The smaller the market cap, the more volatile the asset. It takes less money to move the price – this means you need to have done your research to really offset this risk. Back in November we covered Tranquil Finance as part of our Startup Series. Here’s where they are now.

Everyone wants to “get in early” on a project. You can look at price charts and see these crazy vertical price increases on some projects when they transform from “tiny” to “not so tiny”. Most projects don’t do this. However, when you do find one… you get this:

Enter Tranquil Finance

Tranquil, when we first covered them (Startup Series: Tranquil Finance), sought out to change how people can use cryptocurrency assets they already own in new and more efficient ways. Borrowing and lending was their first approach. Traders can deposit crypto they own and borrow against it. This lets them “keep” their original crypto assets, but use or invest the value of it elsewhere. This isn’t new or unique in general (this capability exists on nearly every blockchain), but hadn’t previously existed in the Harmony ecosystem. This brought in a wave of users and supporters. I took a pretty risky play by making a huge bet (gamble) on this project when it first came out (about a $2million market cap).

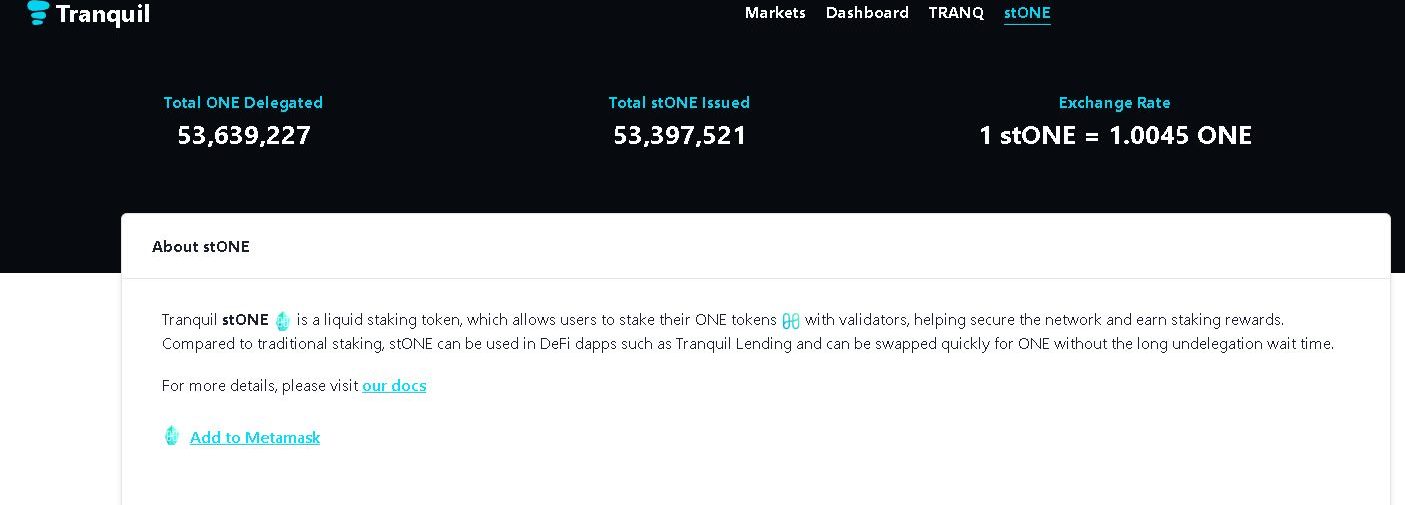

As time went on, the team at Tranquil delivered on one absolutely enormous capability – their stONE smart contract. As we’ve discussed in other articles, a lot of crypto projects let you “stake” the assets and earn dividends. Staking has value to the projects (helps secure the network), and crypto owners are rewarded for that. But – on Harmony, if someone wanted to “get back” their staked assets, they’d need to wait over a week to do so. As we’re well aware, in the world of crypto – a lot can happen in a week.

Tranquil created their stONE product to allow for users to take their native Harmony tokens (ONE), and stake them within the Tranquil platform, and allow them to use that collateral for a variety of other things. This is may not quite make sense to some of us – it’s a pretty advanced concept. Simply put – if you make 10% interest in one year on $5000, you’d have $5500 at the end of the year, for a $500 profit. If you did the same with $7500 you’d make $750 in this scenario. Makes sense, right? Well with lending and borrowing you can borrow (take a loan in crypto) of $2500 and deposit that loan to make interest. It lets you invest as if you have more money than you do for a small fee – so many people in the Harmony ecosystem began using this. At the time of this article, a ONE token is worth about $.29 – and users have deposited over $15million worth of ONE tokens into this protocol. That’s pretty telling of the value we have here. So I doubled down and grabbed more. With the staking rewards I had been receiving from my initial purchase, my cost basis had dropped to somewhere around $.04 per Tranq token.

As we’ve watched Tranquil grow, we became pretty convinced that this project was here to stay. Then – yesterday, Tranquil dropped an absolute bombshell:

Tokens and projects explode (pricewise) when substantial relevant use-cases come out – and this absolutely qualifies. Another project we covered recently, DeFi Kingdoms, has gone from $5-$20 per token in the span of about a month as their project matured.

