Polkadex or PDEX is a decentralized peer-to-peer crypto exchange based on orderbooks. When its main net launches it will have a strong connection to the Polkadot network especially since it is built on Substrate, the same coding backbone as Polkadot.

As the crypto ecosystem continues to evolve, we are always hunting for new plays with positive forward looking economics. One such token we’ve recently added as a mid-term hold is PDEX. PDEX is a decentralized exchange (as opposed to CoinBase, which is centralized, for example). This difference is important because the decentralized nature will allow users to hold assets on the exchange without the typical “Not your keys, not your coins” issues tied to many exchanges.

Since PDEX is based on Polkadot safety and security, this is a great new way to trade. No more paying fees to transfer in and out of ecosystems or between wallets. This will also highly increase available liquidity since asset holders will not be as pressured to pull the asset to personal wallets.

PDEX will offer trustless cross chain transfers between many blockchains. PDEX will be able to integrate with multiple liquidity providers by using forkless upgrades, a concept explained in our Polkadot article (and one of the major reasons why we love Polkadot!). This will allow for greater depth of liquidity for trading without access to users’ funds or keys. PDEX is designed to scale to 500,000 transactions per second, over 20 times the speed of VISA currently.

Polkadex is launching an IDO pallet which will allow projects to create tokens similar to ERC-20 (Ethereum tokens) with built in support for Polkadot parachains. This will allow teams to raise funds through IDOs with a one-click listing in the PDEX orderbook. PDEX also will allow users to easily on ramp fiat currency onto the orderbook. In case that didn’t settle in – We desperately need more ways to on ramp fiat directly to decentralized apps and not centralized exchanges.

Partnerships

PDEX boasts partnerships with Kucoin and Gate.io – two already successful crypto exchanges. Having strong initial partnerships with popular exchanges is a potential huge price driver for such an early stage project. They are also partnered with Fractal and Openware, two emerging crypto technology companies. Fractal is working on fair data economies while maintaining privacy, and Openware aides in building blockchain infrastructure from the ground up. Since PDEX is already partnered with Coingecko and Coinmarketcap, reliable price data is easy to access. We want to know the marketcap at all times during the early stages.

PDEX has many strong strategic investors including AU21 Capital, a major early investor in many projects we are interested in. Theur holdings look a lot like our portfolio; Polkadot, Harmony One, Polygon and Injective Protocol, to name a few. Other investors include DAG, Master Ventures and Blocksync Ventures.

PDEX already has a team of over 20 multi-cultural professionals with a wide background ranging from Chemical Engineering to marketing. The three core founders each have varying engineering degrees in progress and are passionate in the space.

