This article reviews an upcoming project on the ever-popular Arbitrum blockchain. Camelot is an application that allows for swapping of tokens that is building a robust foundation for the Arbitrum ecosystem.

Camelot

Camelot is not just a DEX (decentralized exchange) that allows for trading of hundreds of tokens on Arbitrum peer to peer. The application is a customizable for builders and providers an extremely efficient and flexible infrastructure. Since Arbitrum has become so popular, especially after the ARB token airdrop, leading applications will gain the first mover advantage for the massive amount of liquidity that the blockchain attracts.

Camelot allows for volatile (think Uniswap), and stable swaps (similar to curve). The application offers customizable fee structures that can focus on buying, selling, and fees adjusted individually for each pool [1]. The network introduces NFT staked positions which is a unique feature. These can be viewed as a deposit receipt with a snapshot taken at the time of mint. These NFTs are unique and transfer with ownership making it easier to purchase a known yield bearing asset and transfer it peer to peer.

Nitro pools allow projects to incentivize liquidity for network participants. These pools have the unique ability to create a set of requirements for users to be able to participate. For example a project could allow participation to only those who used a beta version of the project in question. The final piece of the picture is the GRAIL token which incentivizes the entire Arbitrum ecosystem.

GRAIL

GRAIL is a low maximum supply token with only 100,000. Staked GRAIL tokens create xGRAIL which is a non-transferable escrow token. xGRAIL is used for various plugins which include dividends, yield boosting, launchpads, and Camelot/community plugins. GRAIL can be earned through the yield that the NFTs that are associated with liquidity pairs provide. This GRAIL can then be converted to xGRAIL and linked to one of the four plugin categories.

Dividends boast the rewards of the majority of the network fees. Epochs for these rewards are weekly, similar to Equalizer which we have covered as well [EQUAL]. Users can also plug into the yield booster to increase the yields of the linked NFTs we discussed above. The third type of plugin focuses on the launchpad built within the application.

Users can gain whitelist spots for new projects, discounts, airdrops and other bonuses. GRAIL tokenomics incentivize users to purchase GRAIL, convert it to xGRAIL and use the plugins as utility. Since the economy currently boasts almost 100 million in liquidity, revenue is lucrative for the network itself. Since Camelot is decentralized, the users will gain most of the rewards by participating in the various utilities provided.

Revenue=Runway

Even just 100,000$ in fees generated per day is about 3 million in revenue per month, or 36 million per year during a bear market. Remember, revenue is what drives runway for project survival, and building out on a popular blockchain is the way to do it during such tumultuous times. Camelot combines several features that have worked out for popular creations such as Solidly, post beta-Uniswap, and ads various utility to users.

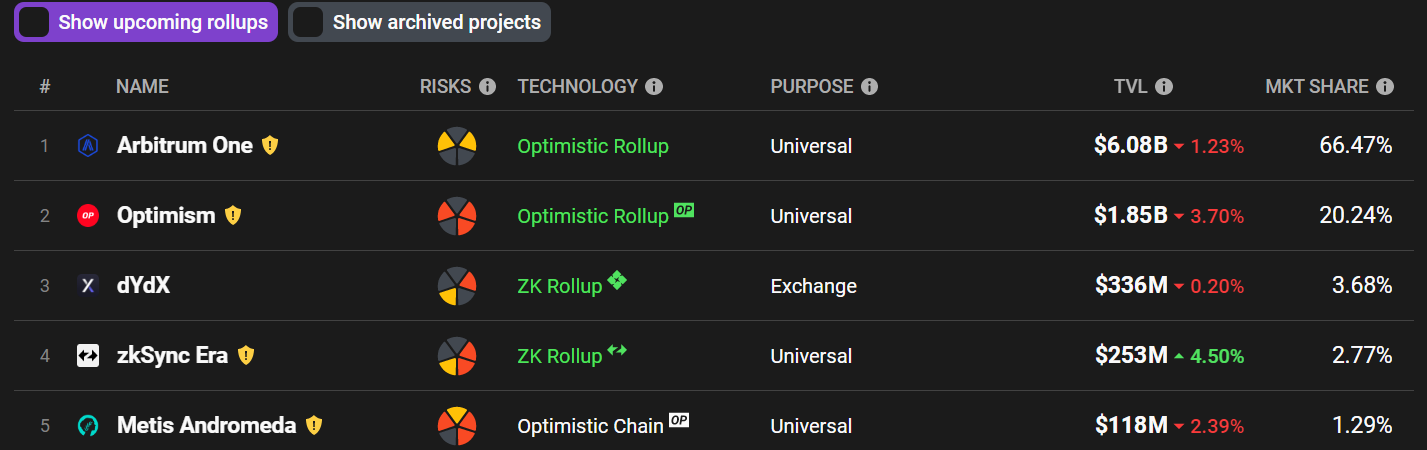

Only projects that are on popular, liquidity vacuuming blockchains will continue to generate enough revenue to pay for builders as well as develop a robust ecosystem. Moneys follows liquidity, Arbitrum remains hot, and will likely continue to perform over-time. Currently Arbitrum is heavily outperforming other layer-2 networks in TVL, volume and revenue generation.

Although the ARB airdrop was lackluster, there is no denying the dominance of the blockchain itself, please check out our other Arbitrum series articles when you have some time. Remember, none of this is financial advice, stay safe out there!

We will review the GRAIL token economy soon.