This article introduces GMX which allows for crypto perpetual trading, along with basic swaps/staking and other Defi transactions. GMX launched on Arbitrum (ETH layer-2) but has also expanded to Avalanche.

GMX Basics

Have you ever traded on Robinhood, Ameritrade or a similar exchange? GMX allows for these same types of transactions in a decentralized manner. All a user needs to get started is a compatible crypto wallet. At Coinbusters we are used to Metamask, for a guide on how to setup the wallet check out our article [here]. Metamask is preferrable because users can easily use both Arbitrum and Avalanche with one wallet.

GMX uses the ever-popular Chainlink oracles for pricing information utilizing the highest volume centralized exchanges. GMX protects users from liquidation by using an aggregate price feed, fending off temporary wicks on the chart [1]. GMX has incredibly low spread price, combined with zero slippage which saves users money.

A key feature of the platform involves the dual token model. The GMX token is the platform token that provides governance, staking and platform fees. Thirty percent of the platform fees are provided to network participators. The GLP the liquidity provider token which accrues 70% of the platform fees. GLP holders can convert their GLP into GMX after one year, they are otherwise compensated in ETH on Arbitrum or AVAX on Avalanche.

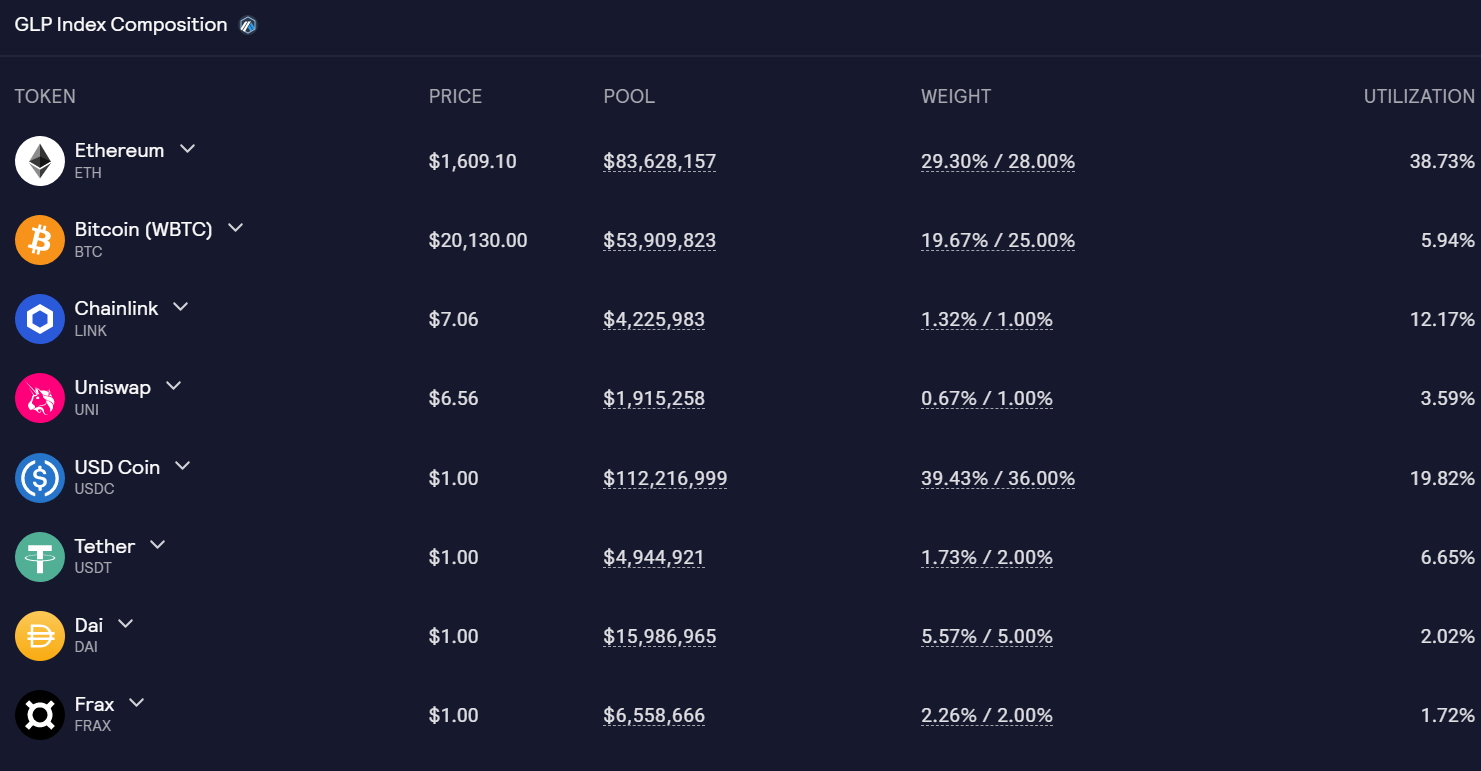

GLP is an index of tokens that are used as liquidity for the platform swaps and features. Almost 50% of the holdings are in safe stable coins focusing on USDC. The other tokens include Bitcoin, Ethereum, Dai, Tether, Frax, Uniswap and Link [2]. This GLP treasury spends 50% of the proceeds on adding to the liquidity, and another 50% for marketing. This strategy displays strong risk mitigation, and during these times of scams, and ponzi schemes, it is great to see strong fundamentals.

Deeper into GMX

Now that we have covered the basics lets turn to some important details of the project. The GMX docs state that as the GLP fund grows, excess funds will be used to buyback and burn the GMX token reducing the supply over time. GMX has a capped supply of 13 million tokens, and currently the entire available supply is already released. Tokens that have all available tokens released are less likely to have early investors crushing the price over time.

The remaining tokens for the Max supply will be provided over time based on how many GMX tokens are vested through the staking (1 year holding GLP). GMX has a concept known as multiplier points which rewards longer-term stakers of GMX. The beauty of this strategy is that it does not increase the inflation of the GMX tokens. Rewards are instead added as ETH or AVAX and the multiplier grows larger the longer a user stakes tokens.

GMX currently has a bug-bounty program which rewards coders for identifying potentially harmful code. The max bounty is currently 5 million dollars. This proves that the project is serious about security and longevity [3]. GMX has also been professionally audited, the audit can be located [here].

As for the future roadmap, GMX plans to first introduce synthetic assets (imagine decentralized tesla stock). They will then expand to new chains as needed to increase adoption. An upgrade known as X4 will be implemented, allowing users full control of their AMM liquidity protocols. GMX will be updating and improving the user-interface adding 1-minute charts and more. They also plan on focusing largely on project longevity through a risk mitigated treasury focusing on USDC. Please remember that none of this is financial advice. Please do your own research, and stay safe out there!