Buy the dip they say, it will be easy they say. The fact is, buying the dip IS NOT easy, at first. However, the more you practice patience and capitalizing on these opportunities, the more seasoned you become as an investor.

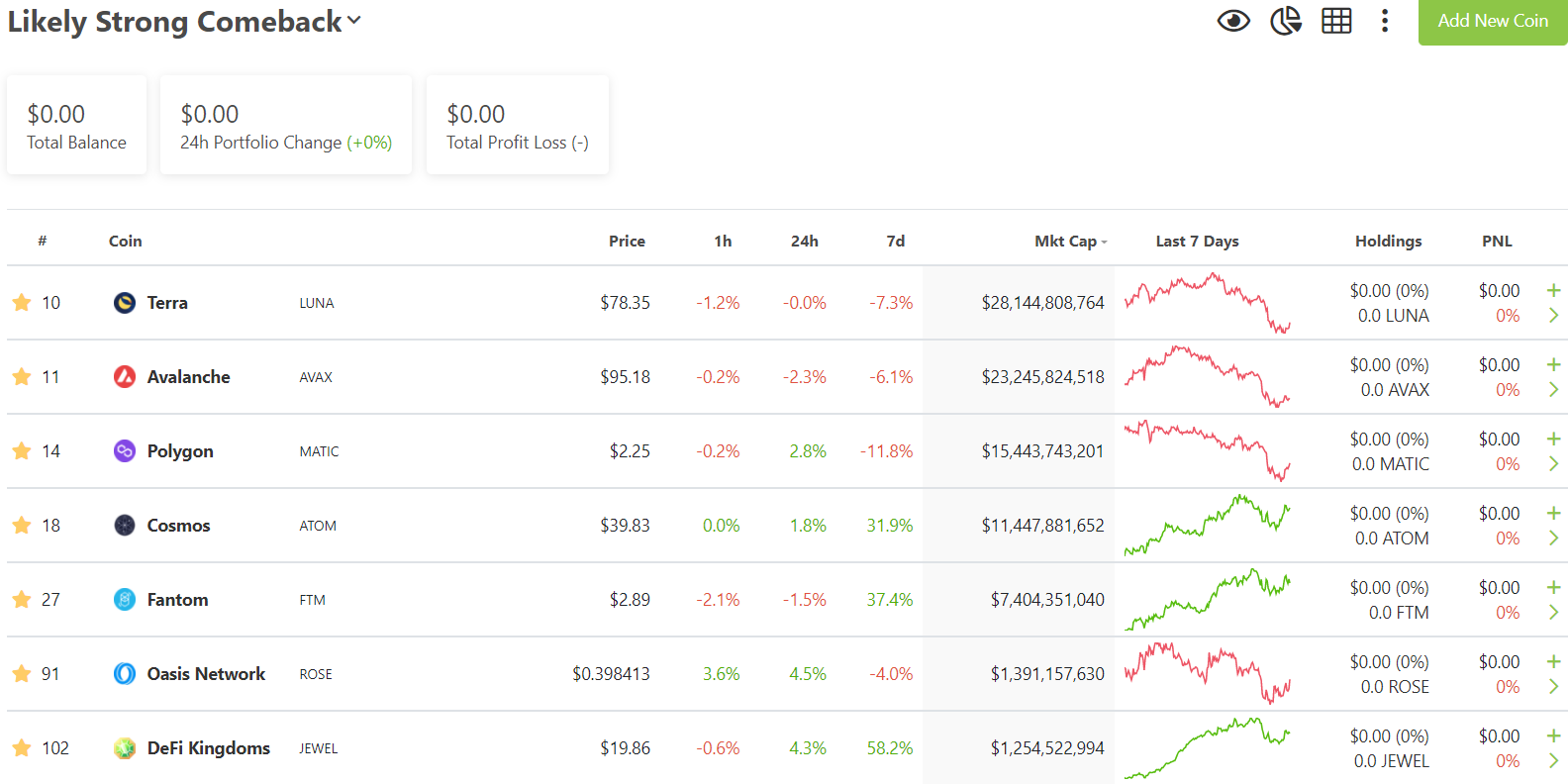

Below you will notice another custom CG list that we have provided. I like to track trends and analyze market sentiment with lists such as these. Everyone token on this list has been trending on CG in the past few months on and off. I like to add tokens to a special list that I notice have amazing charts, and show strength when BTC is weak. These are top picks I have noticed. I do want to point out that I personally own all of these tokens and MoC owns most of them also. Many of our initial followers got into these projects early with us, these are STRONG projects, with long term fundamentals. Every project you see here has been reviewed on our site, some we use simply to stake, others to capitalize on stable coins, some to farm or provide liquidity.

BTC Crash #9000

BTC has crashed again, the open interest was close to an all time high, many investors were using margin(borrowed money) to trade. Leverage (borrowing to add multiples to your trading power) was running rampant and investors were expecting the “obvious” impending BTC pump. However, makets like to do exactly the opposite of what you expect. Large whales came in once again, seeing the massive open interest, and flash crashed the market causing yet another mass liquidation scheme.

Behind the scenes Kevin O’Leary is buying crypto companies and purchasing Solana. Social media apps are integrating crypto directly into their interfaces. Nike is buying NFT projects, Facebook is jumping into the metaverse. This doesnt seem like a bear market, maybe just a temporary bear trend. I view this as a good thing because this strengthens the hypothesis that Crypto is going to experience an “extended cycle”. This would mean shorter bear and bull markets and a slower less volatile uptrend over the years. I welcome this, this is how we gain mass adoption.

The Picks

Now once again you are seeing AVAX and LUNA, you clearly can see we are bias since we own both of these tokens. They have both performed amazingly since we sold our ADA into them. ATOM is a token with a similar pattern lately, resisting the dumpage that BTC is seeing. ATOM I have been staking most of the year, I believe this is the number one clear winner for interoperability for 2022. Polygon remains one of the best projects for building partnerships, and although I sold some recently since I was up many multiples, I continue to stake this token as well. FTM has not seen its day yet, although it has risen from the depths rather quickly, I believe it will make it to where AVAX and LUNA last were, 15 Billion market cap at least. That is a solid 2x from here, and it could easily have more gas in the tank. Oasis, is a slightly riskier bet, but with massive upside. We covered this project a few months ago and have been staking ever since. Since the market cap is only 1.3 billion the sky is the limit, it could easily 10x from here over the next few months.

Finally we touch on Jewel, one of our best performers these past 6 months. MoC and I both farmed this token for many months getting thousands of dollars in free Jewel, I recently sold much of this free reward for stable coins for dip buying and ONE to mess around with the Tranq Finance defi. I wanted to keep this article short and sweet, you know our thesis on every one of these projects, these are what I am dip buying. A bonus token I have been dollar-cost averaging is IMX, which was in my 2022 advanced test portfolio. Please remember none of this is financial advice, we thought it would be fun to track some portfolios from the start of the year to compare their gains to the stock market. Have fun researching these tokens, and stay safe out there! Thank you.