The world of cryptocurrency revolves around a handful of terms. At the forefront? Decentralization. Let’s talk about why this is important, particularly in the world of cryptocurrency. I just wanted to share some thoughts on why decentralization is important as we’re now 13 years past the famous Bitcoin whitepaper that started all of this (in light of the 2008 recession).

Look. I’m an only child. Like most of us, I’ve got baggage that I carry around just from growing up in general. One particular trait I’ve developed is my INTENSE dislike for being told what to do (not in the early 1990’s rap scene type way) because “that’s how it’s done”. Especially in today’s day and age, with the government printing money left and right, arguments over how to tax billionaires, and the student loan debacle facing the US, I think many of us wish “the people running things weren’t running them.”

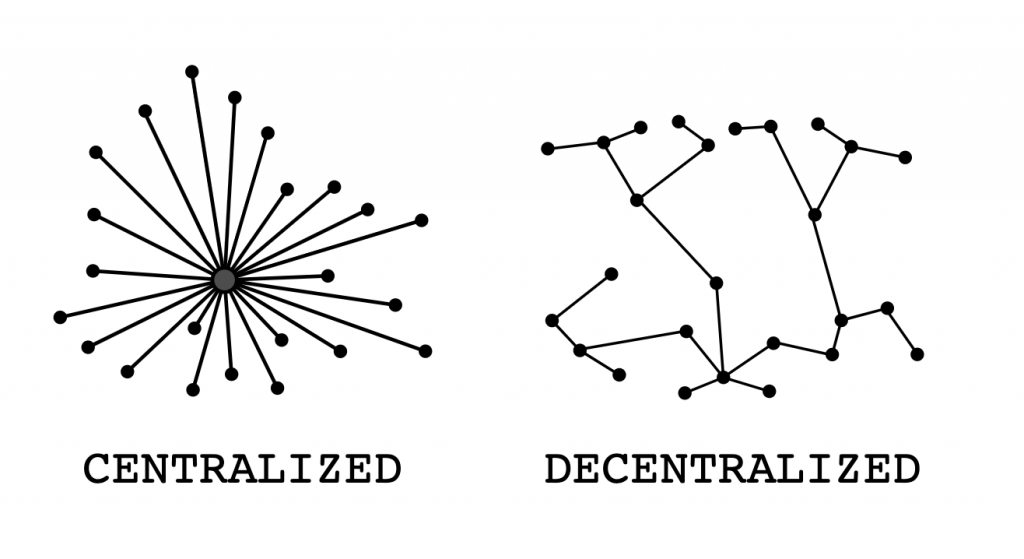

When you have a centralized authority it (essentially) doesn’t answer to anyone. Facebook, Google and many other large institutions (banks, etc.) are centralized. We have absolutely no control over their rules. We either play by their rules or we aren’t allowed to play (regardless of whether the rules are fair, we like them, etc.). Decentralization is not important because we are trying to resist being censured by the government

When you have a centralized entity, it is owned by someone (or a group, etc.). All centralized entities follow the same life cycle – the ‘S’ Curve, shown above. At the beginning, these centralized entities do everything in their power to grab attention, attract users and developers, etc. This is done solely because it increases the value of the services the entity provides. As the platforms these entities develop/own/use evolve, they travel up the ‘S’ curve as their power over users and third party folks (developers, businesses, etc.) grows.

Once the top of the ‘S’ curve has been reached, the only way to continue growing is to extract data and compete with complements over audiences. This process has happened hundreds of times: Google Vs. Yelp, Microsoft vs. Netscape, and so on. In laymen’s terms: Centralized entities and platforms need you (users, developers, businesses) until they become big. They sucker you in with perks and benefits and then monetize what you do.

A more modern example of two centralized platforms most of us know involves iOS and Android operating systems. Because they own the market, users and developers have had to give up privacy, control of their data, etc. Both iOS and Android take significant chunks of revenue from apps, arbitrarily reject some apps, and subsume the functionality of 3rd party apps, and there’s nothing you can do about that (Credit: OneZero). Security breaches, identity theft – these are all possible because of centralized platforms. In short: Centralized applications make their own rules, and there’s nothing you can do about it. Limiting withdrawals (banks, etc.), using data, etc. A centralized entity has CONTROL and they likely don’t care about you.

Decentralization

In a decentralized environment, like Blockchain, the control and decision-making is not performed by one entity. Rather, it is distributed across a network, which greatly deters any one participant’s ability to exert authority or control. Furthermore, this promotes decisions that benefit everyone. Think about it – we see the downfalls of centralization everywhere in simple democratic voting. If an outcome requires a majority vote (51%), things like political influence and money can sway a vote.

In a decentralized environment, all of the voters have no idea who the other voters are, making it essentially a trustless system. The majority of the network has to “agree” on an outcome. If someone’s outcome differs from everyone else, it just simply gets rejected. This way, no one can “alter” their token balance in the case of cryptocurrency to have more, for example. I think we have time for one more analogy.

Some of us may remember Encarta encyclopedia from back in the late 1990’s and early 2000s. There was an awesome game in it where you’d answer trivia and learn things – I used to love it. Well -a new site came along to challenge it – Wikipedia. Encarta, at that time, was a superior product. It had higher accuracy, covered a lot of different areas, etc. But – by 2005 Wikipedia was the most popular reference site on the internet and by 2009 Encarta was completely gone. Why? Wikipedia improved exponentially because it was a decentralized community-governed approach. The collective sum of knowledge and skill across that community blossomed and now we have the site we know today. Encarta could only improve and grow when the employees did it. But – as a decentralized system like Wikipedia grows, it attracts new contributors and the growth accelerates.

In the world of cryptocurrency, started with Bitcoin, this concept of decentralization is a fundamental tenet. Within this space there are no unaccountable groups and companies deciding how information gets ranked, who gets banned or promoted, etc. The network itself, in crypto, makes decisions right out in the open. Literally, there is no way to hide them. Anyone can query the blockchain and see a record of every transaction (another popular part of crypto – there are very few – if any – ways to associate a person with a crypto wallet address).

So – to wrap things up. I hate when some company or group gets to make decisions on my behalf. I hate it even more when they are unaccountable. In the world of crypto if you have sketchy practices you won’t survive. Nothing is perfect, but I’ll take my chances among the everyday people who are growing this industry, that’s for sure.