This article is the first part of a series where we begin reviewing the vast Arbitrum ecosystem. We used PlutusDao with a portion of our airdrop to take advantage of the early rewards.

PlutusDao Arb Claim

If you read our recent Arbitrum [airdrop] article you will know that we used PlutusDAO to claim our tokens during chain congestion, the tool they have built is very easy to use. For those who simply wanted to claim the airdrop it was one button, for those who wanted to convert their tokens and stake it was only another click away.

During the Airdrop the hype was so immense that the chain nearly broke and became very bogged down and slow. Only professional botters/snipers were able to sell the token at launch for 4-5$ with their multiple wallets using front running strategies. For the rest of us mere mortals we had to think of unique ways to get our tokens out. MoC after claiming the drop sent his tokens to Kucoin to be able to interact with the funds.

Before the airdrop we spent hours researching the ecosystem, using the applications, and attempting to find gems along the way. Since Plutus was a larger part of the airdrop, it is an obvious first choice to investigate. We have seen products similar to this in other ecosystems and know that liquid staking is very popular as evidenced by Lido Finance.

What is Plutus?

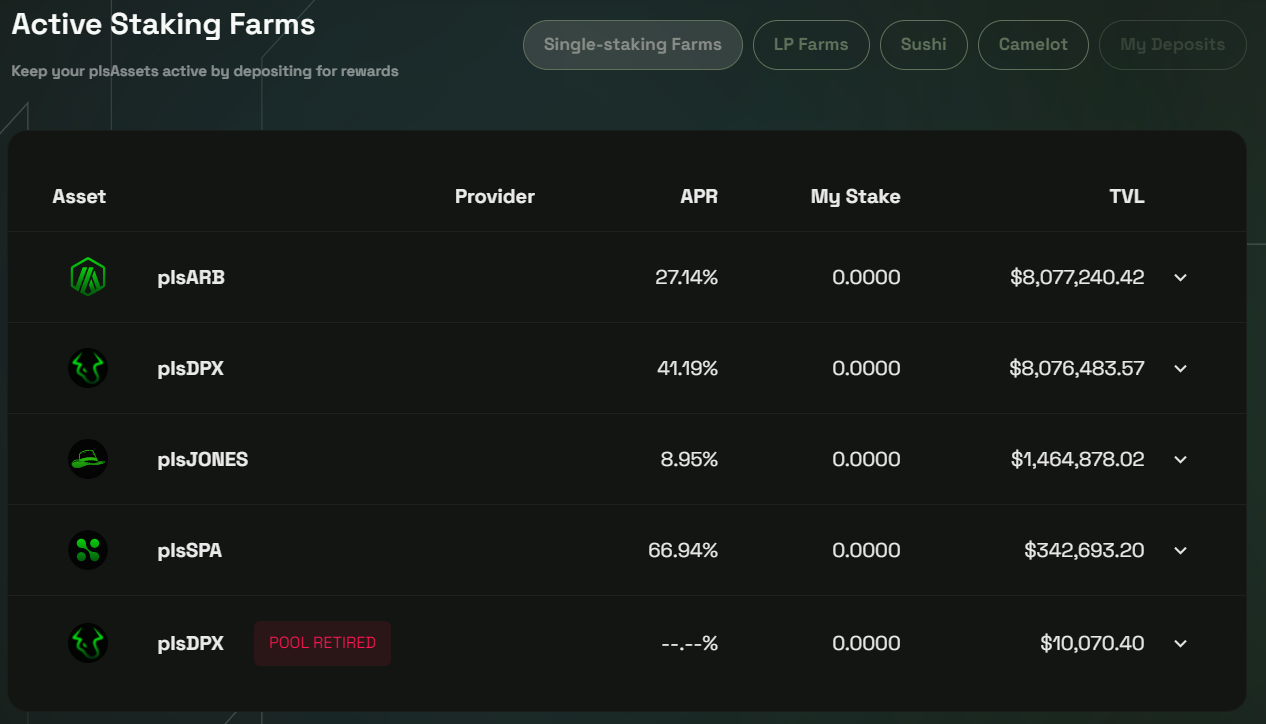

For those who are unaware, ARB currently has minimal utility and no way for holders to receive yield. That leaves rather risky strategies to take advantage of those tokens while maintaining exposure. This essentially forces users to either hold tight, provide liquidity, or sell their ARB tokens. Plutus provides a solution in that users can deposit several tokens including ARB. These tokens are locked permanently so think for a while before committing. In exchange depositors receive pls assets.

Pls assets are liquid derivatives of the token that is deposited. Since the tokens are permanently locked, they should maintain a 1:1 ratio since the DAO holds the native token within a vault. Unlike the banks we have seen falling left and right due to under collateralization, this application holds the assets safe and sound. Plutus functions as an aggregator for governance of networks on the Arbitrum blockchain currently. Plutus aims to become a “blackhole” for layer-2 governance [1].

Plutus currently has two base products, Pls assets which are the governance permalock assets that we utilized for ARB staking rewards. This is akin to your checking account that has digital dollars, each one of those dollars should in theory have a physical bill in a bank somewhere (we know that isn’t true). The Plv assets are vault products which aim to create user-friendly vault products with efficient yield. Users currently can utilize GMX’s GLP token to receive a derivative asset that auto-compounds and as the vault grows the compounding will occur more often, creating higher value.

