This article dives right into two strategies that Apollo uses to earn rewards from volatile markets. Trade Joe on Avalanche and Equalizer Exchange on Fantom offer a wide array of opportunities to gain rewards from popular trading pairs.

Coinbusers: Avalanche AVAX/USDC

To start, I would like to mention that these strategies are research driven and advanced. We do not recommend these strategies to anyone who does not already know the risks of providing liquidity on a decentralized application. These strategies are my opinions and are not to be viewed as financial advice, always do your own research!

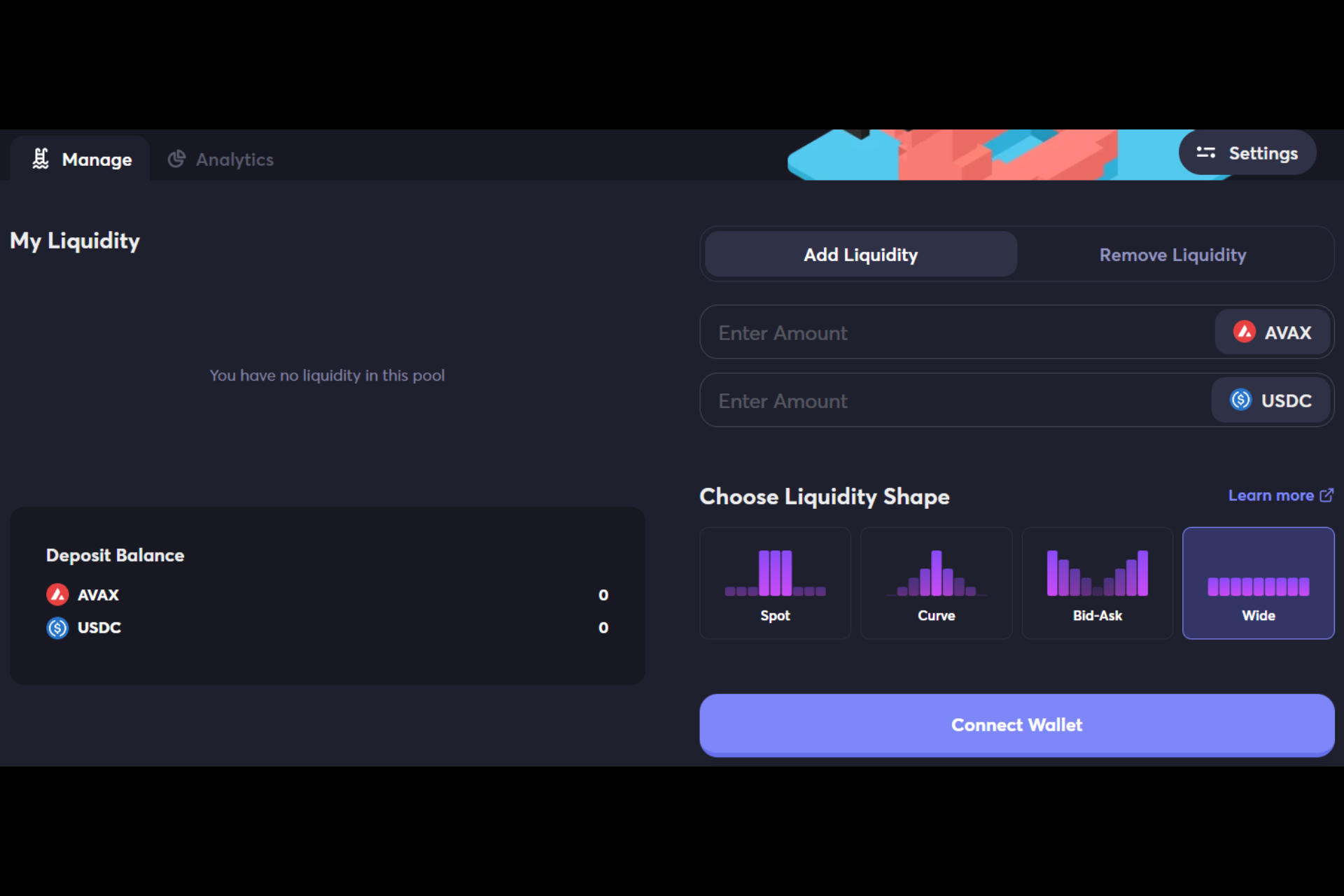

Jumping right into the strategy here since this is a limited time high upside strategy. This morning I was lucky enough to hop onto Avalanche and split my AVAX tokens in half for .88 cent USDC and provide liquidity on Trader Joe. This is a link directly to the LP pair [AVAX/USDC]. I have utilized this strategy for about a month and was lucky enough to be on the Wide setting during the depeg. Part of the beauty of the new Trader Joe LP system is that the LP will auto exit if it moves out of the assigned parameters.

