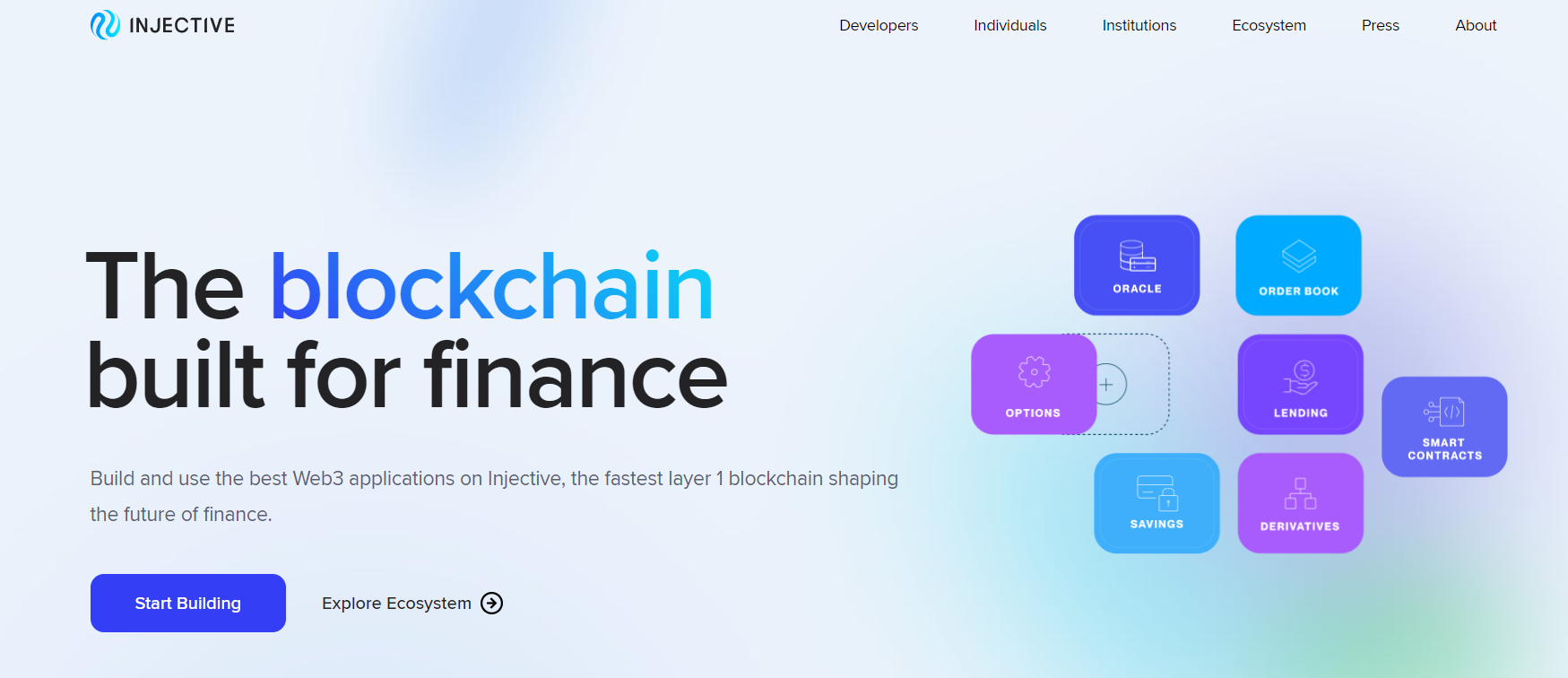

This article introduces Injective which is built using the Cosmos developer kits. Injective aims to become an efficient blockchain, focusing on integrating the broader financial markets and blockchain technology. The image for this article was created using Midjourney.

Injective: The Cosmos Benefit

For those of you who have been reading, you will realize the benefits that building on Cosmos provides. Chains that are built on Cosmos immediately benefit from the interconnectivity of all other chains built on Cosmos. For an article on the power of Cosmos, check it out [here]. Injective furthers the Cosmos smart contract layer by offering auto-executing smart contracts. These allow faster and more unique innovations in the decentralized finance space. This article is in response to a poll regarding Coinbusters covering either Osmosis or Injective, Injective unanimously won the poll. We held a second poll and users requested more derivatives coverage in crypto. Injective provides the base layer for derivatives builders.

Injective is open-sourced which allows people to create applications as well as build upon applications in under construction. All applications within the Injective ecosystem can access native layer-1 blockchains such as Solana, Ethereum, and Binance Smart Chain. Injective is a proof-of-stake network that leverages the Cosmos Tendermint core. This core allows multiple coding languages to plug into the applications built using the kit. With this mechanism also comes the trusted Cosmos bridges which currently offer 15 blockchain integrations.

What is Injective?

This mission of Injective is to create a global financial system that includes the masses regardless of personal differences. Injective has created a “plug and play” model making it easier for creators, which is true to the Cosmos mission as well [1]. Injective allows developers to grab out of the box modules which saves time and frustration for builders. An example of such is the decentralized orderbook, which allows developers to build directly on top of the already solid base application.

Injective allows developers to build using the familiar Ethereum coding language as well. Injective is optimized for financial builders. The protocol has its own native wallet which is generally considered the safest option for networks. The wallet allows for storage of native INJ tokens and bridged tokens as well with is a fairly unique feature. Normally users would have to setup network wallets on each individual bridged chain.

Currently users can bridge to these networks:

- Ethereum

- Solana

- Cosmos Hub

- Osmosis

- Evmos

- Persistence

- Axelar

- Moonbeam

- Persistence

- Secret Network

- Stride

- Crescent

- Sommelier

Injective uses the INJ token as a means of value exchange within the ecosystem. INJ tokens are required to become a validator of the network. The typical validator reward set provides INJ tokens for those who participate in consensus. The token is not only used for these security and incentive features but also for governance and other value captures [2]. Governance features include the below.

- Auction Module Parameters

- Exchange Module Custom proposals and Parameters

- Insurance Module Parameters

- Oracle Module Custom proposals

- Peggy Module Parameters

- Wasmx Module Parameters

- Software upgrades

- Cosmos-SDK module parameters for the auth, bank, crisis, distribution, gov, mint, slashing, and staking modules.

More important than governance and staking is the other utilities that INJ provides. INJ has a global minimum fee for all applications built using the network. A percentage of trading fees are rewarded to the builders of the specific applications through this fee. A larger portion of the fee percentage is used to buy back and burn INJ tokens.

Much like Ethereum EIP-1559, this burning mechanism deflates the token supply with higher volumes. The most important utility of INJ is yet to be discussed. INJ will be used as collateral backing of derivative applications built upon the blockchain. INJ can also be used for margin (debt) and for insurance staking pools. Injective holds weekly auctions for a portion of the trading fees accrued by the protocol.

At the end of the auction the winning bidder receives 40% of the fees as a full basket of the assets involved, the winning bid which must be paid in INJ is then burned. Every application built on the network must have an associated insurance fund. Any users can decide to create and or underwrite for individual insurance funds. This is designed to help protect against any socialized loss for the applications that are building. Larger invested underwriters would receive a larger portion of the fund if things were to go wrong.

After summarizing the network it is clear that a lot of thought was placed on protecting users, adding utility to the native token, and drawing incentives for current and new developers alike. The mandatory minimum fee, and mandatory insurance fund for each protocol provides protection and minimum revenue for all builders who draw in volume. In our next writing, we will analyze the token economy and value proposition of the INJ token. Please remember none of this is financial advice, stay safe out there!

Check out [part II].