This article follows up on our Injective update article. Within this writing we explain a potential thesis on the INJ token, and review the fundamentals and token economy the developers have created.

Injective (INJ) Upgrades & Roadmap

For an update and introduction to Injective Protocol, check out our article [here]. Injective aims to become the base financial layer of the Cosmos by creating an efficient and popular blockchain. According to map of zones, Injective has moved up 40 places regarding Cosmos IBC volume on the 30 day time frame. Injective has moved to second in IBC transfers as well trumping Osmosis and the Cosmos Hub itself [1]. This is a massive increase in volume and transfers likely due to several upgrades and integrations.

Injective began with a native Ethereum bridge but has since integrated with Wormhole which allows for Solana, Oasis, Avalanche, BNB, Fantom, and Polygon interoperability. Perhaps the biggest recent integration involves the Solana integration with Helix. Currently, Injective is the only way for users to move from Solana to the Cosmos. Helix is a popular derivatives trading application built using the Injective developer kits.

Developers were able to use the base order book that Injective provides to create a perpetuals application that allows for futures trading of popular digital assets. Helix offers a unique and user friendly user-interface including trading histories, reward trackers, and advanced order types[2]. With the recent upgrade to injective block time finality of 1 second, previously two seconds, the network has become more reliable.

According to the CEO of the network, Eric Chen, fees are important for the security of a network, as well as creating an incentive for network participants [interview here]. Between moderate fees, and fast transaction finality, the network prevents downtime issues and unnecessary liquidations. Eric has also stated that the vision of Injective is to focus on decentralized financial applications to bring finance to the masses.

With a recent 150-million-dollar ecosystem initiative, the network aims to increase the awareness of the Cosmos, as well as incentivize developers to build on Injective Protocol. With inherent front-runner protection, mandatory minimum fees, and mandatory insurance funds for each application, the network provides a secure and well thought out path for investors and builders alike.

Add the above to the base Tendermint consensus mechanism, and ever-increasing application integration, the INJ token is poised for increased volume. The blockchain recently integrated Astroport which was one of the largest applications on Terra Luna before the collapse. Astroport allows users to trade native and bridged assets alike with ease on multiple chains. The network also aims to bring cross-chain governance and fee sharing. Fee sharing is potentially a VERY big deal as this would aggregate all volume from an asset for liquidity providers providing greater rewards and deeper liquidity. But what about the INJ token itself? After all the protocol is not the investment, the token is.

INJ Tokenomics

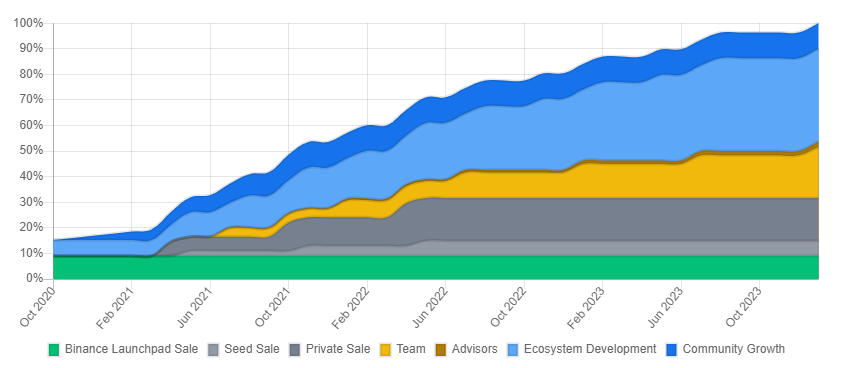

Combining the information in our update article, and the above information, it is easy to see the potential use case of the network. With ever increasing applications, only a handful of popular and easy to use products are necessary to create the network effect needed to increase the INJ token price. Currently 78% of the max supply of tokens are in circulation, with a slated inflation rate of an eventual 2%.

Like many tokens we like, the seed rounds have likely already sold out for massive profits from their initial investments. The token release schedule is approachable focusing on ecosystem development and network incentives. Today INJ can be staked for 17% APR. INJ tokens are used for staking, voting, application collateral or margin, and for weekly auctions.

As discussed in our last article, users can put up INJ tokens for a weekly pot of a basket of assets, the winning bidder will have their INJ tokens burned reducing the supply. INJ is also required for the mandatory insurance pools for each application. Currently 56% of the available tokens are staked reducing the readily available supply for trade. If you have read our articles mentioning supply shocks this is bullish.

The token economy created highly incentivizes traders and investors alike to utilize the network token itself. Many networks simply create a token for governance, and do not put enough thought into the economy aspect. If users must hold INJ to create applications, provide liquidity, provide security, insurance, debt and more, the token truly becomes the value proposition of the network itself.

With enough volume, staked token percentage, and new applications. INJ could become one of the main value propositions for the Cosmos Hub itself. Since the ATOM token has so far failed to provide this utility, Cosmos bulls must search elsewhere for tokens that will have a network effect within the interoperability focused Cosmos. I believe INJ has the potential to provide this value and utility. Since most of the tokens are unlocked, and a high percentage of tokens continue to be staked during a bear market this gives extra conviction.

For transparency , I have sold 33% of my ATOM and will be averaging into INJ for the long-term. With the simple Keplr wallet that also provides Ledger integration it becomes easy for investors to have exposure to multiple Cosmos blockchains within a single application. Since it is so easy to move tokens between Injective and Osmosis, this could be why the IBC volume/transfers have skyrocketed. I give INJ a solid 9/10 for the token economy they have created. We have developed a tried and rather accurate algorithm for scoring these tokens that we have been testing for months.

Please remember none of this is financial advice, stay safe out there!