Premia is a high upside albeit risky bet on options trading in the crypto market. Premia has already integrated with popular Ethereum Layer-2s and Fantom, with Polygon and Avalanche to come. This article is in response to a poll we held on twitter.

Options In Crypto

I would like to start by reminding readers that options in any market are complex and an advanced strategy. Options can be used to hedge risk and add leverage to existing positions, many traders have complex options strategies involving a mixture of multiple strategies. For our larger cap discussion on options, check out our article on Ribbon Finance [here]. The beauty of these protocols is that they offer options exposure to professional traders, while also allowing less risky vaults for passive income.

We will not be explaining options again, I will assume if you have made it this far you understand that basics of calls and puts. While I am not a professional trader by any means, I personally use covered calls on my existing bets, most recently we made a very substantial return on c3.ai and marathon digital calls. We hope some of our readers were able to use our research to assist in getting in early on these wins! As a quick reminder, we are not financial advisors, these writings are our personal opinions.

We believe that the options market in crypto is just getting started and is prepping to become a major trend alongside Ai and gaming. Derivative exposure is a great way to add diversity to a speculative portfolio. Since we already have exposure to new age Defi plays such as GMX and MVX, and gaming exposure with PYR, SUPER and UOS we want to add other sectors. Premia allows users to buy both calls and puts on many popular chains.