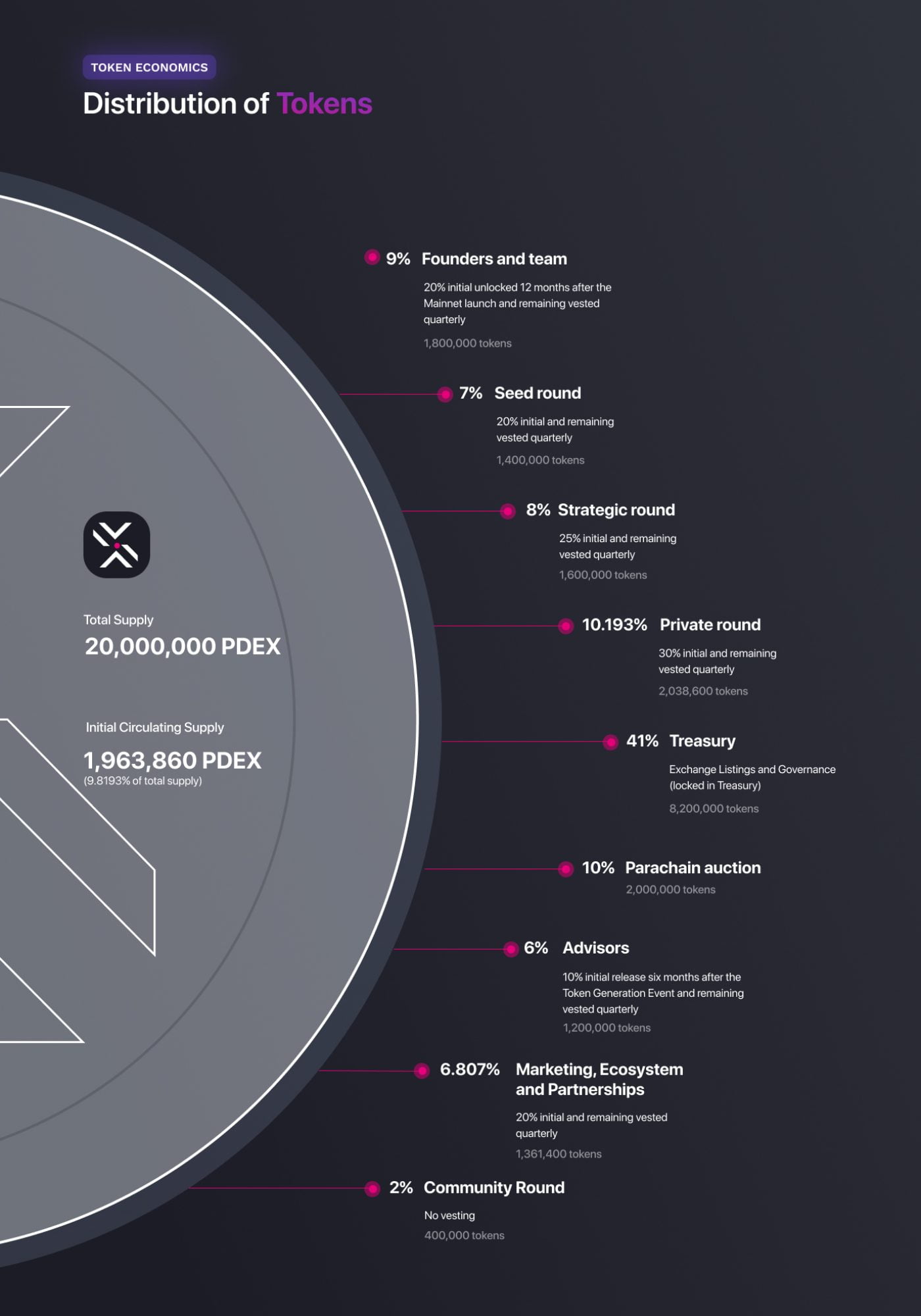

Tokenomics

PDEX has a total supply of 20,000,000 tokens, with its initial circulating supply at 10% of that. The project has a modest 9% of total allocation to the founders and team, which checks the box for legitimate projects we evaluate. 6% will go to advisors to help grow the project. The private, seed and strategic round combined equal less than 20% of the allocation. 10% is reserved for parachain auction rewards and funding. 41% is left to the treasury, which will use these funds to aid in building bridges to other blockchains and on chain governance. The final 7% is left to marketing, ecosystem functions and partnerships. They did also hold a very small community round of 2%. Overall these allocations are pretty reasonable.

PDEX tokens will have a slightly elastic supply in which the total circulating supply can move between 18-22 million. On chain fees will be burned if the supply is over 20 million. Other burning mechanisms will be voted on through on chain governance. PDEX tokens will be used for trading fees and discounts on the platform. PDEX will allow holders to participate in early investing of projects launched on the platform. Holding PDEX will allow holders to become validators through proof-of-stake consensus. All of these features combined with governance give the token great potential utility[1].

Staking

PDEX will incentivize users to hold the token to receive staking rewards of more PDEX over time. The PDEX documentation on their website states they are striving for 50% or greater staked circulating supply. This will be a positive price driver, reducing the available tokens for trade.

Governance

Governance on PDEX will be based on percentage weight of holding PDEX tokens for each investor. Governance voting will include which assets are to be listed on the exchange, giving the community a voice in what projects make it. PDEX will allow for emergency shutdown of the orderbook in case of exploits or hacks of the system. Governance will allow voting for where exactly the treasury funds will be spent and will also vote on inflation of the PDEX tokens. The stronger the governance system the better the utility of the token.

Investor Thesis

Our investor thesis for PDEX began with it being a potential first mover for the Polkadot ecosystem as its core DEX (think Uniswap for Ethereum). PDEX adds to this potential by offering traders the option to store their assets on the blockchain secure exchange, reducing fees and adding to ease of use. At the time of this writing PDEX has a tiny 65Million dollar market cap, and is 42% off the all-time high. This is a 238x difference between the market cap of Uniswap. If PDEX even captured 10% of Uniswap’s market cap, it would have around a 20-30x upside in the near term. This projection is only considering the DEX side of the application. PDEX offers much more than just swapping, as it aims to be a one stop shop with cross chain compatibility. I am a big fan of proof-of-stake crypto assets and would love to sell out my initial investment plus 10% at around a 7-10x and stake the rest for a long-term approach. Another approach I have used is to sell 33% at my goal (somewhere between 5-10x) and stake the rest for a long-term moonbag in case the project really takes off. Always remember that the name of the game is to grow wealth, which requires taking profits when appropriate!

[1] https://www.polkadex.trade/