This article reviews some major upcoming sell-pressure events that could happen as early as next week. With the FOMC meeting next week, bad news could cause further ripple effects, this would bring a catastrophe to the crypto markets.

Celsius

For those who have kept up with Bitcoin & crypto news, Celsius, once a major crypto custodian has nearly suffered bankruptcy. To explain the story briefly, Celsius essentially took on too much debt by lending crypto to other parties. When the crypto market crashed, many of the companies that borrowed money from Celsius went bankrupt by over-trading and over-borrowing. One major fund, 3 Arrows Capital (3AC) practiced the same over-borrowing and thus lost Celsius hundreds of millions of dollars. Since Celsius did not practice basic risk-management techniques to protect their customers assets they were forced to freeze customer accounts. To this day, users are unable to withdraw their initially locked assets.

Celsius is a platform that allows users to lock up some crypto assets for a steady yield. The yield is gained by Celsius when large investors borrow from the platform. These borrowers are charged a percentage in exchange for the funds they receive. Celsius further amplified the leverage by locking millions of dollars in the Anchor Protocol on Luna.

When Luna entered its death spiral Celsius likely lost their entire position(user funds included), so did 3AC who also used Anchor Protocol. Rather than holding money in USDC, Cash, or another stable asset, they risked their clients’ funds utilizing high-risk strategies too often. Celsius is now being sued by a previous employee for fraud, and operating as a Ponzi scheme.

Celsius recently sent 500 million dollars of Bitcoin that it received from paying off a decentralized loan. This Bitcoin was sent in a wrapped form which allows the Bitcoin to move cross chain. The major question here is will Celsius well this Bitcoin to pay back further debt [1]? This will create large sell-pressure, especially if sold on the open market. Would you believe there is a much larger black swan waiting around the corner?

Mt. Gox

Mt. Gox was once the largest crypto exchange in the world, in 2014 it suffered a massive exploit which lost customers 850,000 BTC. Mt. Gox was able to save about 137,000 BTC in 2014, but these funds have been locked in a legal battle since [2]. Users will have the option to be repaid in Bitcoin, cash, or Bitcoin Cash. Since Bitcoin was between 500-1000$ in 2014, this will present a lucrative selling opportunity for the short-term. Even if users take their money is cash, the Bitcoin will need to be sold to provide the fiat currency. Add this to the 500 million dollars that Celsius presents as possible sell pressure, and you have about 3.4 billion dollars in Bitcoin.

There is no guarantee that a high-percentage of users will immediately sell-their Bitcoin since nearly all Mt. Gox users were early Bitcoin adopters/believers. However, this does present a very large possible sell event around the corner.

