Metavault trade is a fork of the GMX protocol. Metavault has two different digital assets, MVX and MVLP. This two token model is important to the success of the protocol and its future longevity.

Metavault Trade

It is important to first understand GMX in order to appreciate the differences that Metavault trade provides. For an introduction to the decentralized trading protocol GMX, check out our article [here]. First off, GMX is a protocol that carries most of its trading volume on Arbitrum, which benefits from Ethereum security. GMX also has a portion of its volume on the Avalanche blockchain. Both Ethereum compatible blockchains can be searched on our articles page for more information.

Metavault, like GMX is a trading platform with no central party, the protocol is built on the ever-popular Polygon blockchain which is a scaling network for Ethereum. Polygon boasts Ethereum compatibility, but at a much cheaper cost with faster transactions. Polygon is easily accessed through bridges, and users can now withdraw crypto directly onto the network as native assets. An example: users can purchase the MATIC token on Coinbase and withdraw it to a polygon address instead of Ethereum.

Metavault offers simple swapping, which is similar to Uniswap and other decentralized exchanges. The protocol also offers futures trading, which is essentially betting on the upward or downward price action of an asset over time. Futures, much like options are known as a derivative asset. In other words, their price is derived by the spot price of a stock or digital asset. According to Investopedia, the total derivatives market is said to be valued at over 1 quadrillion dollars, yes that is 15 zeroes [source].

With the recent fear, uncertainty, and doubt (FUD) regarding centralized exchanges such as FTX or even Robinhood, decentralized exchanges will continue to grow in popularity. Remember, not your keys, not your crypto. As a rule, it is imperative to always withdraw your crypto from exchanges to a personal wallet whenever possible. A major upside of Metavault is that it never had a private fund raise, so there are no venture capitalist firms waiting to dump their tokens on newer buyers.

Metavault Trade Benefits

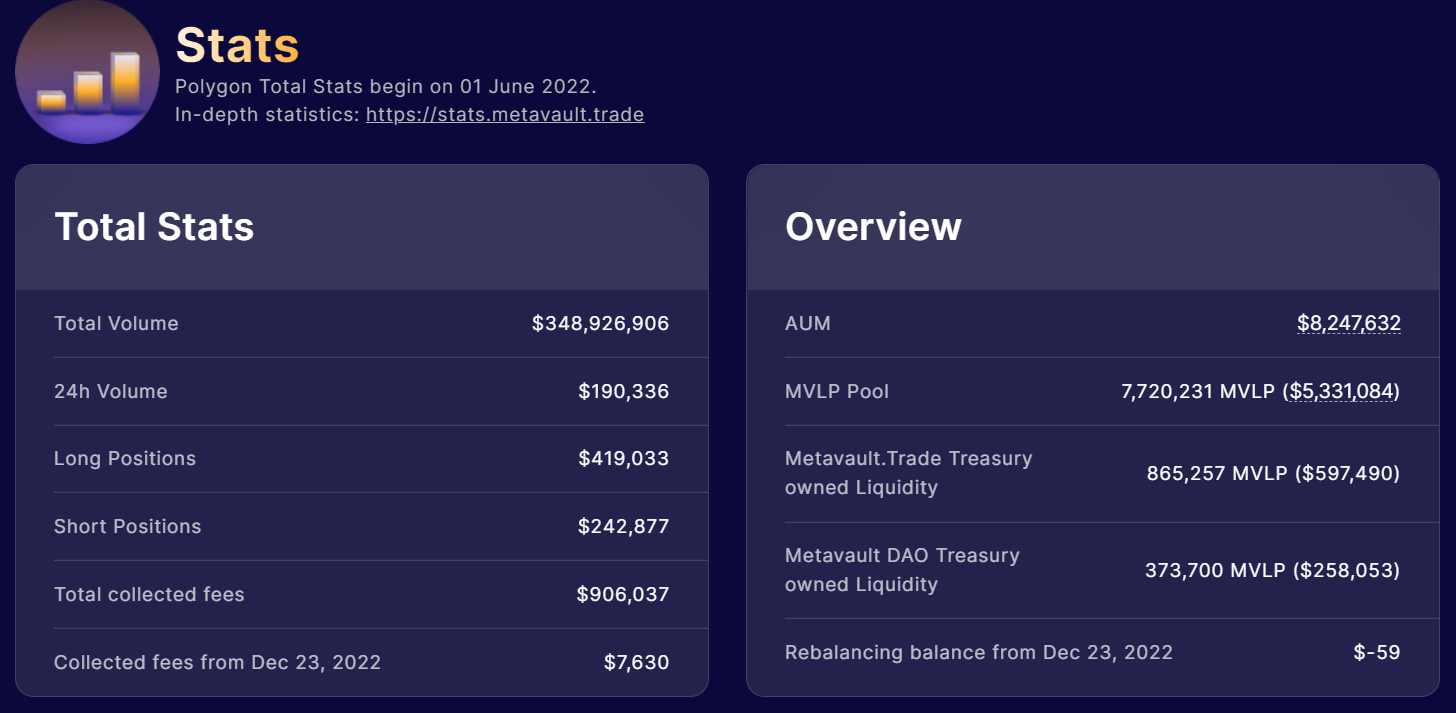

Metavault offers trading with minimal fees. These fees go to the protocol treasury and MVX/MVLP holders to incentivize holding both tokens. The treasury is important because it allows the protocol to build a long and prosperous runway to survive the bear market. These trades, even in large volumes offer no price impact, similar to an over the counter (OTC) trade. If a large whale were to sell millions of dollars of an asset it would not directly effect the price on Metavault trade. This also helps prevent liquidation events such as “scam wicks” often seen on centralized exchanges which commonly liquidate thousands of positions.

