This article introduces the Gemini exchange and the user-friendly interface. Gemini is approachable to the new investor, but also has tools fund managers and institutions can use. (unfortunately blockfi is now filing for bankruptcy >> please take notice, this is one of our older articles****)

The New Crypto Investor & Gemini

Gemini is an American exchange owned by the Winklevoss twins, they own [Blockfi] as well. The Winklevoss twins were both early Bitcoin investors and became frustrated during their search for a secure place to hold their growing assets. Both Blockfi and Gemini are leaders in the space and provide intuitive, secure access for crypto storage and investing. Gemini backs the average investor for up to 250,000$ using American FDIC insurance. This means that if Gemini were to ever suffer an exploit or loss of funds, your money will be protected by the federal government [1]. Mishandling crypto transactions or sending to incorrect chains/wallets generally is not covered by insurance.

Gemini tends to offer reliable, vested, and legitimate crypto assets. They do of course offer the popular meme-coins and some very speculative assets as well. For the most part, Gemini offers the basic large market-cap projects from Bitcoin to Solana or Luna. They have recently added a few crypto index funds which are attractive offerings for new and veteran crypto investors alike. Index funds allow investors exposure to a basket of assets similar to traditional mutual funds in the average retirement portfolio.

Jumping into the website or application users will notice a streamlined interface, with easy-to-understand directions for getting started. Gemini requires the usual “know your customer” information you would expect from Ameritrade, Robinhood or another crypto exchange. Once this process is completed users can simply link their bank account to onramp funds. A perk that Gemini has above some other exchanges is that they offer returns for holding some assets. Users can gain 7% APY on GUSD (a dollar-based token/stable coin) by simply holding the asset in their Gemini wallet, this greatly outperforms the average savings account.

Gemini offers security forward features including 2-factor authentication which is a must for any investor. Users can enable face-ID to bypass the need for typing a password which is another important security feature. A security key, and additional 2FA is also available for those who wish to use it, generally a phone and email is linked to the account. Gemini also offers self-custody wallets which tend to be safer than allowing an exchange to hold assets for users, assuming the custodian is knowledgable. Gemini lets users swap between basic, and active trader modes (more trading metrics/charts) without the need for setting up two exchanges. Coinbase requires a setup for both Coinbase and Coinbase Pro which can be overwhelming for new users

