This article explains why Patrick O’Neil, a major Altcoin investor, has shifted his stance and is accumulating Bitcoin during this market crash.

What are Altcoins

Altcoins have a variety of definitions; it depends on who you talk to. For Coinbusters, we consider any token that is not Bitcoin or Ethereum to be an altcoin. There are many categories of altcoins but we favor separating them by their market capitalization, or total value of all of the tokens combined. Using this metric Bitcoin is the clear leader, followed by Ethereum, with an ever-competing set of tokens fighting for the top 10 spot regarding value. Bitcoin is generally considered the safest of the crypto assets, followed by Ethereum. Those who have a long time horizon and are bullish on the space will find many reasons that Bitcoin will appreciate in value for the next 10 year period.

Ethereum at times the time horizon can be blurry, it becomes challenging looking at the ten-year outlook for Ethereum when it has so many direct competitors. These direct larger market cap competitors are generally the next safest basket of assets. Solana, Cardano and Avalanche to name are a few examples of Ethereum competitors. There are of course other types of networks that do not directly compete with Ethereum, generally the higher market cap projects provide a bit less volatility.

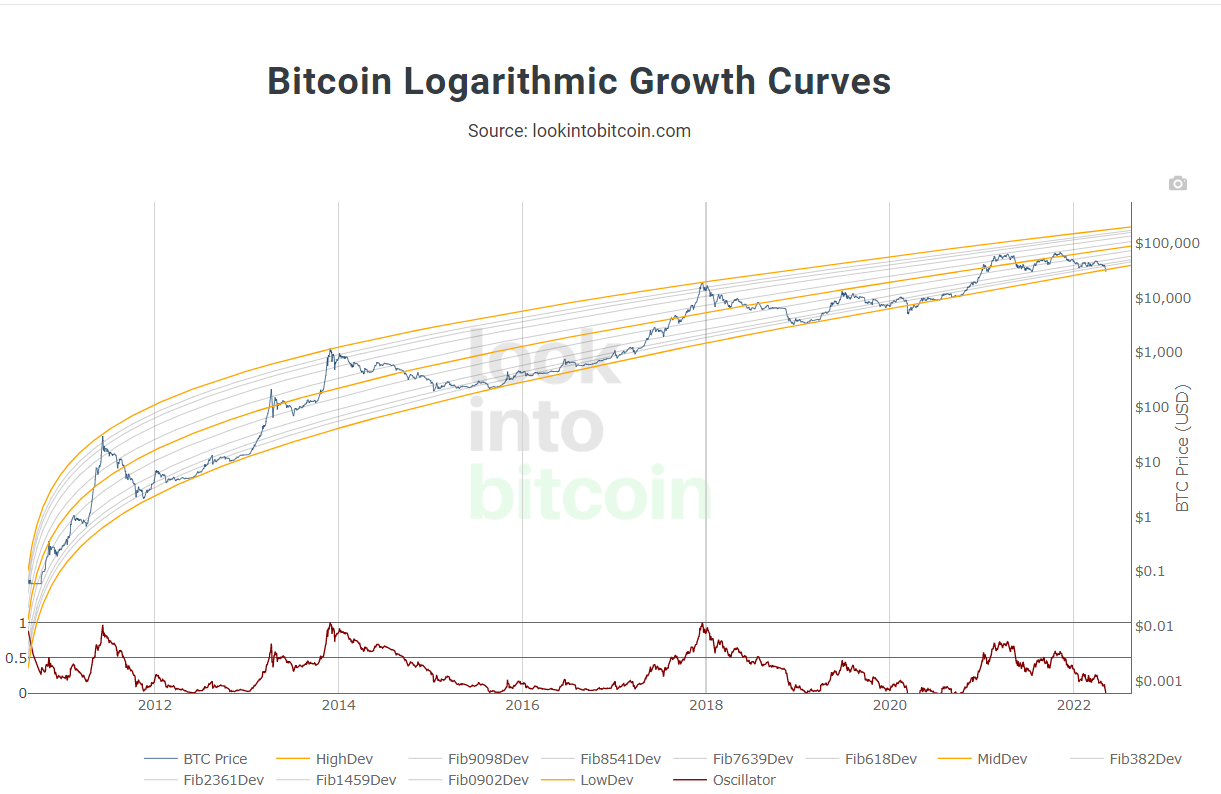

Nothing is certain in crypto, we just watched one of our favorite tokens LUNA crash Bitcoin alongside it. We have another article in the works to explain what happened, but the token dropped from 8th place to 18th in less than 48 hours. This is where Bitcoin comes in, yes the price action has not been great lately, but Bitcoin is the several year hold. The BTC price keeps getting more and more attractive for those looking to enter the market. Many long term investors were calling for a 100k Bitcoin this year, entering on a 30k BTC is a solid 3x were this to occur.

Enter Bitcoin

I am mostly an Altcoiner, I hold Etheruem, and mostly a basket of altcoins, I rarely ever buy Bitcoin because the returns are less than our favored altcoins most of the time. During these market conditions the only sure thing is that Bitcoin will be accumulated by larger investors over time. Since I believe this to be true, the least risky and sure bet I can make is to dollar-cost average Bitcoin. In crypto, it is very easy to find yourself chasing gains and always looking for more. When I bought my largest bags of Ethereum between 100-200$ I wanted more than the 10x plus gain I received. This is how I got into altcoins some of them would provide 10x gains in half the time, others 30-40-50x, it was addicting to research and invest in new projects, but it was always risk on, heavy risk on.

Now investing in any asset class right now is likely to be considered risk on by standard investors. Buying Bitcoin for a crypto enthusiast might be boring, its definitely not a sexy strategy to buy a few hundred dollars of Bitcoin every week either. However, its tried and true, if you are confident in the long-term horizon for the asset class, Bitcoin is the best way to start. Even for a seasoned crypto investor, Bitcoin makes sense right now. The market is flushing out the weak projects, more pain is to be had, more spirits are to be broken. Bitcoin has the greatest adoption we have seen in its history, countries are making it legal tender, it can be used as collateral for real life loans, the bullish news is seemingly endless.

The markets are on fire right now and we have seen a lower low on the long-term time frame for the first time for Bitcoin price action. The contrarian would say now is definitely not the time to buy, however I like to buy on the way down, not on the way up. To put it plainly I get up in the morning, and I set some limit orders, I try to think fairly bearish (price going down mindset) when I place the orders. Yesterday I put some for 30,720$ and 29,999$, one of my orders hit, the 29,999$ limit has a strong likely hood of hitting as well. You can use this strategy for any token that is bouncing around in a range, not necessarily going overtly upward or downward. Since I do not have many stocks I am confident will rebound soon, I look to Bitcoin as my medium risk dollar-cost average strategy.

The best part about this is even if the price drops, I am accumulating a very long-term asset that has proven to outperform all markets in the long run. For US investors, Coinbase pro has competitive fees along with the FTX exchange, these are two relatively easy to use fiat on ramps. A fiat on ramp is just a place you can connect a bank account to for on ramping of cash to potentially buy assets. Do remember, just because I am shifting my focus to Bitcoin does not mean I am selling my altcoins or not buying any more. I am just shifting my risk into a more stable asset, altcoins like to drop 2-5x harder than Bitcoin when it crashes, the risk is far more intense. Please remember to stay safe out there. Thank you for reading, none of this is financial advice!