Tranq, prior to launching Defira, was trading at about $.14 per token. The value in Defira, Tranquil’s new game, is that the Tranq token serves as the in-game currency. Transactions made inside the game burn the token (destroy it from existence). Tranq has a fixed supply… so with more use and less available Tranq… the price will skyrocket. When reviewing the roadmap for Defira it became clear that this project was going to take off – and it has.

For those keeping score at home – this is an over 500% increase in less than a day. In other words – if you had $1000 worth of Tranq yesterday at this time, today you now have $5000 – and we don’t believe the growth is done (Tranquil is STILL extremely small).

So – how did we identify Tranq and nail this bet?

1. Engagement with the community is everything. For brand new projects there is a high degree of trust between token holders and developers that must exist. Tranquil has been enormously interactive with the community, open about their plans and challenges, and prompt with development. It is reassuring to see repeated successes from startup projects. If the community doesn’t like decisions that are made, people aren’t going to invest. Very early on in the project the team made some important project changes that reflected how the project was being perceived and used right after it launched.

2. Decorated development teams – The developers of Tranq have worked on major projects, including the well known game Dragon Age (0xYamcha is credited in that project). It is not to say that “new” developers can’t create successful projects, but in general – great developers are more likely to make great new projects.

3. Unique/Niche capability – This is the biggest one. You cannot “hope” people care about some feature the people online tell you is important in a project. In fact, most projects in the crypto sector are viewed as significantly more mature and developed than they actually are. Projects with real use cases and functioning capabilities are what you should look for first, followed by whether or not people should care about what they have done. In the case of Tranquil – lending protocols have been enormously successful on most other main blockchains, and Harmony didn’t have one. That was enough for me to take a flier on it. The stONE capability followed by the game, compounded on that. Now, Tranquil has significant use and active capabilities, which makes it extremely valuable, especially in the blossoming Harmony Ecosystem

We can’t wait to see how Defira turns out and hope many of you reading this were able to get in on Tranq and are enjoying the ride. See below for our interview with the Founder of Tranquil Finance, 0xYamcha from our previous article.

An Interview with the Founder

Since Tranquil is about as new as it gets (less than a week since launch), it’s also fascinating to watch and learn about all of the growing pains that most investors never see. Crypto has really just started to become mainstream, so most of us weren’t participating when the household crypto projects we know were nascent. I was really happy to be able to pick the brain of 0xYamcha, Founder and Lead Developer of Tranquil Finance on starting Tranquil and what it will be. Enjoy the conversation, I found it to be really enlightening!

MoC: Why is having a lending protocol important in the first place? What impact will this have one the Harmony ecosystem?

0xYamcha: A lending/borrowing protocol is a critical DeFi primitive for every blockchain. It allows the user to leverage their assets in new and powerful ways. For example, you can take a loan against your ONE instead of selling it and avoid a potential nasty capital gains tax hit. It also allows users to borrow assets in order to trade with leverage or for short selling.

With the launch of Tranquil Finance, users on Harmony ONE can now use their assets in very flexible and creative ways without incurring potential trading fees or tax obligations. These capabilities will help increase the utility of all assets and grow the DeFi ecosystem on Harmony.

MoC: How would you say the last couple months have gone from a development and anticipation standpoint? What are the days leading up to the launch like? Did everything go according to plan?

0xYamcha: We were completely taken back by the sheer passion of the community response when we first announced the project. We were definitely not expecting such a strong and large community to form this quickly around Tranquil Finance. Although we had some growing pains because we were initially unprepared, we are very proud of our community that has been built so far.

Development wise, we were set back substantially by the delay of Chainlink, which was originally scheduled to launch mid-October. We had to design a completely new oracle stack in a short amount of time, and we were literally coding and testing until the last few hours to launch. Technically, though, other than a few small bugs, the launch went smoothly, and we were very proud to have delivered a functional, high-quality app under significant constraints.

MoC: Fast forward – If Tranquil’s roadmap is realized – what will this do for the Harmony ecosystem in general? How do these “new capabilities on Harmony” compare to other networks?

0xYamcha: In addition to having a robust money market for all major assets on Harmony, our next task is to build a liquid staking token — stONE. Right now, a huge amount of ONE is staked, which means it is locked up can’t participate in the DeFi ecosystem. By staking ONE into stONE, users can not only get validator staking rewards, but they will also be able to use stONE as collateral on Tranquil Finance (and other DeFi applications).

This would be a game changer for the Harmony ecosystem in general, potentially unlocking additional value for the billions of ONE that are currently staked.

MoC: What inspired you to make this project in the first place?

0xYamcha: I’ve been a huge fan and user of DeFi, but Ethereum has been basically unusable due to it’s high gas fees, especially for a money market. For example, depositing and enabling collateral for all my assets would take 10 transactions, totaling well over $1000 on Ethereum. Not only is Harmony almost free, transactions are also committed extremely quickly.

Money markets have always been one of my favorite type of DeFi apps, and I have assets deposited in them on almost every major blockchain. Harmony was distinctively missing such a protocol, however, so we decided to go ahead and build it ourselves.

More Info

For more information on Tranquil Finance head over to Tranquil Finance

The Tranquil & Harmony themed piece is currently listed for auction on OpenSea: Tranquility of the Mind