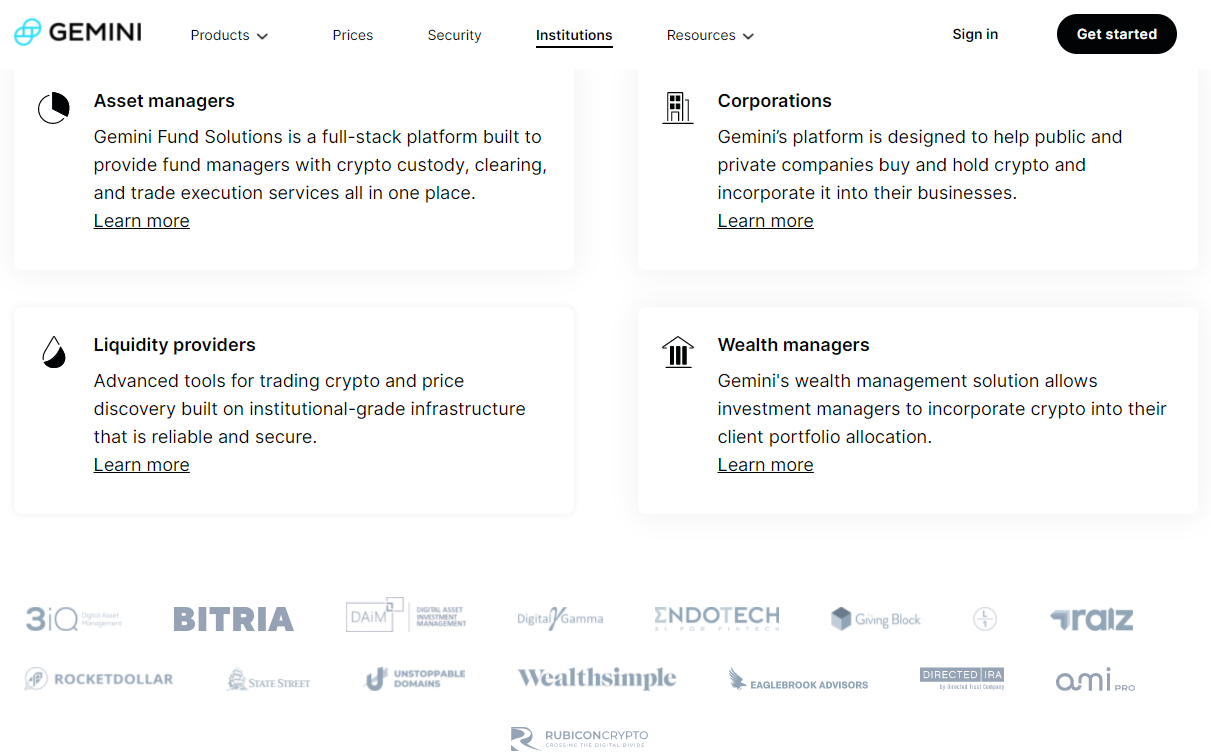

Fund Managers/Institutions

Gemini is a regulated crypto custodian licensed to store crypto for customers of all backgrounds and income levels [2]. Gemini maintains around 300 million dollars in digital asset insurance for these institutional funds. They store most of their assets in qualified cold-storage, the safest option. These avenues allow for same day withdrawals, and instant access for trading/rebalancing. All applicants are subject to extended “know your customer” reviews, anti-money laundering sanctions, and anti-secrecy laws.

The cold-storage wallets have multi-signature features, meaning that if someone were to attempt to steal a large pool of assets, they would need multiple unique passcodes only held by specific individuals. Allow-listing is mandatory for these larger accounts. Allow-listing is when only specific withdrawal wallets or addresses are allowed to be used. For example, a fund manager has 2 wallets he or she uses, only those 2 addresses would be allowed for the withdrawal of the investments he or she controls. This is an immense security feature as it would be nearly impossible for a hacker or exploiter to withdraw funds successfully. Furthermore, if the multi-signature wallet was ever exploited, the thief would not be able to withdraw to their personal wallet.

Gemini Clearing & Other Aspects

Another valuable feature that Gemini offers to clients is known as Clearing. This is when two parties wish to trade assets in a private manner peer to peer, no order books involved. Gemini acts as the confirming third party ensuring timely settlement as well as security enforcement [3]. This is a secure version of over-the-counter trading, imagine one large investor buying another investor’s Bitcoin for an equalivalent amount of stable-coins(USD valued tokens), Gemini simply makes sure there are no bad-actors, and pushes the transaction through. These transactions are also anonymous for Gemini, only the counterparties know the identify of the two participants.

Gemini offers some of the best customer service to date for crypto exchanges. Coinbase and Binance US users have often complained of lack of support when they wish to submit a ticket or get a transaction reviewed. All support for Gemini is online with written documentation for user receipt and review.

Gemini offers a MasterCard with Bitcoin (or other crypto assets) cash back rewards, similar to the Blockfi rewards program. The Coinbusters team has been utilizing the Blockfi credit card for months know, these have offered more rewards than any credit card we have used in the past. Gemini boasts a green initiative and pledges to actively reduce their carbon footprint. They also have an opportunity fund focused on fostering secure and sustainable Bitcoin growth for the future. For more information on Gemini check out their website [here]. As you can see, Gemini is far more than just an exchange, they are a forward-thinking company who focuses on security, custodial management and block-chain mass adoption/sustainability. Please remember to do your own research, none of this is financial advice, and stay safe out there!

[2] https://www.gemini.com/institutions/asset-managers