This article explains what a short squeeze is, and why it can sometimes effect the price of an asset drastically. Bitcoin and several other assets experienced this last week.

What is a Short Squeeze?

To understand what a short squeeze is, you must first understand derivatives. Derivatives are a means to trade a predicted direction of an asset, they are paper contracts. The price of a derivative is connected to the underlying asset that is being traded. Generally, users must have some form of collateral to trade derivatives. Collateral is a form of debt which can either be in cash reserves or an asset that the user owns [1].

The two most popular forms of derivatives are perpetual futures, and options contracts. Both types of contracts involve betting on the upward or downward price action of an asset. The combined open contracts of a given asset is known as “open interest” [2]. When a large amount of open interest builds up on a given asset, it is only a matter of time before a big move in either direction occurs. Remember open interest is debt owed to market makers. Short traders borrow shares or tokens and eventually have to repay that debt whether they lose or win the trade.

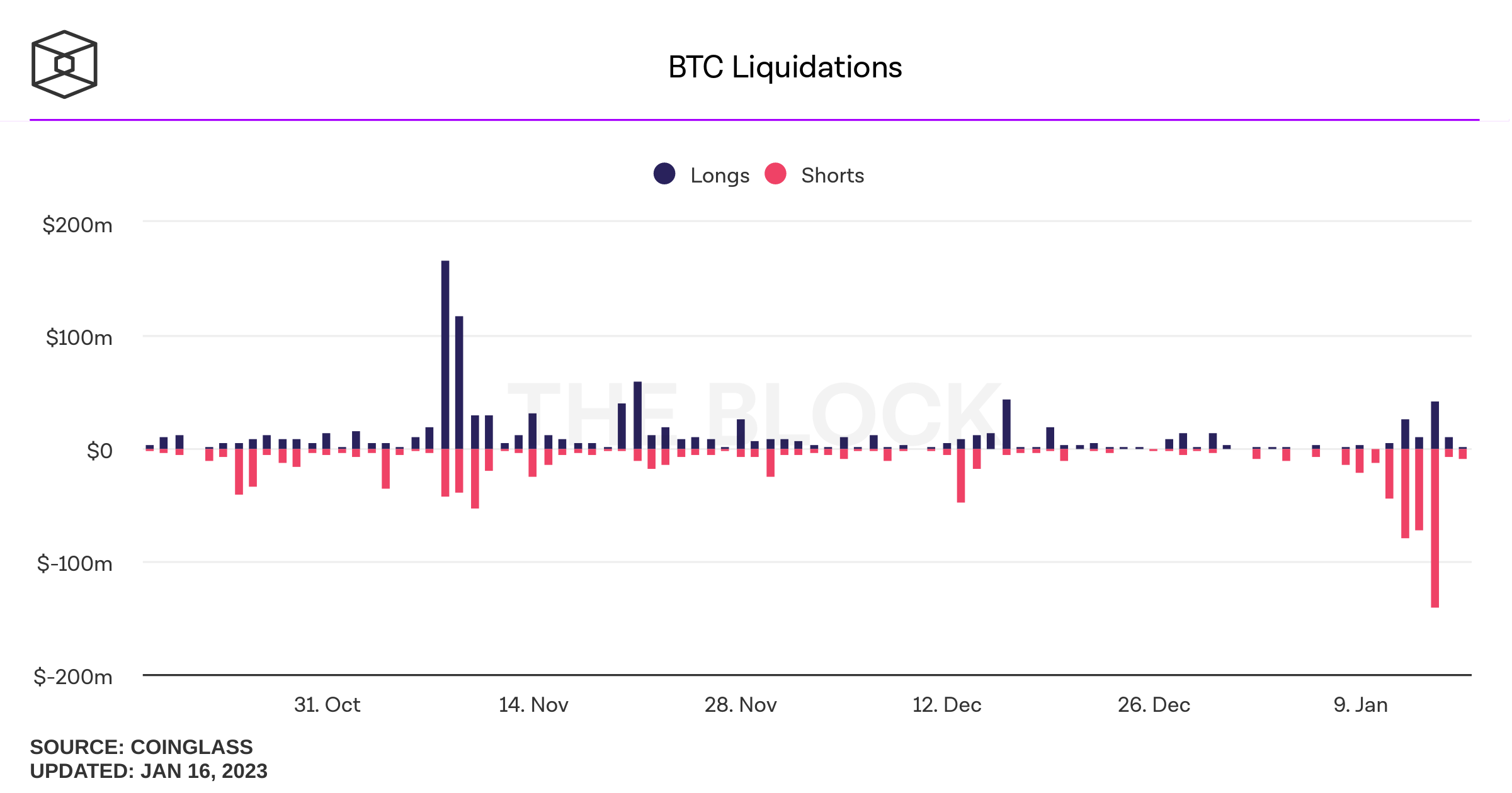

The chart below, courtesy of Coinglass, shows Bitcoin liquidations leading from Jan. 11th to the 14th. Liquidations are when a position is eliminated due to overtaking a trader’s collateral ratio. Full liquidations cause a loss of the entire trade including 100% of the collateral. As an example, on the 11th a massive short squeeze began to unravel. Traders are “short” when they are betting on the downward direction of an asset.

Traders who were short on the 11th began to lose their trading position, when this happens, more collateral is requested to keep the trade open. The losses of shorting an asset can technically be unlimited depending on how high the asset price goes, and how far the trader is willing to go to add collateral. If a user is unable to provide more collateral, the position is lost to the market.

In order to cover a position more Bitcoin is needed, traders need to buy Bitcoin on the open market. This creates a perpetual cycle of needing more and more Bitcoin to cover the losing trade. This in effect causes the price of Bitcoin to rapidly increase as losing traders scramble to protect their trade. Eventually they lose the position, and the market makers sell the Bitcoin to cover the liability, usually this Bitcoin is sold to more traders close to liquidation, they are forced to buy an appreciating asset.

This Pump was mostly a Short Squeeze

On January 14th, 140 million dollars of Bitcoin shorts were liquidated. The previous three days had already liquidated 190 million dollars. The Coinglass chart shows just how bad the losses were relative to several previous months of trading. Remember, open interest on any asset is like a kettle pot boiling and waiting to explode in either direction. Large institutional traders and investors alike are always watching these ratios ready to liquidate other traders for a profit. The unfortunate part of this recent uptrend is that it is mostly due to leverage and margin trading. There is not a massive amount of organic buy pressure to prop up the current price levels.

While any Bitcoin uptrend is certainly welcome, the overall macro environment is very bearish and uncertain. Eventually large institutions will begin buying in enormous quantities. The short squeeze is the main reason for the price action we witnessed last week. This has happened many times. The phenomenon can also happen in the opposite direction when many traders are betting “long” and on upward price action. For information on a simple strategy to combat market volatility check out MoC’s article [here]. Please remember to stay safe out there, none of this is financial advice.