This article will focus on crypto risk reduction through diversification and other methods.

Diversification

A common method for most investment strategies is known as diversification. Through diversification an investor can spread out the exposure they have to market sectors, individual stocks or cryptos, and unique asset classes. Since we are focusing on crypto, investors can diversify in a number of ways, either by gaining exposure to different crypto categories, ( as discussed in the crypto categories article) or by equal weighted portfolios, or individually weighted portfolios. When investing in any market, one must first decide what level of risk they feel comfortable with, this is known as risk tolerance. Risk tolerance traditionally varies based on age, investment goals, and other factors [1]. In the early stages of forming an investment strategy one must decide what level of risk they are comfortable, this will be apparent when the markets are volatile.

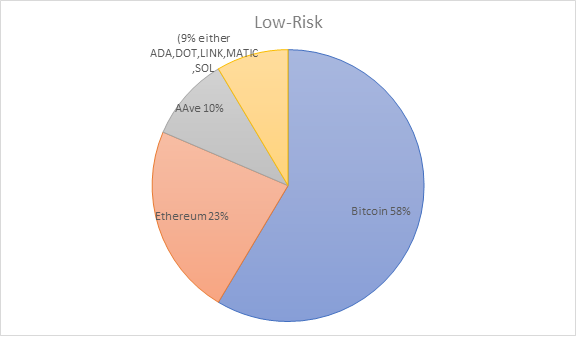

For the purpose of this article we will focus on changing risk levels through diversification of a crypto portfolio. Generally higher market cap cryptos are considered lower risk for the most part, the opposite is true for lower market cap cryptos. An example of a investor strategy for a low risk portfolio would generally carry high percent weight of Bitcoin and ethereum and then a few other top ten cryptos. Since bitcoin and ethereum are the two largest crypto assets, they tend to drop the least when the market plunges. The downside of the large market cap cryptos is that they tend to go up more slowly and have less runway upward relative to some other assets. There is nothing wrong with buying only Bitcoin or only Ethereum, since they have proven themselves as market leaders, and have the most adoption.

Mental Fortitude

Risk is a large factor for all forms of investing. Risk is the level of uncertainty involved when investing, risk can also vary based on the mental fortitude of the investor[2]. If one believes that an asset is strong fundamentally, is it really that risky to dollar cost average in? By using its standard definition of investment risk, purchasing lower market cap, more speculative assets can highly increase risk, but in return highly increase reward. When evaluating risk vs. reward many factors are at play, every investor has a different strategy. Many crypto investors stick with the top 5 or ten cryptos by market cap for this very reason, they have proven themselves therefore the risk is lower.

Ratios

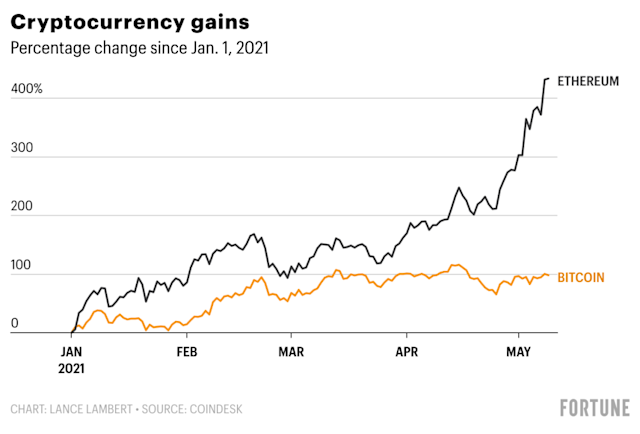

The chart above, courtesy of [yahoo finance], is a simple visual showing Bitcoin vs. Ethereum price action since July 2016. Generally Ethereum has outperformed BTC over time providing a higher rate of return. Because Ethereum has a lower market cap than BTC currently, it requires less money from investors to provide a higher return. This strategy can be repeated downward when looking at most of the top 10 cryptos and beyond.

Outperform Ethereum

This next chart shows a project formerly known as Matic, now Polygon and its performance against Ethereum. These charts are valuable because it does not compare the asset to USD, it compares the asset directly to another crypto’s performance. If polygon were to remain even with ethereum in terms value and pace, the chart would remain perfectly flat. While investing in polygon four or five years ago would increase risk, one can easily see the potential upside, in this case investors outperformed Bitcoin and Ethereum without purchasing either. A solid strategy when looking into lower market cap coins is to look at the asset compared to ethereum, maybe the asset is in a downtrend and currently not outpacing ethereum, this might be a potential buy signal when using this strategy. These opportunities can be seen on the polygon chart above, every big dip vs ethereum would have outpaced ethereum on the uptrend.

Risk vs. Reward

Too much exposure to low market cap coins can highly increase the risk of a given portfolio. This is why a good strategy early on involves high exposure to larger market cap cryptos. When buying the new speculative asset you just heard about from your friend, it pays to always do your own research, and create an investor thesis for this new potential buy. Do you know what the project does? Do you have a reason for buying it instead of Bitcoin or Ethereum? These questions must be answered before proceeding, through discipline in the strategy, greater confidence and performance can be attained. When buying your first new coin with a low market cap a big life saver is to never invest a large portion of your total portfolio value. If you own 50,000$ in crypto currency, a risk averse purchase might be 100-500$.

While a measly 500$ for a portfolio of that value seems small, the upside can be enormous. Many small cap projects have gone up 5, 10, 50, even 1000x in the past year. A 500$ investment in a good pick could rake anywhere from 2500-500,000$. The 500$ buy also limits the risk that the investor faces in this new speculative crypto. When the investor cashes out they have many options for profit taking, they can profit take into one of their favorite long term coins, or into USD stable coins for future crypto purchases. Always keep in mind the moment you take profit on these short term holds, you are liable for the taxable event. Make sure to check with your accountant regarding tax implications.

Diversification and risk management can help create a strong and long lasting crypto portfolio. By weighting a portfolio based on risk, an investor can increase the upside, while reducing the downside in the markets. We will conclude with an example of a low-risk crypto portfolio. Bitcoin is king, Ethereum is the runner up, while aave is a bluechip defi play. Other exposure can include any combination of smart contract platforms and oracles, generally the higher market cap the lower the risk exposure.

[1] https://www.nerdwallet.com/article/investing/what-is-risk-tolerance-and-why-its-important

[2] https://www.finra.org/investors/learn-to-invest/key-investing-concepts/reality-investment-risk