FOMC

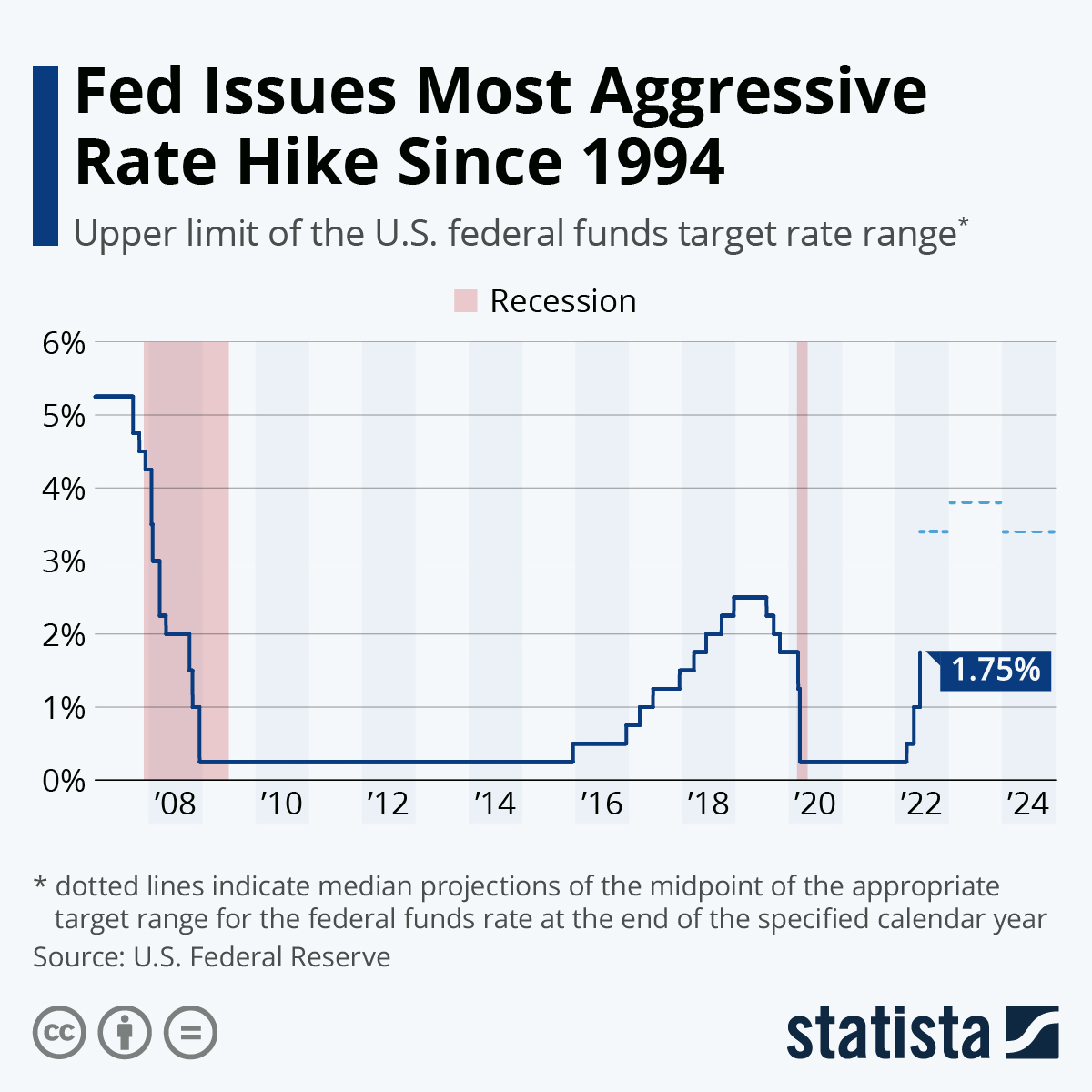

The Federal Open Market Committee (FOMC) is the governing body that is responsible for the federal rate hikes this year. Rate hikes are required to curb inflation, inflation is the worst we have seen in nearly 40 years [3]. The federal government continues to deny that we are currently in a recession, despite the clear signs of decreasing GDP growth every month and other metrics. With record commodity prices, a looming real-estate bubble pop around the corner, and steadily increasing fed rates, the short-term price action for Bitcoin does not look promising. I refer to this phenomenon as a FUD (fear-uncertainty-doubt) bomb.

Usually FUD bombs are engineered, with a mix of fake events, and over-exaggerating real-life events. The problem this time is that most of the recent FUD events are currently real. There is less smoke and mirrors this month than usual. I am predicting a lower Bitcoin price in the coming weeks. With this in mind, investors who want Bitcoin exposure have multiple options.

Dollar-cost-average the entire dip weekly with small bites at regular intervals is a solid plan. Or wait for the market to go lower and really turn up the heat. As for myself I have been dollar-cost-averaging some Bitcoin related stocks and eating up larger crypto dips as we see these crashes. Remember none of this is financial advice, please stay safe out there.

[2] https://cryptoslate.com/will-release-of-3b-bitcoin-from-mt-gox-cause-market-bottom-in-august/

[3] https://apnews.com/article/key-inflation-report-highest-level-in-four-decades-c0248c5b5705cd1523d3dab3771983b4