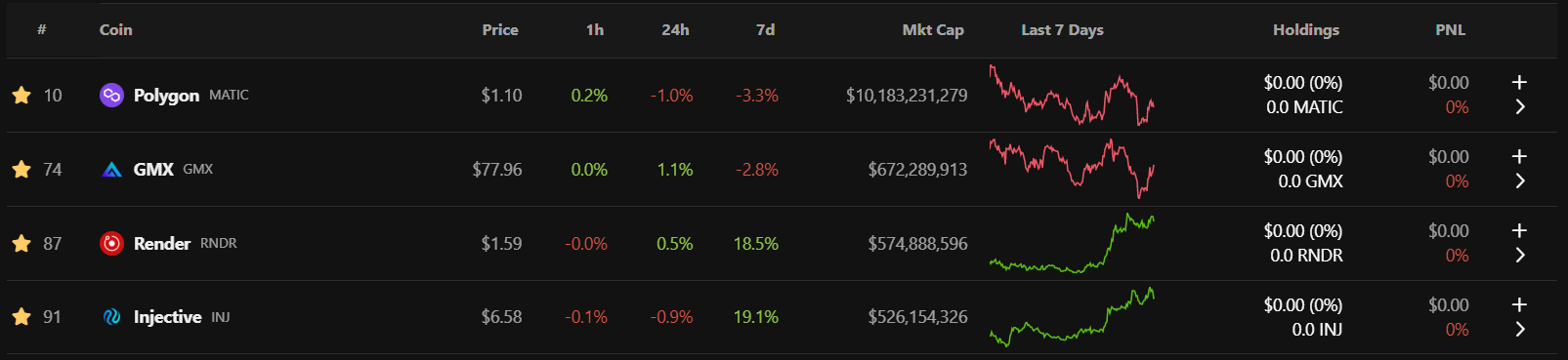

This article reviews four altcoins we have been bullish on for a while. Each one outperformed Bitcoin over the past 6 months. Many believe all alts will bleed against Bitcoin as dominance increases, but there are diamonds in the rough.

Bitcoin Dominance & Altcoins

In this article we will jump right into 4 major positions that Coinbusters team holds as part of a balanced portfolio. A common mistake that experienced Bitcoin and Ethereum investors make is assuming that as Bitcoin dominance increases, all altcoins will drop in value relative to the king of digital assets. While this assumption is generally true, and a solid way to practice risk-management, some altcoins shine above others.

We have covered all four of these assets, some to great lengths. From a technical perspective they have all outperformed Bitcoin since last summer. They also continue to provide immense value relative to holding only Bitcoin. When the bull market rears its head, market participants will not be ready for the explosion of smaller market cap projects. Therefore we believe small allocations to select altcoins is the only way to do it, bear market or bull market.

Polygon’s Matic

Our first, and largest market cap pick is no surprise to our readers, we have been bullish on Matic for over two years. Polygon has done a great job marketing and delivering a solid blockchain experience. The chain is fast, cheap, and the company has purchased other small companies specializing in zero knowledge proof technology. Zk rollup technology is likely to take the crown when it comes to scaling Ethereum. The technology also provides inherent privacy mechanisms.

In this [article], Vitalik, the main founder of Ethereum states that Zk rollups will outperform Optimistic rollups over time. The fact is Zk rollups will be far more efficient and scalable, but the technology needs more work and is a few years out from full integration. With the impending Shanghai upgrade for Ethereum, tokens like Matic are likely to see a massive upswing over the next few months. For an analysis article on Matic, check it out [here].

GMX on Arbitrum

The second altcoin is GMX which is on the Arbitrum blockchain. Arbitrum is an extremely popular competitor to Polygon. It is important to diversify layer-2 exposure to Ethereum, and GMX is an indirect way to do just that. GMX is a relatively new token, we entered our position between 25-30$. While were a little late to the party, the impressive revenue of the project paves a bright path for its future use case.

Having a low capped token supply, real yield, and an awesome way to trade perpetual contracts on chain, GMX has attractive massive volume. For an article on GMX, we have one [right here]. We believe that GMX will become a blue chip asset as Arbitrum grows in popularity. Now that the chain has the ARB token the hype has been unleased. This is a long-term hold that should trend upward with Ethereum.

Render Network & RNDR

Our next token is a MoC special, RNDR. Render Network mobilizes under utilizes graphics processing units and allows owners to participate in much needed services. Those who have downtime for graphics processing will be able to provide their GPU’s power en masse to help render images and 3D models. Every game, model, and 3D image utilizes rendering to view the said virtual object in all aspects.

This includes all angles, lighting, refraction, shine, and more. In summary, rendering takes a massive amount of computation. Imagine playing a game with beautiful graphics and you are walking through a field in the rain with your character. The lightning strikes in the background, and the shield on your back reflects some of that brightness, while the rain saturates your armor and clothing. As you move your mouse around your character rendering allows for every possible version of an adaptive image you might experience within the game.

Rendering as a service is the goal of the Render Network, and the RNDR token is the economic driver of the network. Users will be able to essentially mine Render jobs or utilize downtime for existing graphics cards as the network expands over time. We like RNDR because it currently has no competition, and the founder has been in the game since 2014 building real products and conducting real research.

INJ on Cosmos

Our final pick is the INJ token for Injective Network. We believe INJ will become one of the monetary drives for the entire Cosmos. Cosmos is one of the main interoperability infrastructures within the crypto market. INJ has built a strong fundamental base that allows builders to focus on financial products. Injective has developer kits that include order books and more for the basic structure of an application on Cosmos.

Any application on Cosmos automatically benefits from the interoperability that Cosmos provides. Many strong chains already exist on Cosmos including BNB, Rune, and Osmosis. A while back we sold a large portion of our ATOM tokens into INJ because we realized the shortfalls that the ATOM token had relative to INJ. INJ is a newer position for us but one of our most bullish tokens. Here is our intro article on [Injective]. Please remember that none of this is financial advice. This is a list we currently focus, holding a majority of our altcoin position in the four.

Do remember to never sleep on Bitcoin, dominance is a real thing and most altcoins will bleed against the king. However, holding a small percentage in these tokens can potentially increase your overall Bitcoin holdings over time if positioned well. Practice risk-management and never be afraid to take profits. Stay safe out there!