This article discusses our simplest and preferred way to claim the ARB airdrop for Arbitrum. We will also review several strategies to utilize this lucrative airdrop, including various liquidity provision strategies.

Arbitrum Airdrop How to Claim

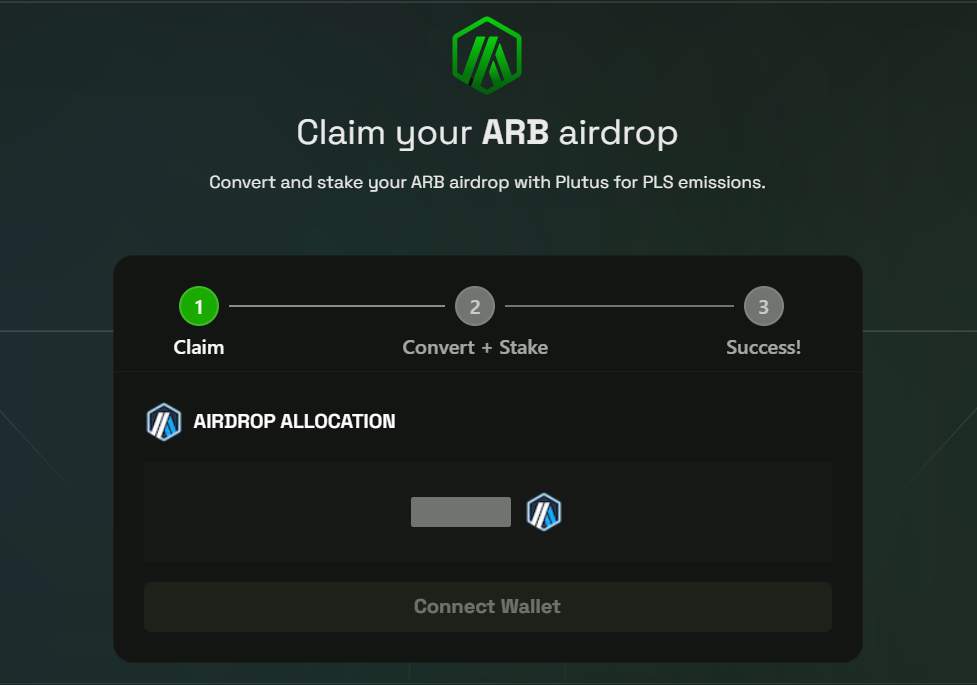

Users who have been using Arbitrum over the past year or so are eligible for this free token airdrop. By utilizing popular DAOs on the chain, trading using GMX and other apps, early adopters were able to increase their maximum airdrop of up to 10250 tokens. We had success utilizing [PlutusDao] and their ARB airdrop section. Simply connect your wallet and hit claim. Make sure to NOT hit convert and stake. If you are a fan of Plutus and want to stake there that is up to you.

The link provided is a safe link directly to the DAO claim page. Once you have your ARB tokens go to Coingecko and find [ARB], if using Metamask go to your main page and hit “import tokens” on the bottom. Copy paste the token address from Coingecko and paste this into the custom token area it should fill it with ARB and 18 decimals. If you would rather take the address we will provide it here >> 0x912ce59144191c1204e64559fe8253a0e49e6548 . Your airdrop will now show in your wallet.

There are several things you can do with the airdrop, you can sit tight, stake it on a variety of platforms, split it up for liquidity provision, and more. In the next section we will provide a few great examples of what to do with this long awaited airdrop. The safest option would be to swap it right into Ethereum or Bitcoin. Remember, free money is hard to come by, especially during a bear market. While this airdrop money came from somewhere, the only investment was a few dollars in network fees, and your time.

Arbitrum Airdrop Strategies

For this strategy section we will start with the least risk and move to more risky strategies. As mentioned above, a solid strategy would be to just exit into a large cap, you could also exit into a preferred stablecoin. Never regret taking profits, especially if you are 100% in the green. Arbitrum is the best performing layer-2 for Ethereum currently, so we could see hype like the Optimism token had but to a greater extent. With Bitcoin approaching 30k and banks falling left and right who knows where the market will go.

