This article introduces a protocol that allows users to deposit single sided assets, and improve their return with a mixture of lending and options trading exposure. Ribbon Finance is available for use on Ethereum, Solana and Avalanche today. This is an advanced article recommended for those who have used options/futures in the past or greatly understand how they function.

Ribbon Finance & Options

Ribbon finance expands on a type of derivatives trading. If you are familiar with GMX or Metavault trade you will be aware of this concept, if not check out our article that explains derivatives [here]. The total derivatives market is said to be over 1 quadrillion dollars (15 zeroes). Ribbon Finance invented “Defi Option Vaults” in 2021, this allows users to trade volatility on their underlying assets passively. These are known as “Theta Vaults” which sell weekly options. The premiums are reinvested on the user’s behalf increasing their yield over time.

There are two types of vault currently:

1. Covered call selling: each week the vault issues OTM (out of the money) call options on all deposits.

2. Put selling: each week the vault issues OTM put options on all deposits. [1]

Covered calls allow investors to add risk to their bet on the upward price action of an asset they already own. These are considered covered since they already own collateral in the form of the asset they are betting on with options. They make a profit when the asset moves up in price, they do not have to predict the exact price of said movement because they can still sell the contract despite being “out of the money”.

Being out of the money means they missed the “strike” price of their option, which is the selected price upwards or downwards the investor decided upon when purchasing the contract. You can still make money on options without hitting the strike price, but you cannot enact the option trade which gives you the right to purchase the shares/tokens at the strike price. In the stock market hitting a strike price on calls and enacting your contract will net you 100 shares.

Puts are bets on the downward price action of an asset. Selling puts allows users to make a profit if the price of the asset moves downward, in the stock market hitting your strike price will allow you to sell 100 shares of an asset. Both calls and puts increase in price as volatility of the underlying asset increases. There is a rather complex mathematical formula for options. The shorter the expiration date, the less time value they have as well. This is why longer-term options have less general volatility than weekly options.

Other Ribbon Finance Products

Ribbon Finance also has earning strategies for both Ethereum and USDC. These products utilize volatility to increase the base yield you would normally see using AAVE or Curve. Ribbon also has an institutional lending suite which allows users to lend to selected KYCed and/AMLed market makers. This is riskier but the product comes with credit underwriters and built in insurance since bigger money players are involved.

Aevo: Is Ribbon Finances core product that makes all of this possible. Aevo is an order book based, exchange that appeals to professional options traders. Aevo offers instant fiat onboarding as well as access to the deep liquidity of the best options trading firms in the world. The exchange offers hundreds of assets to trade with many options settings and strike prices, but in a decentralized manner. [2].

RNB Token

RNB token is the governance token for the protocol. Owners of the token can vote on the strike selection methods, how far out the options expiration dates are, and which currency the yield is rewarded in. By earning in Ethereum and USDC this avoids inherent token inflation of RBN, this is a newer age strategy that separates many new tokens from older tokens with hyperinflationary token economies. Currently the Ribbon treasury has 35 million dollars in assets [treasury].

