This article discusses market capitalization, investor thesis. We also discuss entry and exit strategy basics.

Some simple explanations will be helpful before we begin sharing the “rules of the game”. I have made many mistakes in crypto and have spent many hours learning the hard way, or doing things inefficiently. The purpose of this article is to share my opinion of best practices to help reduce risk, increase confidence, and increase knowledge in the space. When you invest confidently you sleep at night knowing that you have a plan and the conviction to live by that plan to reach your goals. This article is not financial advice, but instead a compilation of things that I believe when practiced together lead to better results.

Market Capitalization

The first concept that needs to be discussed is Market capitalization. Market cap is simply the amount of shares of a company multiplied by its current price[1]. In crypto this changes slightly as the amount of coins released changes over time in some cases. Microsoft today has a market cap of 2.1 trillion, it has 7.56 billion shares that are each worth 282.38$. Market caps are VERY important in the stock market but especially important to remember in crypto.

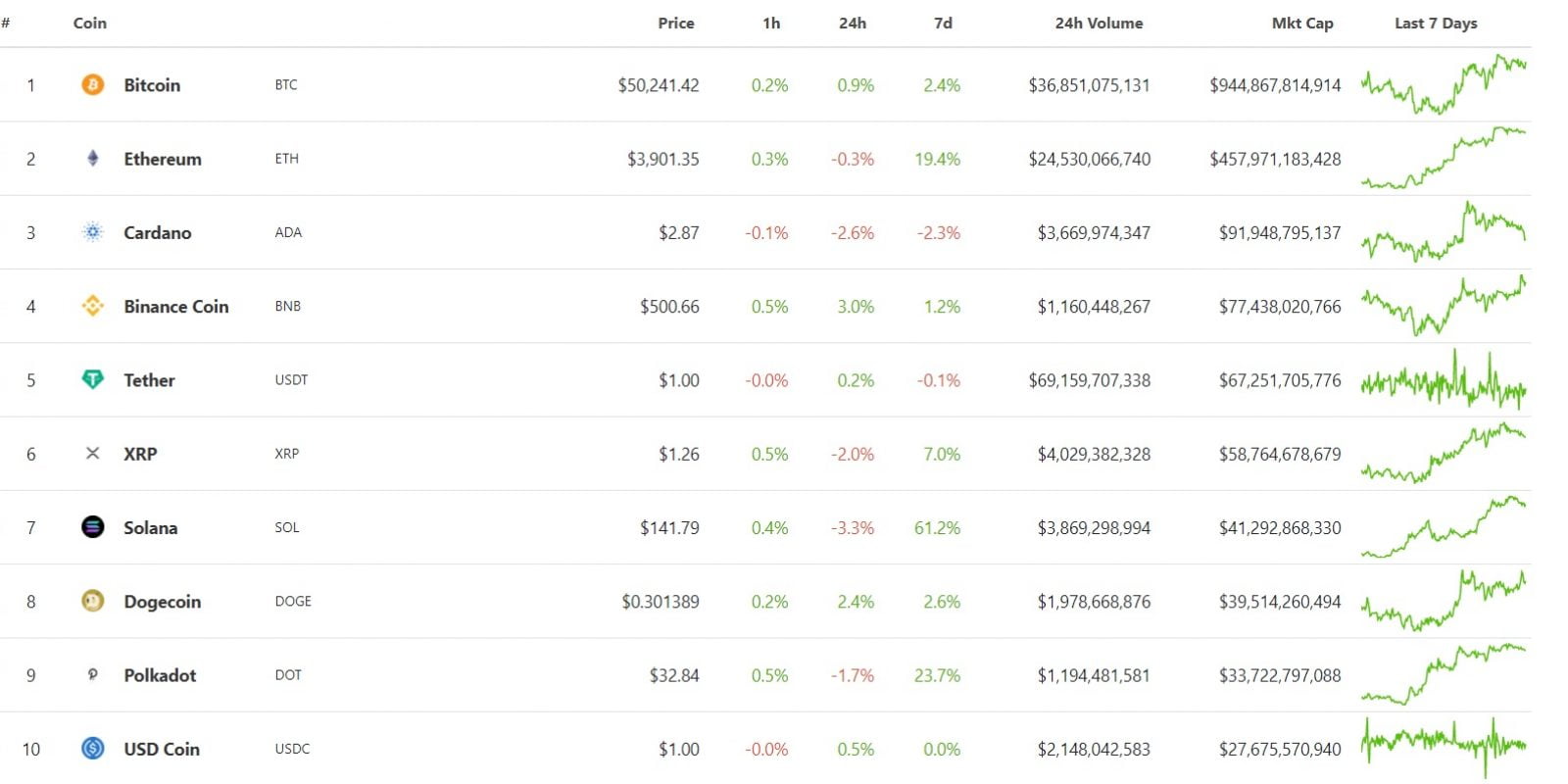

A company worth 100 billion dollars needs another 100 billion dollars of value added to grow by 100%. This is why coins like SHIBA will never reach 1$, it is not physically possible if you were to look at it in terms of market cap. If you wanted to make 10 times your investment on a project worth 10 million dollars it would need a value of 100 million at time of sale. Any time you purchase a crypto you should know its market cap, and compare similar projects in the space. The chart below on coingecko’s website shows the market caps of the top 11 crypto assets at this current time.

Realistic Evaluations

This chart above proves why it is unlikely dogecoin will rival bitcoin, it would need to grow 23x from its current point while bitcoin remains stagnant. Market cap is very important when looking at any project because one can compare assets in similar categories. An example of this is LINK is the largest oracle crypto in the market, it grows slowly relative to newer oracles that are gaining traction because it has a large market cap. BAND another popular oracle is 34x smaller than LINK making it potentially a good choice as a growth coin, higher risk, higher reward because it has a long way to go to compete for the market cap that LINK currently holds. Market cap is part of why Poldadot and Cardano are so attractive to investors recently, they would compete with the market cap that ethereum holds so they potentially have a long runway to move upwards.

Investor Thesis

