How does Grayscale Work?

In America, the Securities and Exchange Commission has made it VERY challenging for institutional investors to get their hands on Bitcoin, and broader digital asset exposure. To date, no spot ETF has been approved despite over a dozen attempts. A spot ETF would allow any investor to purchase a funds ticker symbol to immediately gain Bitcoin exposure. Users could purchase the shares; the fund would then purchase and hold Bitcoin. The fund would track the upward and downward movements of Bitcoin to a far greater extent than grayscale shares similar to mutual or index funds.

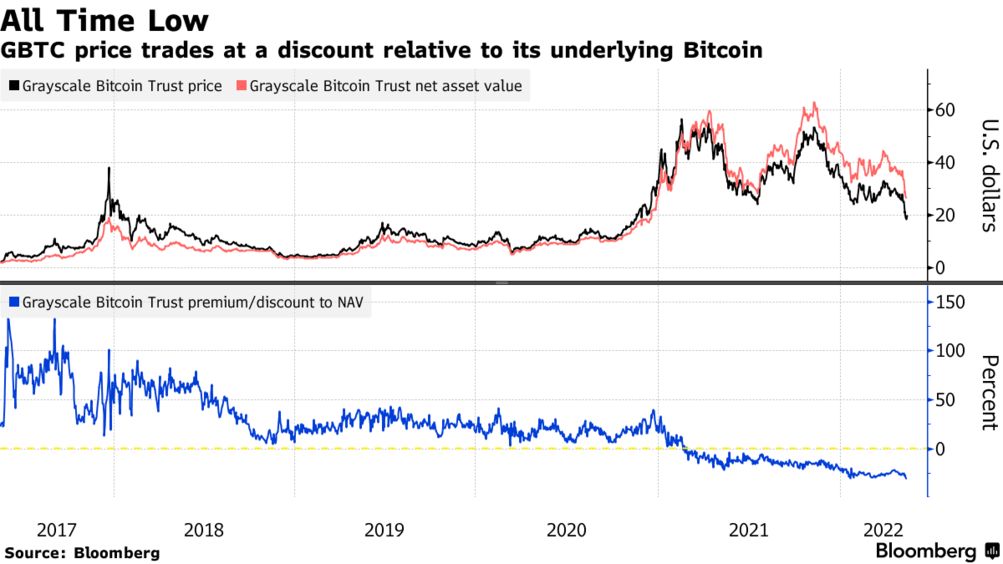

Instead of this, the SEC has only allowed for trading of paper future contracts, which have no impact on the price of the real asset at hand. The other option is to purchase GBTC from Grayscale. Currently Grayscale holds more than 650,000 Bitcoin according to [yahoo], this is over 11 Billion dollars with a price of BTC at 17,500$. Grayscale makes money by charging a 2% management fee, this is far more than the fractions of a percent of the common ETF. When Bitcoin has more value than GBTC, the company also charges a premium for the shares [1]. GBTC has a market cap of only 6.89 Billion today.

Grayscale also provides a discount when the demand for Bitcoin is lower. Many large investment funds and institutions have taken advantage of this discount to arbitrage between actual Bitcoin and GBTC. There are many downsides to owning GBTC instead of the real deal.

Cons of Grayscale vs. BTC

1. Not Suitable for Smaller Investors

GBTC charges a 2% annual fee. On top of that, you have to pay a premium to buy shares when demand is high. It’s not a good fit for smaller investors, because you need a minimum investment of $50,000 to buy into Grayscale Bitcoin Trust.

2. You Never Actually Own Any BTC

You can never redeem your shares for actual BTC because the Grayscale trust owns the private keys to the BTC in your shares.