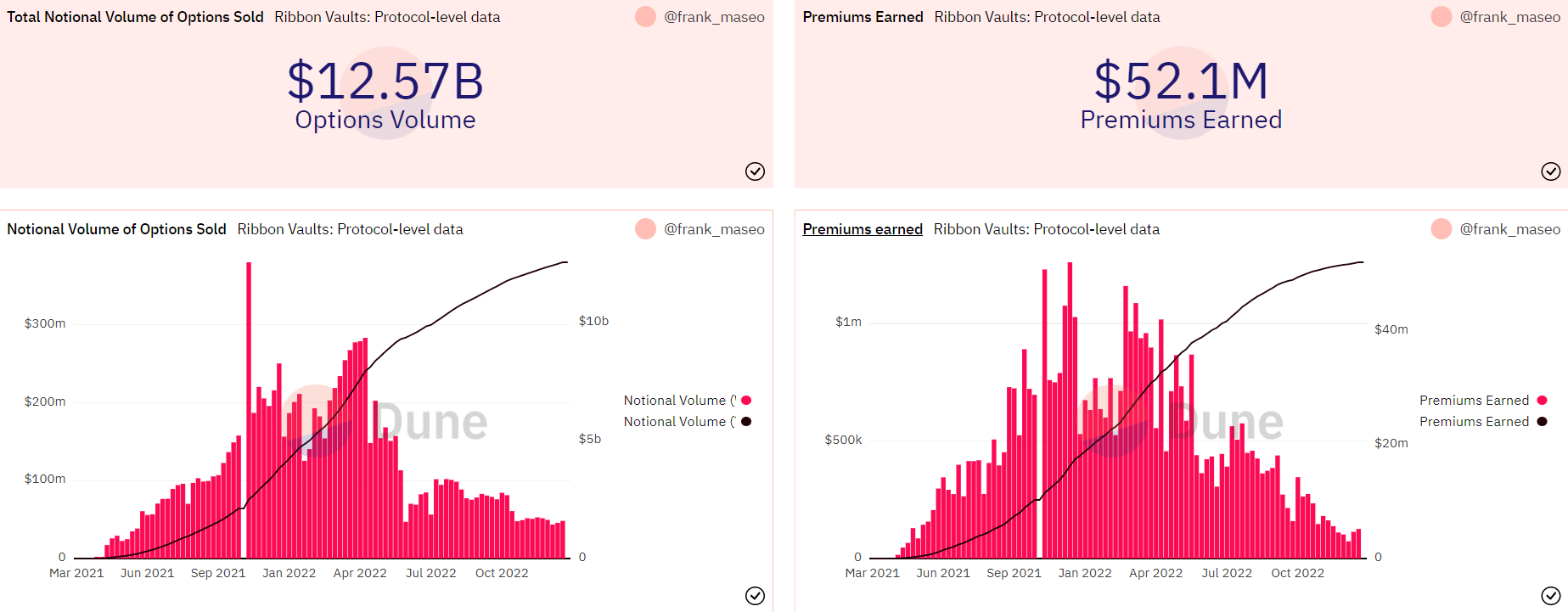

Currently the protocol has 52 million in total value locked, with 10 million in protocol revenue, remember no revenue means no runway. Runway is how long a project can survive if they were to stop making profits. The strongest projects have multi-year runways as they build out their network or application. Ribbon options volume has already broken 12 billion dollars.

Since this protocol requires institutional grade players and investors, the attractiveness of the governance token is increased. Normally a token that is used simply for voting can suffer from constant sell pressure since there is no underlying utility. However, since options trading is reserved for professionals, and professionals are always looking for better products, RBN has a unique outlook. Institutions will be able to utilize their research on options through voting on the future strategies and implementations of the products within the ecosystem.

50% of the RBN supply has been reserved for the community rewards. Over 60% of the supply has already been released. In order to vote, users must lock their RNB tokens to receive a vote-escrowed version of RBN. In order to receive the full-escrowed amount of tokens users must lock the tokens for a full 2 years. Anything less provides a ratio of less than 1 on return of RNB/veRNN. Holders of veRBN receive 50% of the protocol revenue, this is their long-term locking reward.

Bullish on RBN and Options

As more options activity occurs on the platform more Ethereum revenue is provided to holders of veRBN, this is known as real yield since the yield is partially in a bluechip asset. Stakers (technically locking not staking but similar) receive both the rewards from the RBN locked vaults AND the pool trading fee rewards.

Currently RBN is on many notable exchanges including Coinbase, it has decent trading volume. I believe that derivative trading has not yet fully taken off in crypto and RBN is a unique project that offers real world products. This is the type of network that can bring massive institutional adoption especially if the Aevo exchange offers an enjoyable user experience. I am bullish on Ribbon for the long-term, but be careful in the short-term as we approach a 24-27k Bitcoin. Remember none of this is financial advice, stay safe out there!