This article is a token economy analysis of the Equalizer Exchange and Equal token. This project is built upon the robust Fantom network and has a unique approach to solving the Dex token problem.

Equalizer Exchange (Equal)

Equalizer Exchange aims to solve the ever too common Dex token problem. Traditional Dexs (like Uniswap) have inflationary tokens and tend to perform poorly over time. If the only reason to hold a token is to be able to vote on governance proposals, the token is doomed to plummet in price. Equal token is on the fantom network, it can easily be purchased using the Equalizer Exchange directly.

Equalizer aims to equalize the rewards for liquidity providers and token holders. They have created a network fee structure that ensures the utility and reward for locking tokens long-term [1]. This reward is high enough to support the liquidity needed to keep slippage on trades perpetually low. Equal furthers this by not falling into the trap of absurdly low trading fees.

Very low fees require massive volume to pay off in the long-term. Liquidity providers get antsy when they watch the value of their liquidity drop in value. Rewards for LPing need to be high enough to offset dropping asset value, crypto is volatile! Equal brings the familiar Dex user interface to the world of perpetuals and derivatives trading.

Equal Token Economy on Fantom

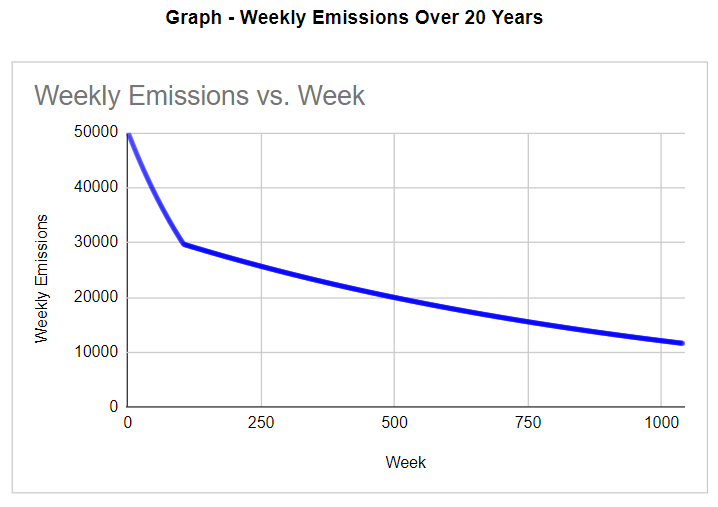

The Equal token is used for emissions and can be locked into a veNFT. veEqual can be locked into these NFTs upon locking the regular Equal token. Locking tokens gives investors voting rights and a percentage of the platform fees in return. The maximum lock is 26 weeks which gives the highest yield. Equal has a negative emission rate which slows over time.

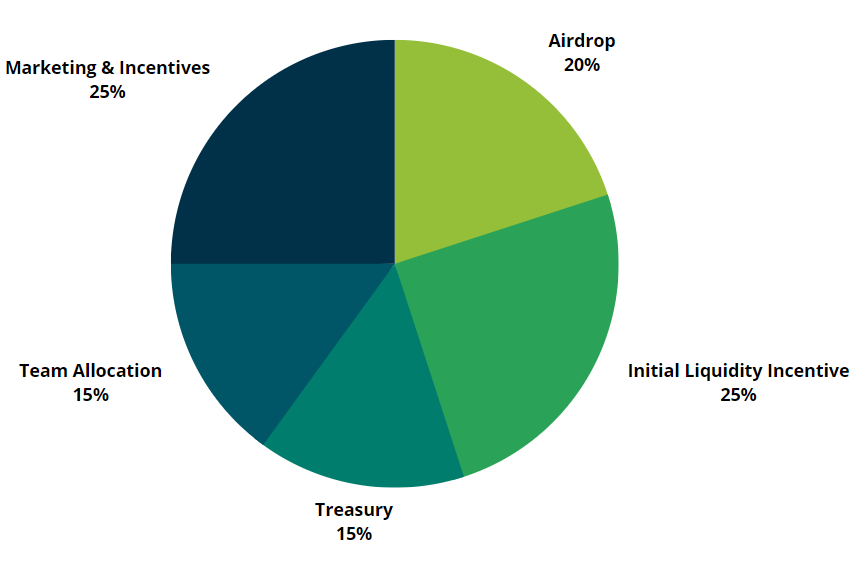

Only 15% of the initial allocation is reserved for the team, there was no private round which prevents large whale early investors from dumping on later investors. Building a robust treasury is important because this is the runway for the project to survive for the years to come. These treasuries are especially important during bear markets. A project can have the best idea in the world but if it does not create revenue it is doomed to almost surely fail over time.

Emissions decline at a rate of 0.5% per week until all tokens are issues. Predictable emissions without inflation is bullish, investors can invest in a monetary policy that does not change. The network has chosen to not go with the rebase model which overly rewards early investors with excessive voting power (Uniswap anyone?). Any wallet that interacted with Solidly, oxDAO and Solidex received an airdrop. The more involvement in the stated applications, the higher the airdrop reward.

Investors who locked tokens can vote on the selection of LP token pairs that receive emission rewards. Votes will continue to vote for the same pair until the voter changes their decision. Governance for the sake of governance is not useful in my opinion. In this instance, investors can vote on something that directly effects their trading interests and platform interest.