The second and perhaps equally important concept is having an investor thesis. Every project that an investor holds should have a thesis, or reasoning behind the investment. Buying a coin because someone said to or because it has a cool icon is not enough to back that investment long term. When purchasing a crypto one should be able to explain what the crypto is, what it does, and why it is a good investment. For example, someone purchases Cardano because they believe it is the future of smart contracts and will compete with ethereum. They also invest because it has a much smaller market cap, if it were to rival half the market cap of Ethereum, they would grow by at least 250%, if it were to pass Ethereum’s current market cap they would grow 570%, respectable gains. These prices are evaluated during a big market correction, these projects have much higher all time highs.

Re-evaluation

When a project has a made a fair amount of profit it is encouraged to re-evaluate the investor thesis. Do you still hold the coin in question for the same reasons? There is nothing wrong with changing your mind, this is part of the process. If you are unsure you have many options, one recommended option would be to take your initial investment out plus 10%. This way you have made some profit, your risk is eliminated, and now it becomes a question of how much more money are you going to make. Maybe a project is slow on launches, has changed the development team for the worse. Is a project not living up to promises, and has non-ideal tokenomics? If your mind has changed, and you can no longer validate holding the crypto, there are always promising projects on the horizon, stable coins , Bitcoin and Ethereum are always a safer bet.

Entry and Exit Strategy

The final concept for part 1 of this series is having an entry and an exit strategy. Maybe their “exit” strategy is to gain as much bitcoin as possible and move out of the higher risk coins over time into bitcoin. Maybe someone wants to pay off their house and they will move their funds to an exchange and cash out. In order to create an exit strategy, one must ask themselves, why am I in crypto. If you are in for the long term, the exit strategy will likely involve amassing as much of the top 5-10 market cap coins as possible. If you are one who wants to make 50,000$ and leave the space that is a strategy also, the key is to stick to the strategy and not stray too far. We cannot forget the entry strategy because this is just as important. An entry strategy might entail weekly dollar cost averaging into your favorite coins. I tend to use this strategy but I buy much more heavily during aggressive dips. I like to take profit into stable coins to buy dips on my favorite large market cap coins. I also keep stables on the side to buy new exotic lower cap projects also. Please check out the rest of the series if you enjoyed part 1!

[2] https://www.nerdwallet.com/article/investing/dollar-cost-averaging-2