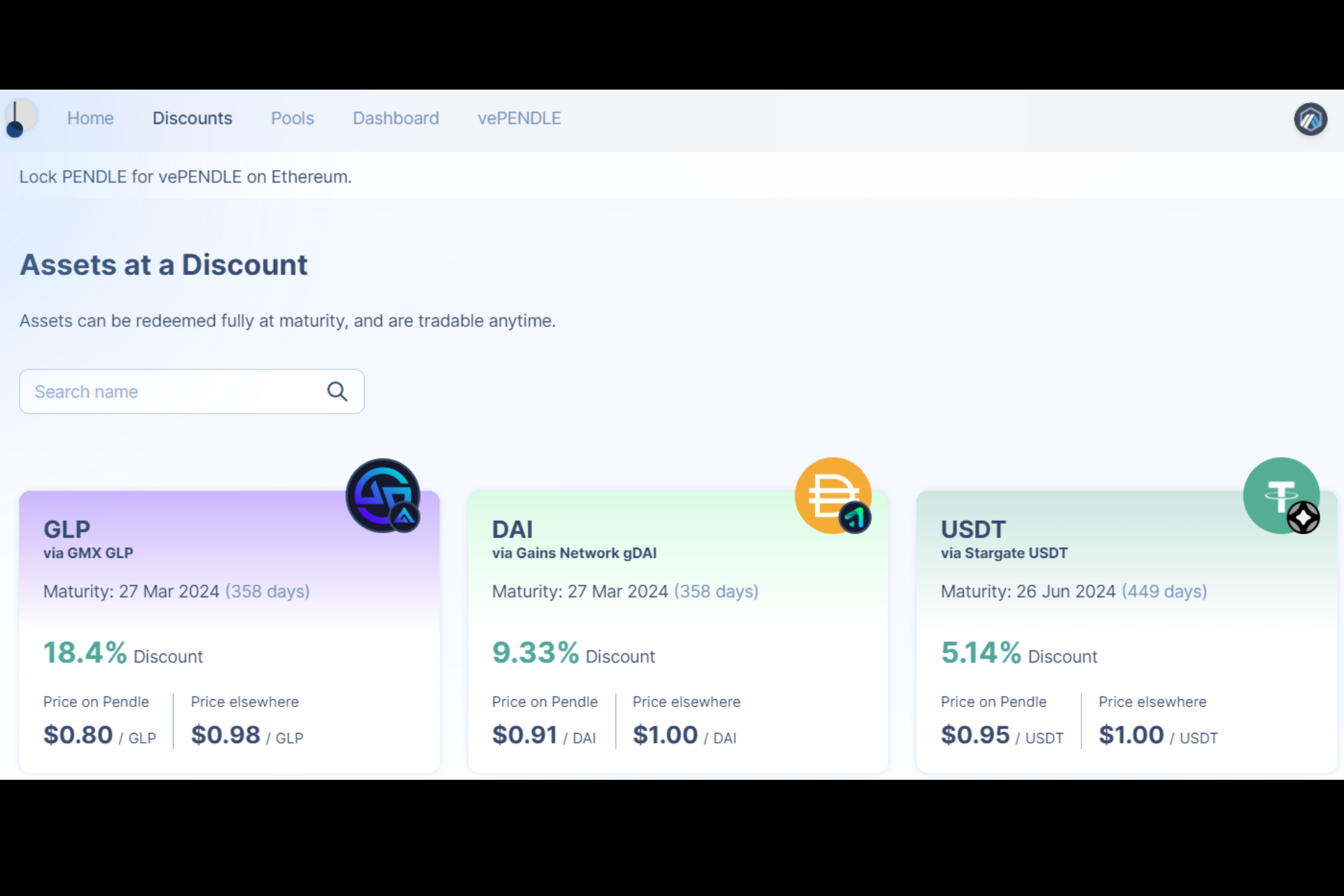

Pendle finance offers popular digital assets at a discount. This service provides bond like yield that can be tokenized, traded, and bridged across multiple chains.

Pendle Finance & Bond Products

Pendle Finance is currently on both Ethereum, and recently Arbitrum as well. Ethereum currently has more assets at a discount as well as pools to provide liquidity. Arbitrum will provide cheaper fees and faster transactions, more assets will come to Arbitrum over time. For those who have never purchased bonds they work in a rather unique way. Say you purchase a bond for 1000$ with a 5% yield for a one year term.

This bond will be purchasable for 950$. Over the course of the year, the bond will grow to maturity, on expiration it will be made whole, it will be come 1000$ again. This provides a discount up front for a guaranteed rate over the expected term. Pendle aims to provide bond type products in the form of digital assets. Users can receive rather hefty discounts for a lock period generally around a years’ time.

Since bonds are generally fairly liquid in the markets, pendle is bringing a 400 trillion-dollar market to the blockchain [1]. How does Pendle achieve a higher and more stable yield than many markets in crypto? Pendle splits each asset into two types of tokens. The first is based on the principle of the yield bearing token (PT). The second is the yield portion of the same asset (YT). Since the yield is removed and separated, the principal token can be purchased at a discount.

This service works just like bonds in that the maturity date will provide the full yield, but the asset can be traded in the waiting period if needed. If someone is bullish on ETH, they can purchase 100 ETH for 95 ETH. Pendle also offers liquidity provision with single assets rather than the typical pair.

Pendle Finance Pools & Token

Pools on Pendle are also bond style services. Users can provide single assets and receive trading fees with a much higher yield than simply staking or purchasing assets at a discount. Pools have different maturity rates, so these LPs are locked for predictable durations. Single sided pools have benefits to paired LPs because there is no impermanent loss involved. If a user provides a stable coin, they will receive the stable coin at maturity with only the opportunity cost/hacks/scams as a risk.

PENDLE is the governance token for the protocol which also aims to capture the value accrual of the network. PENDLE allows users to vote on the future of the protocol. If you have been reading along you will know we DO NOT like pure governance tokens, no matter how good the protocol/network is. PENDLE adds utility by providing vePENDLE when staking and locking. This boosts liquidity provider rewards by up to 100 [2].

PENDLE holders also receive a share of the protocol fee capture and revenue. Like another product we enjoy (Equalizer) users can vote for LP pairs and receive rewards for doing so. Voting on a pair unlocks some of the paired rewards for swapping. Successful applications capture real revenue over time and focus on growing that revenue for the long term. Projects that do not put revenue high on their priority list struggle to survive in bearish markets.

This business model is solid and has an attack plan with potentially massive, reliable revenue. Having the application on Arbitrum while it is hot was a great strategy as well. Looking at the graph above you will notice a very small team allocation for the governance token. The rest of the tokens are allocated to ecosystem funds, incentives, and future rewards. This is what we like to see. In our next article on Pendle we will provide the full token economy analysis and give the token a score per usual. Please remember none of this is financial advice, stay safe out there!

For another article on the Arbitrum ecosystem check out our update article on [Trader Joe].