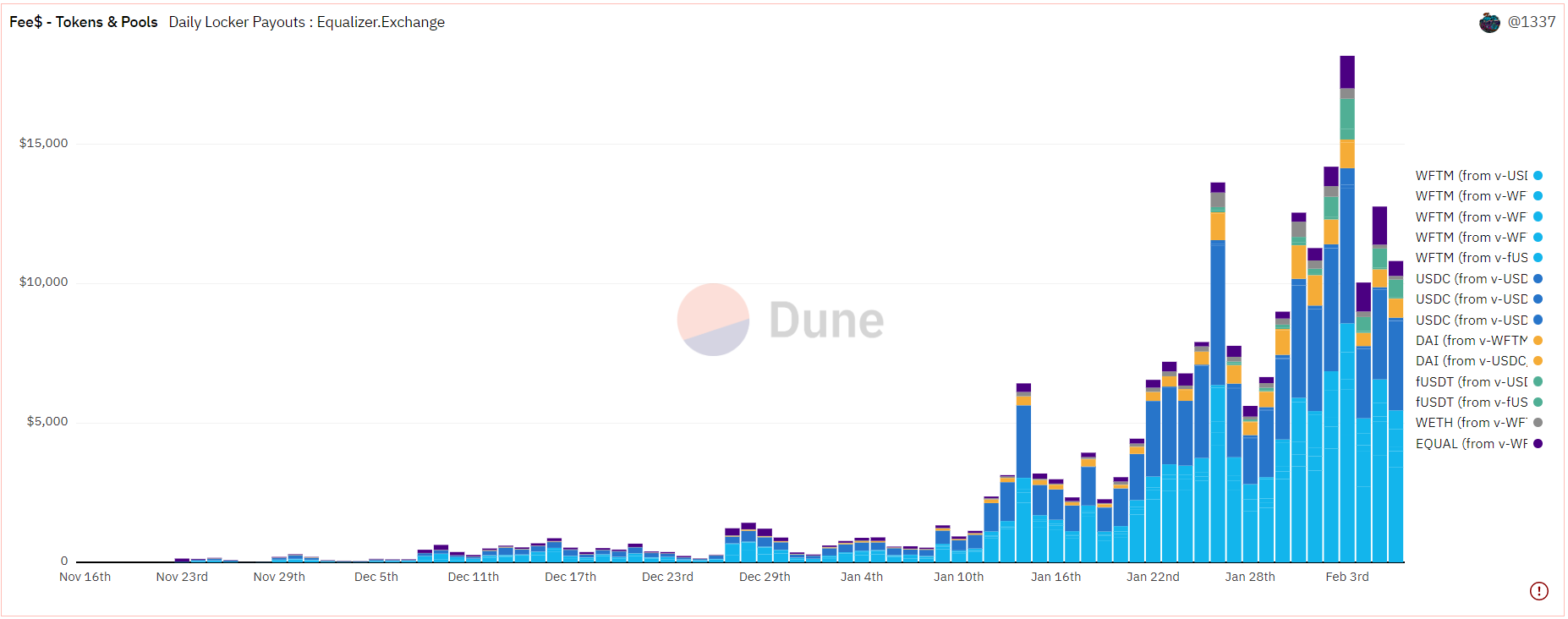

The Equal token provides 3 types of rewards. The first is emissions which we already discussed, look at the image above to see the general inflation trajectory. Emissions reward LPs. Platform fees are the second type of reward, obviously more volume and more Fantom interest effects this. Fantom recently hired a new marketing lead and he has done a great job so far.

The third type of reward is unique and known as a Bribe. Equalizer lets those who locked tokens accept bribes to vote for certain LP pairs. The higher the voting power an investor has, the more their bribe is worth. Equal uses their unique balancing system to consistently incentivize liquidity to both flock to and stay within the network. This incentive program is what keeps the slippage fees low. Equal points out what is the point of charging a low fee if the slippage is multiple percentage points [repeat source].

The network uses 0.2% for volatile pairs and 0.02% for stable token pairings. Equalizer believes this model will retain liquidity as well as attract it. After all, Fantom has some of the highest developer incentive rewards for TVL. The market cap is 3.2 million, the token is up 700% on the monthly, I do not like to buy pumps but the small market cap is attractive as a small buy and hold. Below is the daily fees that the protocol nets, you can see massive growth and for such a small project, this is a sustainable model.

Since I have the majority of my crypto funds on Fantom this makes sense to me. This project, if successful at drawing liquidity can easily pump to 100 million, this is a 30x. A popular competitor spooky swap is at a 24 million dollar market cap, closer to a 10x away. I chose to not fully discuss the perpetuals concept that LP pairs offers as to avoid making this article too long and complicated, do some research on it!

As always I like to be transparent about which projects I own, and I do not receive compensation for discussing tokens. The small DCA for equal started tonight. We score Equal tokenomics 7/10, only suffering from emissions vs. volume of buys and lack of being on a major DEX. Please remember to stay safe out there, this is not financial advice! For an article on a type of derivative asset that we utilize, check out Apollo’s writing on options [here].