What users do with their plsARB is up to them. They can stake it for an APY which will decrease as the total value locked in the pool increases. This allows users to receive exposure to max locking of various assets while staying liquid. This would be like if you had 10-year bonds that previously had a great rate, and you could sell them immediately before the yield curve issue arises.

Plutus has a revenue generating treasury that currently is controlled by the core team, this is slated to become a full DAO in the future. DAOs are run by the community of holders of the governance tokens. PlutusDAO currently has over 40 million TVL.

PlutusDAO Thesis

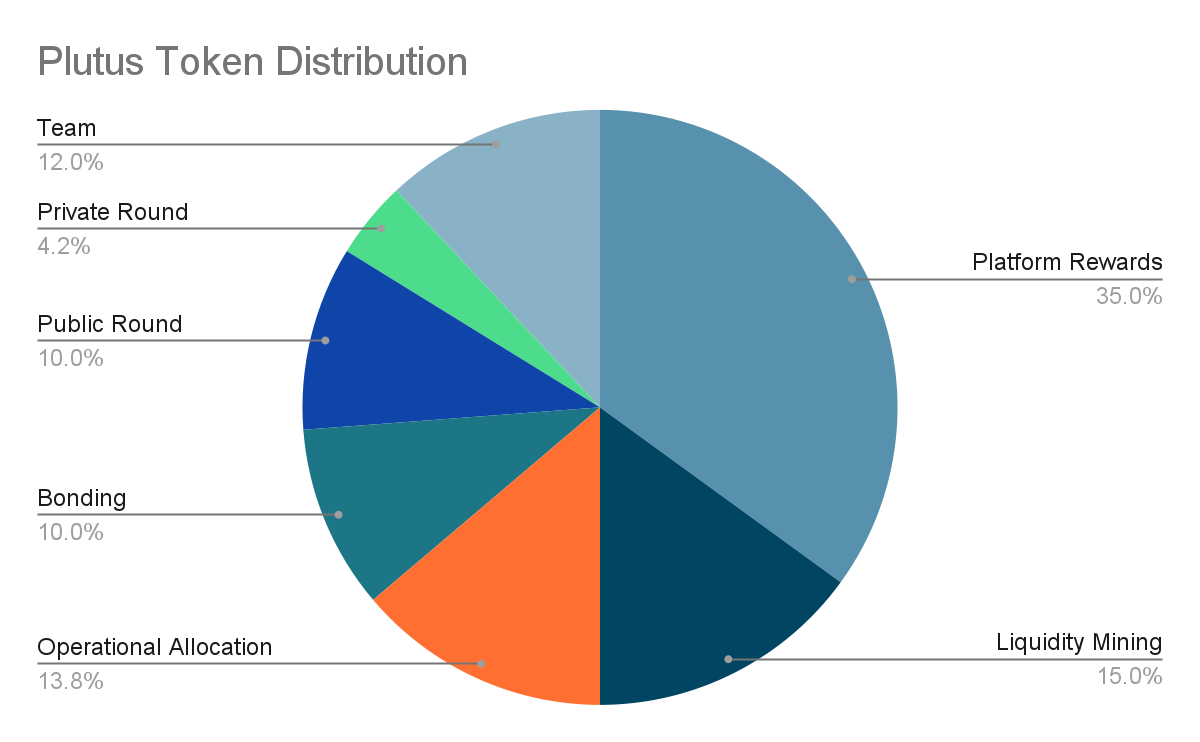

Plutus currently has a market cap of just over 10 million dollars. The supply has a fairly standard release schedule that ramps up on the 4 month. This has already occurred, the price of PLS has risen despite the tokens releasing monthly. This is due partly to the tokenomic setup for PLS that incentivizes monthly lockups. Locking PLS provides a portion of the treasury which gains revenue mostly from Dopex and Jones. Locked PLS receives bribes (Solidly anyone?)

With the v2 tokenomics upgrades from last September, the team has decided on a familiar 16-week lock. Locked PLS will receive multiplier points to receive 10% more rewards. Users can either automatically relock PLS by leaving the tokens or they can withdraw their PLS and rewards. Like GMX, multiplier points incentivize users to continue to stake their tokens and compound. Also similar to GMX, escrowed PLS is received and be claimed after a year duration which even further incentivizes long-term holding.

These reasons above could by why the PLS token price has been climbing despite continuous unlocks. Another reason could be that the team and private round allocations are modest and not overdone. Most of the tokens are reserved for the community as well as the future longevity of the application itself. A Plutus boost was also added last year. Borrowing from the Curve design, users who have PLS or PLV assets will receive a total boost on the entire ecosystem.

This mechanism does not cause inflation but rather increases the weight of rewards proportionally for a user, this is a very well thought out mechanism. Using the above information on my specialized algorithm, we give the PLS token an 8/10 for tokenomics. We simply cannot rate a token above an 8 when less than 70% of the total supply is released, let alone only 11%. The nice thing about the application is that users can participate in the pls/plv products without buying PLS directly.

I will say that the team has done an exceptional job at mitigating their token release schedule potential sell pressure. I do have a portion of my ARB airdrop in the ecosystem and plan to take full advantage of long-term exposure to the setup. As always I like to be as transparent as possible about my holdings or projects I am bullish/bearish on. Please remember none of this is financial advice, stick around for more Arbitrum project reviews in the near future!