Options with Premia

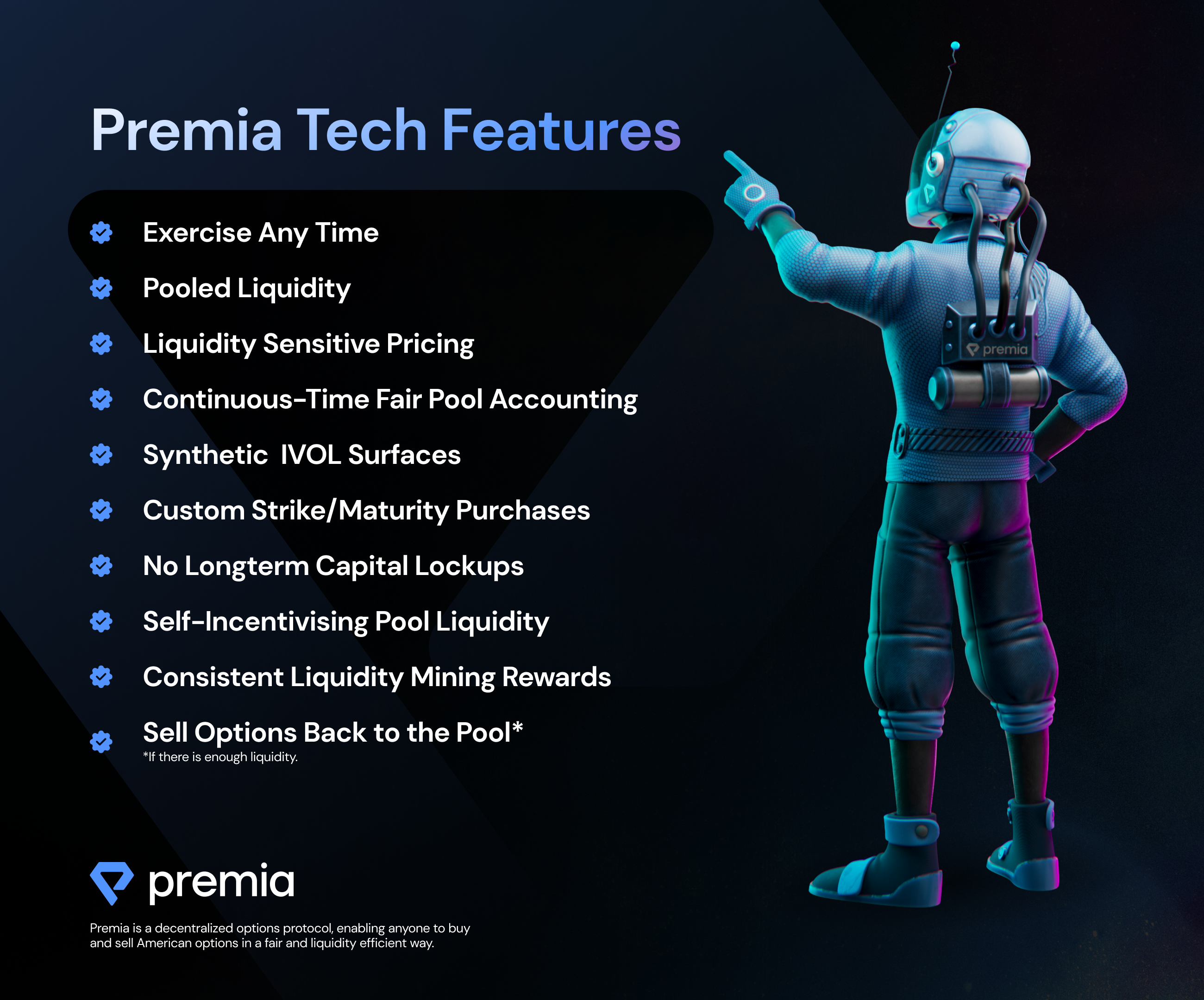

We will review the problems that Premia helps solve directly from their whitepaper.

“The key problems Premia solves compared to other options protocols: [1]

- Market driven option pricing

- Capital efficient pool-to-peer architecture

- Optimal liquidity pool utilization

- Risk management and instant withdrawals for liquidity providers”

With Market driven options pricing the supply and demand directly dictates the options price feeds. This allows users to achieve the same experience they receive in the stock options market. The capital efficient pool-to-peer technology allows users to experience cheap fees and low slippage. The automated protocol incentivizes initial liquidity providers upon launch of a new pool, this reduces slippage and increases LP rewards.

Liquidity providers can also target only the markets that they specifically are interested in. They have the ability to customize strategies to focus on their desired markets. Larger demand options carry a higher premium thus increasing the rewards for the LPs that flock to the trends of the traders. LP providers are able to instantly withdraw their funds if they have a change of heart or want to chase an emerging trend.

Premia allows the market to decide the price, remember that if you play with supply or demand there is no free market, the market needs to find both on its own. Crypto offers an opportunity to be free from the manipulation of our current economy which suffers from inflation and lack of backed dollars. Premia also highlights that many options approaches in crypto have failed in the past because they simply use existing options equations.

The network takes a unique approach by adding to the existing options structure, this is in hopes to solve the over and under valuation of the contracts. By focusing on the relative supply and demand of opposing options contracts the market will come to a price realization naturally. The network uses a risk-adjusted model which is attractive to LPs.

Premia enhances the crypto options market by adding two things in the V3 upgrade. The Uniswap version range orders which allow market makers to collect multiple fees with a single order. This strategy is enhanced with an over the counter (OTC) quote system. This OTC quote system vastly increases liquidity since each specific option has its own dedicated pool. Remember that LPs can move to the higher demand strikes/maturity dates etc. instantly. Premia has essentially solved the crypto options problem in a single upgrade.