3. The Ever-increasing Performance Gap

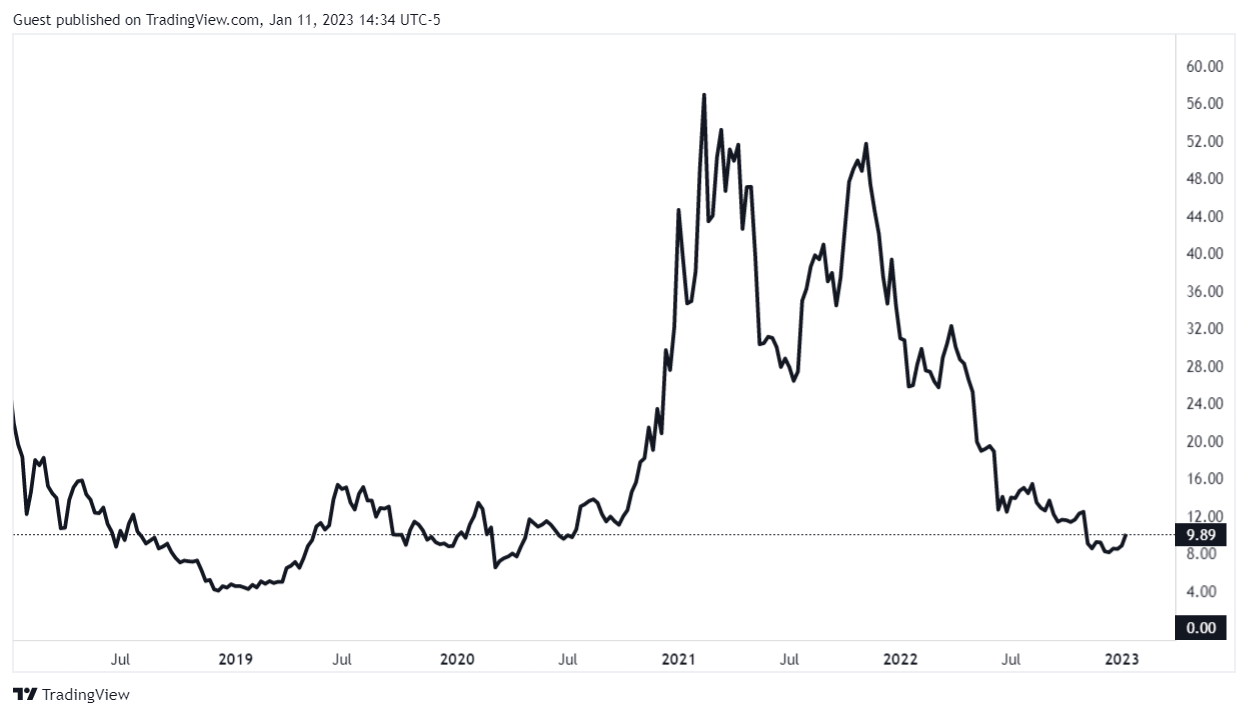

The value of a GBTC share hasn’t been growing at the same rate as its underlying asset. Even if you don’t have to pay a premium, you still won’t earn as much profit by buying shares as you will by owning Bitcoin directly. From 2020 to 2021, GBTC’s share price increased by approximately 220% in value while BTC surged by nearly 340%.

4. Refusal to Share Proof of Reserves

On November 19, 2022, Grayscale stated that it would not be sharing its proof of reserves (PoR) with its customers due to security concerns, despite the global panic over the FTX implosion. This refusal has sparked public furor over the company’s future [1].

The above is courtesy of Bybit (see [1] cited)

How did Grayscale Assist in the Market Collapse?

Funds exploiting the grayscale discount were able to make almost guaranteed money by immediately selling their GBTC shares when they unlock. Since only wealthy investors ccould afford the 50,000$ minimum to participate without astronomical fees, this trade excluded the little guys. Another challenge is that many investment firms simply would not allow their traders/advisors to buy digital assets directly.

Many famous CEOs such as JP Morgan’s Jamie Dimon once stated they would fire any advisor who recommends Bitcoin [2]. This is one reason that investors had to be creative to access Bitcoin exposure for clients.

The challenge began once GBTC investors stopped being able to make such easy money with the GBTC discount. Funds such as 3 Arrows Capital and FTX made a large portion of their crypto profits with the GBTC arbitrage. Once this easy trade disappeared, they lost massive amounts of money engaging in riskier practices, farming and trading uninsured assets with customer money.

Combine these collapses with the fact that other countries were allowing BTC ETFs. Grayscale suddenly no longer provided anything unique for customers. Their 2% fee nearly disappeared with lack of demand. Grayscale also does not practice stock buybacks which helps prop up the price of a stock during difficult and prosperous times alike.

Grayscale now suffers a disparage between their asset holdings and GBTC value. This means if a bank run occurs on the GBTC shares, they will be forced to sell their treasury assets (Bitcoin) to fill the gap. With a heavily reduced demand in their product, they might be forced to do this or hold a massive fund raise. Since Grayscale is owned by the Digital Currency Group (DCG), the exposure that DCG has to the FTX collapse could spill into the GBTC fund.

FTX owes DCG hundreds of millions of dollars and DCG owes Gemini almost 1 billion dollars to date. Gemini is also owned by DCG. This just goes to show you how deep contagion can go with collapses like Luna, Celsius and FTX combined.

The key takeaway today is that owning a portion of the 21 million Bitcoin that will ever be mined into existence is far superior to buying GBTC. Currently the safest way to hold Bitcoin is with a hardware wallet. For an explanation of cold storage and hardware wallets, check out our article [here]. Not only is the performance far greater, but contagion events will never be able to take your assets. Hopefully the SEC will realize that they played a part in this by not allowing a regulated ETF. Their failed oversight of FTX and other exchanges, and their ruling through litigation has certainly played a role. Please remember to stay safe out there, and always do your own research!