This provides investor protection from large impermanent loss by maybe losing 1 AVAX token at most. When the LP automatically exits it converts your LP pair back into AVAX. Do remember that because of this you will need to reenter the LP if you want to long it. I will eventually go back into the concept in detail but I want to focus on the two strategies for today. Upon entering this LP, the investor will currently reap over 600% APR. The reward is split between AVAX and USDC. If you are worried about the depeg continuing, you can convert to USDT for now or AVAX, we also like PAXG.

The on ramps for AVAX are many including Coinbase, Binance US and bridges. I usually just send AVAX to Metamask on the C chain once the funds have cleared on the preferred exchange. These days MoC and I are using Coinbase One since its 15$ a month for no purchasing fees.

Coinbusters: Fantom FTM/DAI

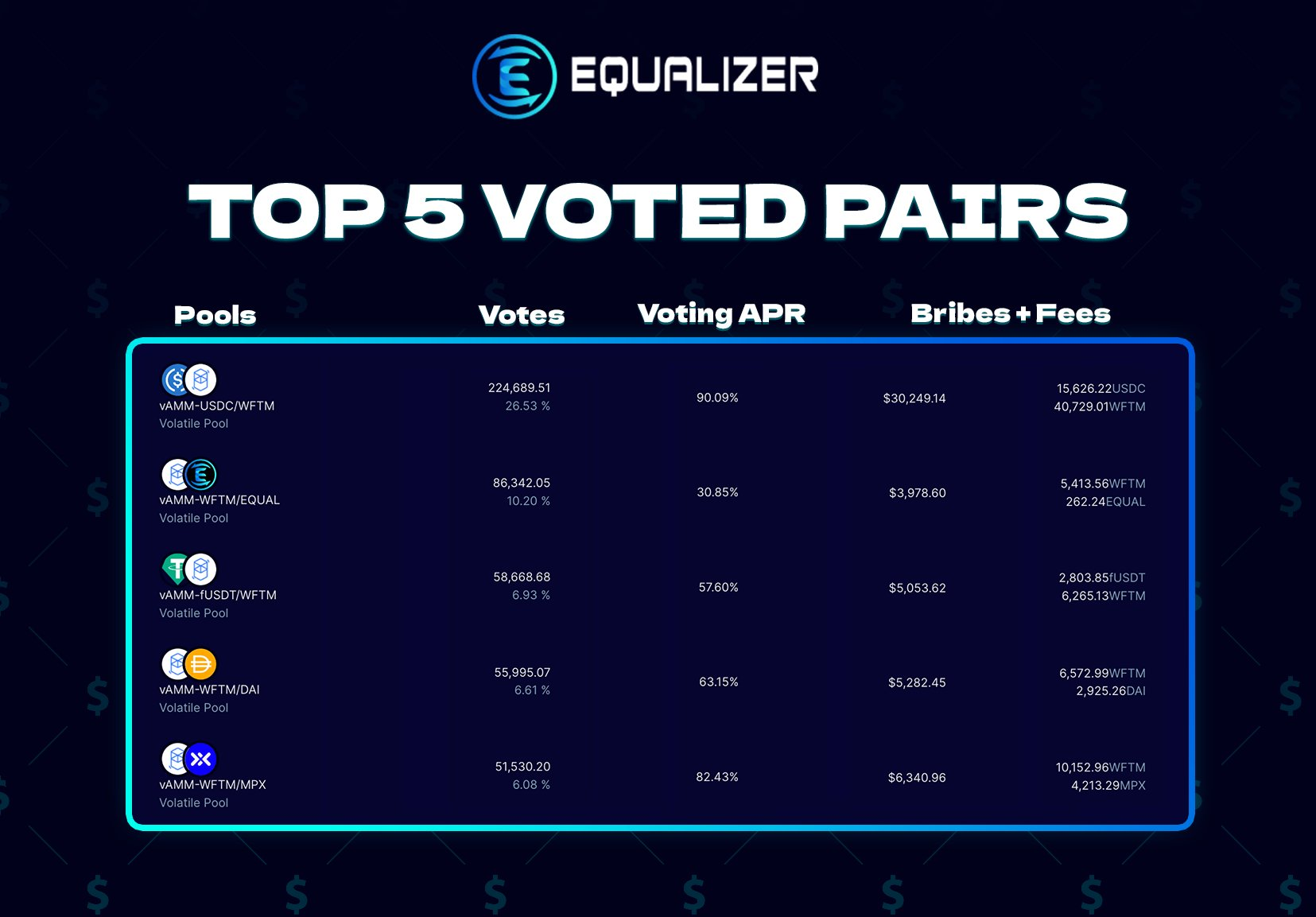

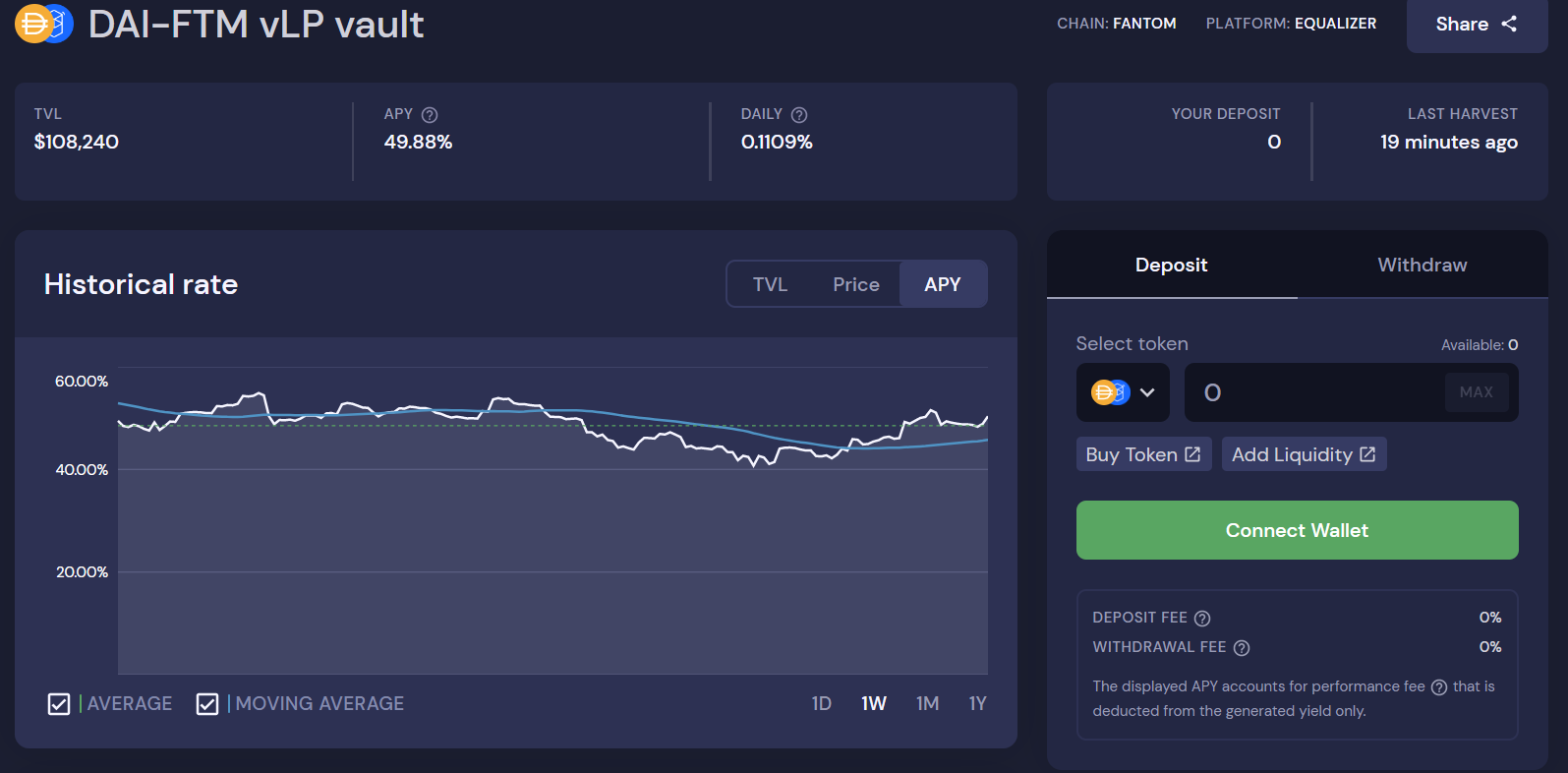

The second strategy is on Fantom, my largest bag altcoin. FTM is on Binance US and Kucoin. You can also bridge. If you have been reading along you will have read the Equal token analysis [article]. I am currently locking Equal and voting for my own LP pair reaping double rewards. The pair is FTM/DAI swapped to and added using Equalizer. I then take the LP tokens and enter Beefy Finance.

Looking above you will see the pair on Beefy Finance, simply deposit the tokens on Beefy, this provides a slightly higher APR than Equal directly on the pair. Beefy works by rewarding LP depositers when they exit the LP. Rather than providing a constant stream of rewards and thus sell pressure. This is a very unique application if you had entered with 500$ of initial tokens, you should theoretically exit with over 500$ of LP value.

Remember when providing LP to always consider network fees especially during high volume (gas can be expensive), and impermanent loss. If you do not know what impermanent loss is I do not recommend LPing. Generally these pairs provide very high APRs because the stablecoin side of the LP is usually stable in price. This has changed for the time being allowing users to buy their digital dollars for less than a dollar. This is part of what makes these entries so special and for a limited time. I personally take all of my AVAX for the first pair because of the auto exiting LP protection.

For the FTM LP I use 30% of my FTM holdings as the LP. I use this to print stable coins for future purchasing power. This allows me to avoid having to add money from my real-life job. I am essentially compounding on my existing investments which I hold long term. I want to keep this article short for today so stay safe out there!