Premia Token

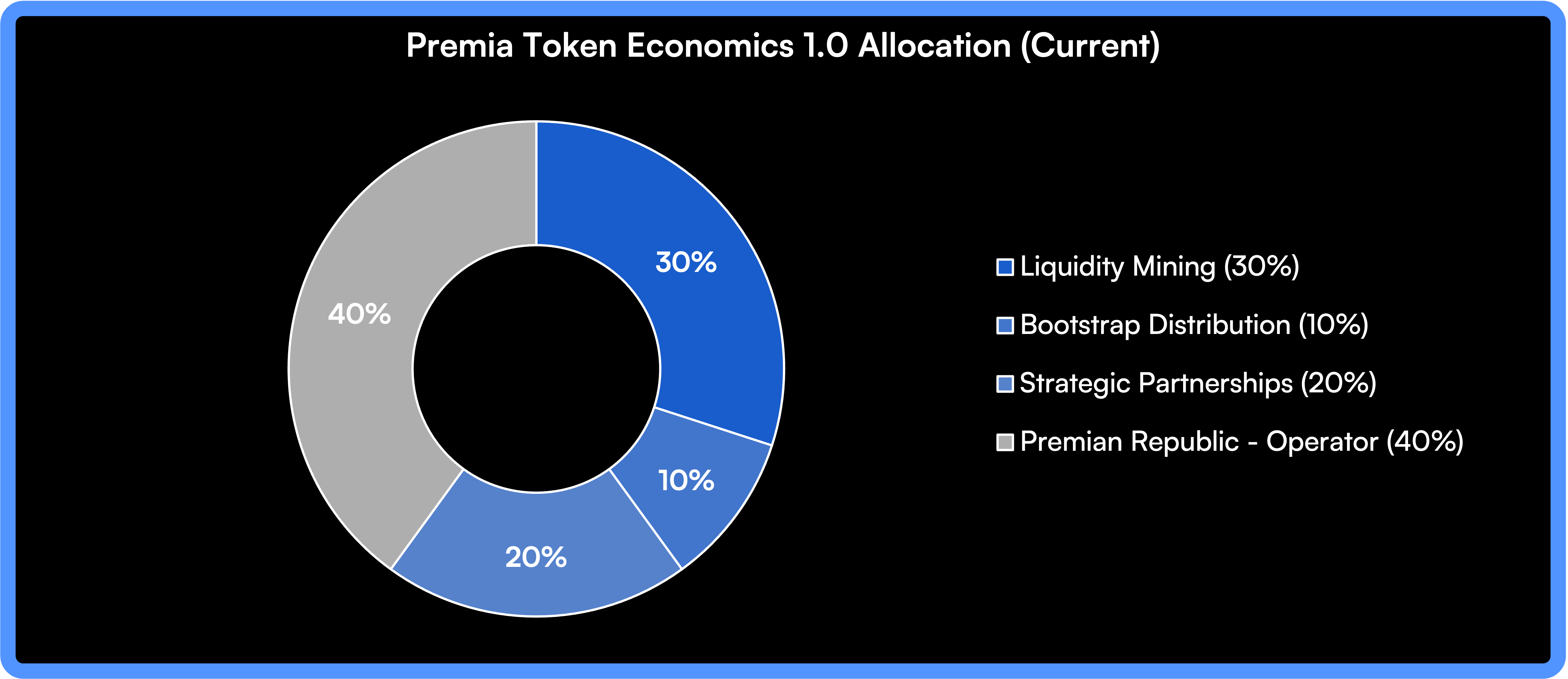

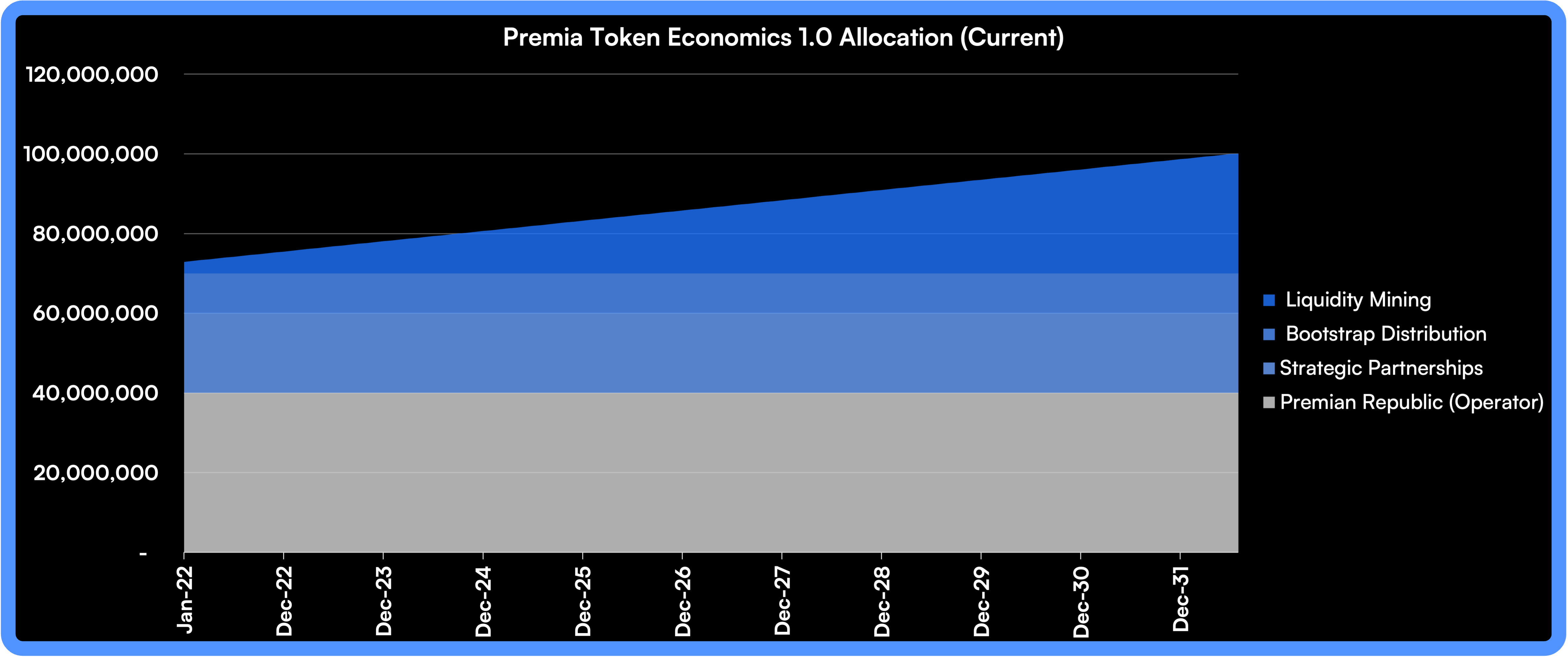

True to Coinbusters form, we love to highlight that a protocol can be amazing and have a horrendous token economy. Premia not only nails the network design and fundamentals, they also hammer the tokenomics. The two images above are from the tokenomics page in the protocol whitepaper. You will notice the usual initial allocation and token release schedules which we always analyze.

Only 10% of the initial allocation is reserved for the team, there is no private fundraising round. 10% is reserved for a safety and insurance model which is fairly unique, not enough protocols do this. 30% is reserved for the cross-chain LPs. This provides enough incentive for network participants, and having no private fund raises means no large institutions dumping their tokens on unlocks on retail investors.

Today the circulating supply is approaching 11 million tokens, with a maximum supply of 100 million. Users can lock Premia tokens and receive a boost, which is a mechanism used by GMX and other popular protocols. The network enhances this concept by adding layers to the initial strategy. Locked tokens create “Influence”, this is used for governance, liquidity mining and fee rewards structures.

The Premia enhancements allow for truly natural supply and demand. The locked tokens can be moved to any of the chains that Premia participates on, and perhaps the most attractive addition is stable-coin rewards which equate to 50% of protocol fees. Users can either compound the USDC they receive or take the stable yield over time as essentially cash. This concept is known as real yield, since a portion of the rewards are not simply in the network token, this helps avoid hyperinflation of the network token seen in far too many protocols.

In order to avoid making this article too long, I encourage you to check out [this section] to further understand the economic model. With a 10-million-dollar market cap, 12 million TVL, and 270 million trading volume it is interesting to see where Premia price action will take us. When looking at Ribbon Finance which is a larger cap competitor, Premia is 1/16th the size with potentially a lot more to offer.

A small position of 250$ at a 1$ average entry could easily 10x to 2500$ by the end of 2023. For those who do not know I am a massive Fantom bull, the fact that the protocol is on multiple Ethereum layer-2s and Fantom with plans for Polygon and Avalanche is extremely bullish. Premia also has a Cosmos hub like interchain protocol that allows users to move locked funds cross chain. I will be transparent that I entered my first DCA today and will be adding more on the Fantom blockchain. I might even take my FTM staking rewards into this thesis. Please remember to do your own research, stay safe out there!