This article explains two strategies for Bitcoin accumulation during the current bear market. Bitcoin accumulation is likely to outperform the sp500 by many multiples for the patient investor.

Dollar-Cost-Averaging

You’ve heard it before, we at Coinbusters love to talk about dollar-cost-averaging. DCAing is a valid strategy for any market, especially when focusing on the most fundamentally strong assets within a market. Bitcoin being the leader of crypto assets leads the charge for strong fundamentals. Those who have been reading along know this well, and for those who had the conviction to dollar-cost-average in 2020 or earlier, the rewards are aplenty. A common strategy would be to buy 100-300$ of Bitcoin weekly, averaging in your cost basis slowly and steadily. This strategy has proven to be an effective, although boring way to smooth out the volatility of asset markets.

Bitcoin finds strong support around 28.5k, therefore averaging in these past few months could be favorable. It is important to remember that anything can happen in these markets. Bitcoin could be at 22.5k when we wake up tomorrow. When we look back at Bitcoin at 22.5k vs 30k 2-5 years from now we at Coinbusters believe this will all be irrelevant. With a projected price of 500k-1million dollars per token by 2030, the difference between 22.5 and 30k is not significant.

Cathie Wood, a famous macro investor and fund manager became famous because she DCAed into Tesla over a long period of time. Many fund managers and investors made fun of her and accused her of bad fund management. Averaging in at 70$ to watch Tesla explode over 1,000% highly rewarded her investors. She continues to be a major market advisor focusing on market disruptors. One of her most bullish theories is that involving blockchain technology, of which Bitcoin is the clear king. Cathie even went so far as to sell over 200 million in Tesla stock to invest in Crypto, gaming, and streaming shares [1].

Focus on the Channel

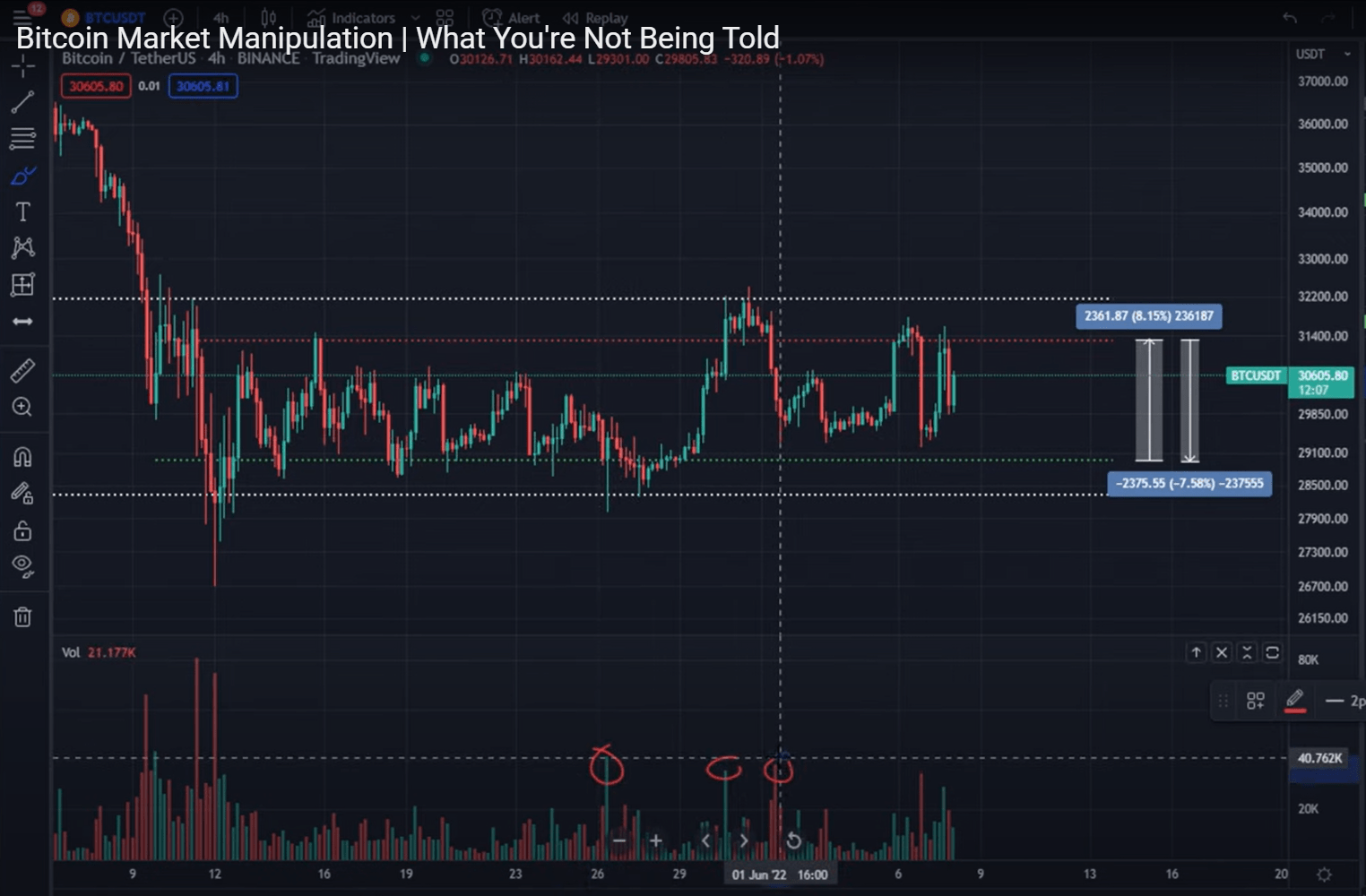

The second strategy is a little more complex, but if done correctly will highly reward short to medium term investors with a better basis, especially if they focus on spot markets. Above is a chart courtesy of Data Dash, one of my favorite Bitcoin analyses Youtube channels. When looking at the chart Nicholas has created, it takes a long-term support line from the past year or so. This line helps build a channel of recent price action; you can see this delineated by the two white lines making a channel. Initially we see a standard downward price action and descending triangle. Past this we see a lot of manipulation, leveraged washouts and more.

The second strategy involves confirming a channel breakout. I am by no means a technical analysis expert but confirming on this time frame would require a few retests above or below either white line. Once this occurs, this strategy would put a larger amount in than a standard DCA. If Bitcoin price breaks below 28.5k and continues downward for a day or so, this strategy would take advantage with much larger DCAs. Imagine in the first strategy an investor is adding 100$ per week. This strategy might start with 1000$ on the confirmation, then 500$ per week taking advantage of the steep discount. This is obviously a more risky strategy, and the patient investor using the first strategy could easily come out on top in terms of cost basis. The choice relies on how confident of an investor you are. I myself am choosing to do a mixture of the two. I have reduced my weekly dollar-cost-averages which are highly focused on BTC/AVAX/FTM. I am saving cash on exchanges for a hope in a breakout from these channels with a multi-day 4-hour time block confirmation, preferably a day or two. The importance of a breakout would confirm a change of market direction, upwards or downwards. Please remember this is not financial advice. Also, stay safe out there, thank you for reading.

[1] https://www.forbes.com/sites/jonathanponciano/2022/03/30/cathie-woods-ark-invest-sells-205-million-in-tesla-stock-buys-crypto-gaming-and-streaming-shares/?sh=3025c46e6db1

[2] Data Dash https://www.youtube.com/watch?v=-2U3uqC97MY