Granary Finance is a multi-chain lending market built using the open source AAve code. Aave is a trusted and highly successful DeFi lending leader. Granary chose a product first model, with the GRAIN token to launch soon. The image for this article was created for an NFT auction by https://twitter.com/spearheadirl.

Granary Basics

Granary was founded in mid-2021 by a small and passionate team who witnessed many shortfalls in the DeFi landscape. The team believed that average users were not receiving a fair stake in the protocol revenues of many popular DeFi protocols. Users also experienced high fees and poorly thought out control structures that generally benefitted large whale investors. The team, like Coinbusters, also witnessed many pump and dump schemes with rapidly rising and falling TVLs.

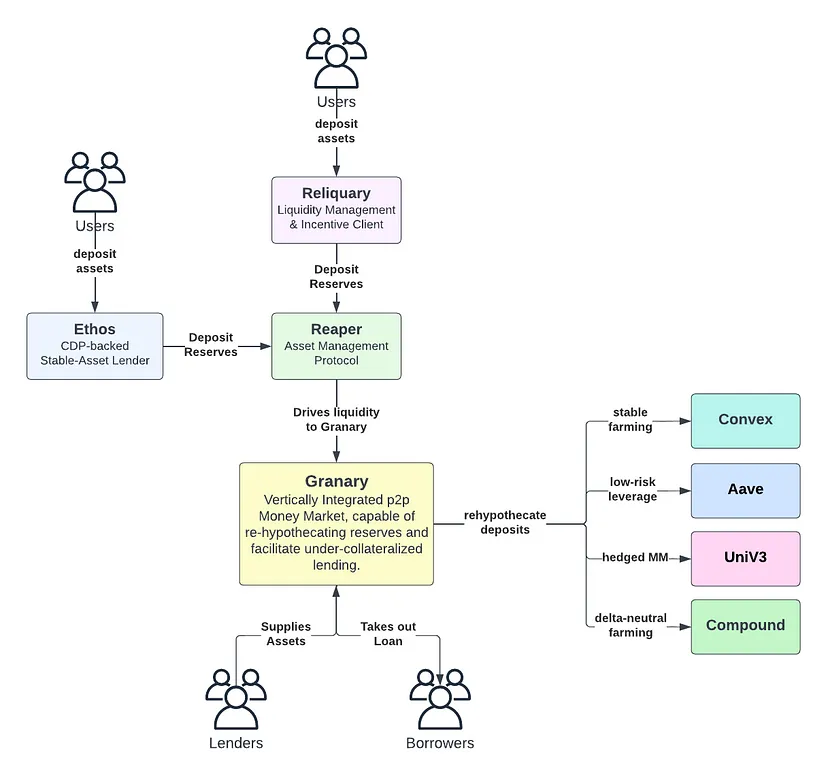

Projects were essentially popping up out of nowhere, hyperinflating their token and dumping on retail investors. Many of these projects had venture capitalist backing and tokenomics setups to benefit the early and usually private investors. Below is a rather busy image, but shows the general structure that Granary has planned to use. By actively managing the Granary reserves, protocol revenue would theoretically be much larger than traditional Defi [1].

For an article on AAve, check it out [here]. The goal of this active management is tied together with the impending GRAIN token. Unlike many others, the team has decided to focus on product first, and token later. As a researcher, this is something I am always looking for, this puts the teams money where their mouth is. In order to build the application, the team had to dig into their own pockets, highly delaying their reward with the GRAIN token.

Grain Token

The goal of the GRAIN token is to provide incentives for network backers. The protocol will collect fees from lending, borrowing liquidations, interest, and other incentives. Granary was built by the Byte Masons which already have a successful Reaper protocol. GRAIN will interweave all of the Byte Mason products with the token utility. As Reaper gains more success with risk and asset management, token holders will benefit.

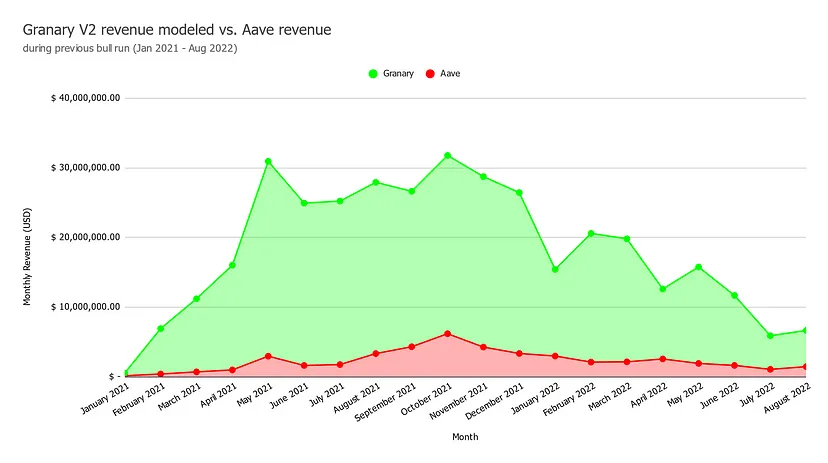

The image below shows a projected revenue using the strategy they have created assuming a volume akin to AAve during a 20-month period. The team will build unique derivatives products focusing on futures and options. As reads know, derivatives make up for the majority of the dollar value in the world. A market that massive has plenty of room to share since the volume is astronomical.

Revenues from the Byte Mason applications will pour value into the Grain token and distributed across the increasingly vast ecosystem. Since the applications are already on Fantom, Avalanche, Optimism, Metis, BSC and Arbitrum, users will have several on-ramps to choose from without the need for a bridge.

If I use the protocol I will send funds from various chains to Kucoin and convert to my desired chain. I have been eyeing the deposit APR on fUSDT on Fantom, but a whale came in today and dropped the rewards in half by adding a 40k deposit. Granary V2 aims to add fuel to the fire by capitalizing on Nitro pools which benefit from previously dormant assets. Native protocol keepers would automatically and efficiently liquidate borrowers on a variety of protocols and blockchains.

This revenue would move into the Grain token as well. Automated buybacks of the token would also occur in given intervals and predictable amounts when criteria is met. Only 15% of the initial supply will go the team with no seed or private rounds. The Grain sale will happen sometime this month and will be the first of its kind, with a multi-chain public fair launch [2].

We will review the token economy a few weeks after the token drop. We are highly interested in the Byte Masons ecosystem for several reasons. The professionalism of the product first mentality speaks volumes, the token economy strategies are sound, and the chains they launch on are popular. I plan on trying to snipe an airdrop, or grabbing a small bag early on FTM or Arbitrum. Do remember none of this is financial advice, do your own research and stay safe out there!