The fees on the network are 0.1% for opening a position, and 0.1% for closing a position. 30% of these fees go to MVX stakers, and the other 70% to MVLP holders which are the liquidity providers to the protocol. There is also a small borrow fee which is deducted at the start of every hour. Users can set how much slippage they will allow, much like Uniswap. They can also set stop losses, and take profit limit orders to risk-hedge or strategize. It is important to remember that advanced trading should be left to the professionals if you want to minimize risk.

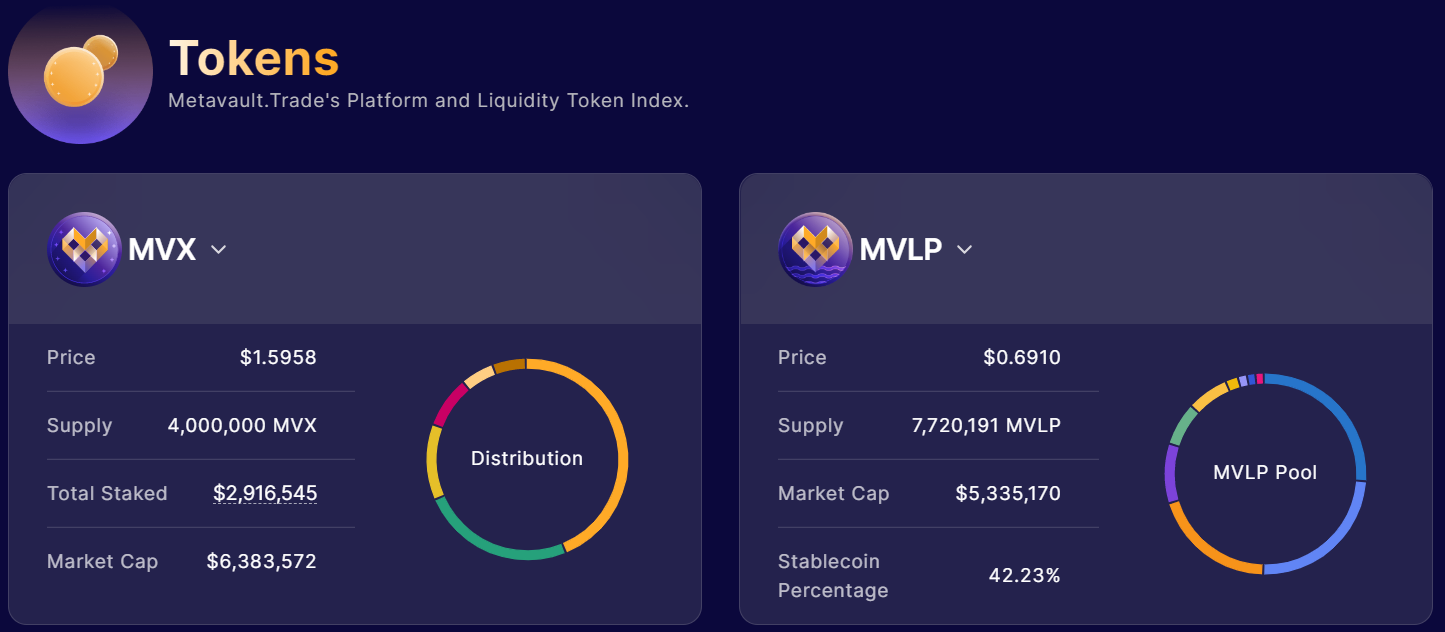

The MVX token is the protocol governance and utility token. 30% of all swap/leverage fees are converted to MATIC and given to stakers. This helps reduce protocol token inflation by providing “real yield” or yield in blue chip assets/ stable coins. If the rewards were all in MVX it would suffer from the same fate of other inflationary tokens during the bear market. Liquidity for the protocol is owned by the treasury. What is done with the treasury is voted on through structured governance. MVX has a small, limited supply of 10 million which is fairly low when compared to other tokens.

MVLP is created whenever a user deposits liquidity into the protocol. MVLP is burned when users redeem their deposit. Depending on which token is the most scare within the MVLP treasury, fees will be the cheapest for that asset when depositing. Deposits for abundant tokens will carry a higher fee. For example, say USDC is low in supply when a user deposits. They can deposit 1000$ of USDC for a cheap fee and receive MVLP in return. This MVLP can be staked to earn a share of the 70% trading fees on the platform. These tokens can be converted back into USDC in the future.

This single token liquidity eliminates impermanent loss which is the usual risk of providing paired liquidity tokens. Impermanent loss is the discrepancy of token pair prices over time. LPs only make money if their rewards are more than the loss between the pairs. If the prices of the tokens within the MVLP treasury rise, the MVLP token value will rise accordingly, it will also drop as the treasury value drops. MVLP stakers receive their rewards in Matic and an escrowed MVX token which over time can be changed into MVX or Matic.

MVX today has a market cap of only 3.2 million. Its closest competitor Gains network (GNS) has a market cap of 100 million. I like to always be transparent about my holdings, I own all three network tokens, GMX, GNS, and MVX. I choose to not participate in the LP tokens on these networks because I like the limited supply of their utility tokens. MVX being on polygon separates it from GMX, GNS has some downsides dealing with their fee structure. In part two of this article, we will analyze the tokens and articulate their potential future value as a thesis. Please remember none of this is financial advice and stay safe out there!