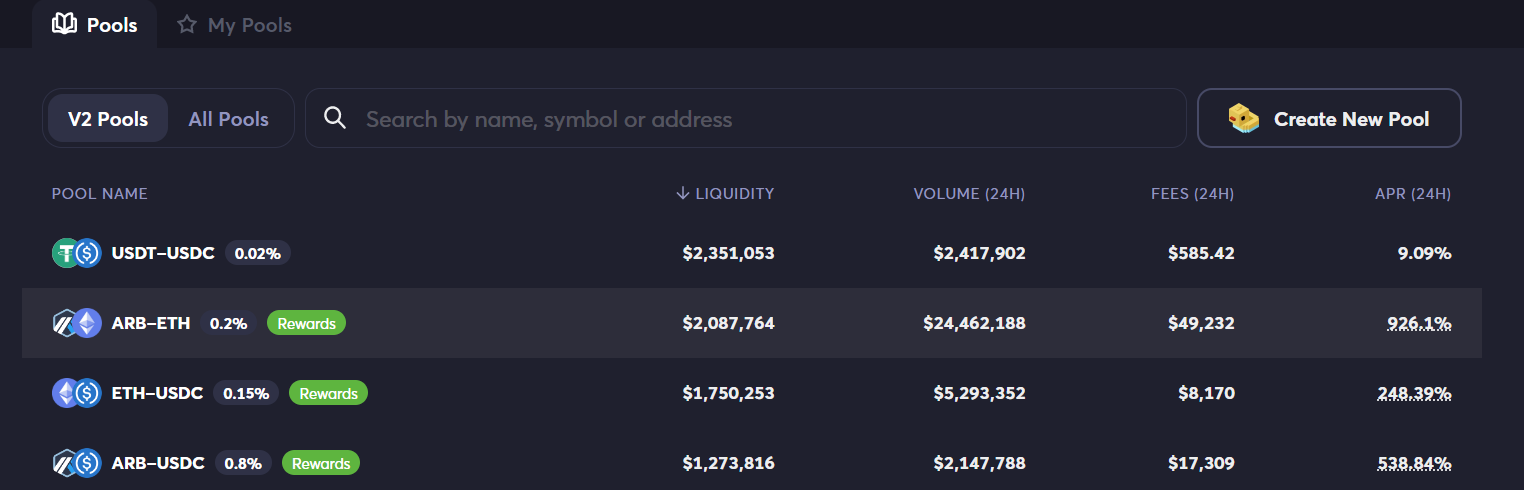

MoC and I decided to go with the LP route for these tokens. MoC went with Uniswap early for a whopping 15,000% APR, this obviously didn’t last long, and the chain was under very high stress during this drop. I was at work and could not claim my airdrop until later in the day, I knew I wanted to check out Trader Joe per usual. Trader Joe is my favorite platform for farming in all my years of crypto. The team is outstanding, and they have improved their app as well as token economy greatly over the last year.

Above is a picture of the pool I decided to enter (highlighted), I also sold my GMX temporarily to really take advantage of these rewards. When entering an LP I like to go for safer, longer term LPs that I can sit in for multiple days or weeks. With Trader joe if you select the Wide setting, you will have the lowest impermanent loss, and capture volatility swings.

The app also pulls your LP if you’re about to suffer too much impermanent loss. Since we have no idea where ARB price will go, and we believe it has found a temporary bottom, I LPed tonight about 60% ETH 40% ARB. This is in the hopes that if I have some impermanent loss I will get more ARB instead of ETH.

Since we believe, ARB will go to at least 2.5$ in the near-term it will likely outperform Ethereum. Entering an LP and having both of the deposited assets grow in value is VERY lucrative, especially if you are reaping the high yields in the meantime. Another strategy that is risky but likely less involved than LPing would be to use the Plutus Dao converter to get plsARB. This strategy provides a near 50% APR and boosts your rewards through the protocol.

The beauty of this protocol is that you receive a liquid derivative of the asset when you lock your Arbitrum. This is like Lido finance where you can just swap your derivative into whatever asset you like. You can also use looping strategies such as swapping back into Arbitrum, and LPing, or taking your formerly pls token and locking that again into Plutus for double rewards.

The final and most risky/speculative strategy would be to disperse a fraction of your ARB airdrop into the ecosystem tokens. This takes a lot of research and sometimes simply luck to play out. So far, we like GMX , Pendle Finance, and Handle.Fi to name a few. Please remember none of this is financial advice, please always do your own research. Stay safe out there!

For an article on one of our favorite Arbitrum protocols, check out [GMX] here.