In this writing we compare Bitcoin Ordinals and Ethereum NFTs. While both non-fungible tokens are unique, they offer some differences which may or may not increase adoption.

Ordinals: What is an NFT?

Both Ordinals and Ethereum NFTs are non-fungible tokens. Non-fungible means something that is unique and cannot be replicated. Examples in real life include phone numbers, some furniture and other one-of-a-kind items. According to [Ethereum.org] NFTs are tokens that represent ownership of art, collectibles and more. Since Ethereum NFTs are created with the security of Ethereum, no one can modify the record of ownership for an NFT.

NFTs can be exchanged for one another, or for another digital asset that represents value (think ETH,USDC). This was made popular using the Opensea marketplace which allows for open, and semi-decentralized trading of non-fungible assets. NFTs eventually will be popularized by other use cases including passes, real estate, cars, governmental data verification, and more.

With NFTs it becomes easy to verify ownership with the public record of the relevant blockchain. Non-fungibles allow content creators and artists to create and sell their work within a global market. They also allow for collection of royalties which go to both the marketplaces and the creators. In the future marketplaces will take smaller and smaller royalties, and some might even take zero fees such as Blur.

Bitcoin Ordinals vs. Ethereum NFTs

Why the recent hype with Bitcoin NFTs? Bitcoin is a slow mover, and the traditional reserve currency of the digital asset market. Bitcoin tends to not have many updates over time and rarely new features. With the upgrades that the Stacks network provides, smart contracts are now possible on Bitcoin. With smart contracts come the possibility of inscriptions that allow for these new Ordinals.

With Ethereum, NFTs are validated from a unique Ethereum ID system with associated metadata. With the approval of an Ethereum smart contract and associated ETH gas fee, users can gain ownership of a purchased NFT. Ethereum then manages the ability to transfer ownership per the owners needs, they can trade, or sell by auction or a set price. Users can provide offers which the owner may deny or accept [1].

Ethereum NFTs are good for high count and high volume NFTs since Ethereum is so secure. Ethereum also has several very popular layer-2 scaling solutions with NFT ecosystems benefitting them the security of the main network. These networks allow for scalability increasing speed and reducing fees. These include Arbitrum, Optimism, Polygon, Zksync and more. NFTs account for a large portion of Ethereum validator network fees.

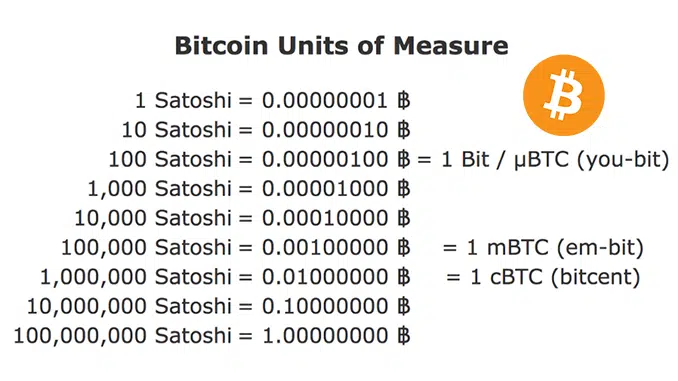

Bitcoin Ordinals are slightly different and will likely have different use cases if their adoption continues. Ordinals are essentially inscribed upon the smallest unit of a unique Bitcoin, known as a “sat”. This inscribed data can be a sound file, an image or a video. In order to utilize Ordinals, a special ordinals wallet must be used with some Bitcoin present in the wallet.

This concept allows for a more historical and likely more rare version of an NFT. Since Bitcoin is slower and not developed for smart contracts, Ordinals will likely hold more rare 1:1 art and niche concepts. Bored Ape Yacht Club has announced that their next NFT drop will be Ordinals as well which of course increased the hype even further [2].

These Ordinals have been met with some criticism as Bitcoin maximalists state that the network will be bogged down by meaningless inscriptions. However, Bitcoin miners are enjoying the heavily increased network fees due to the volume of these smart contracts. During a bear market, fees can sustain miners without necessarily needing to sell their mined Bitcoin if enough volume is present.

While we tend to agree that Bitcoin has a sacred quality to it that should maybe not be tampered with, Ordinals present a unique approach to NFTs that could continue to grow in popularity. Only time will tell, but we could easily see more rare and expensive NFTs being moved to the Bitcoin network since it is the most decentralized and secure network in all of the crypto market. As always none of this is financial advice, stay safe out there!

For an article on two projects that will utilize NFTs check out our Wilder World and Vulcan Forged article [here].