This article discusses a medium sized ecosystem that is poised for enormous growth this year. This project falls under the investing early category, rather than the strong remain strong (our two types).

Fantom Metrics (FTM)

For a recap on Fantom check out our article from last year [Here]. The easiest way to get Fantom in America is to use Kucoin, for the rest of the world, Binance is the likely choice. FTM, like many of our layer 1 interests, starts with Ethereum compatibility from the ground up. Users can link their Fantom wallet to Metamask to participate in the ecosystem with ease.

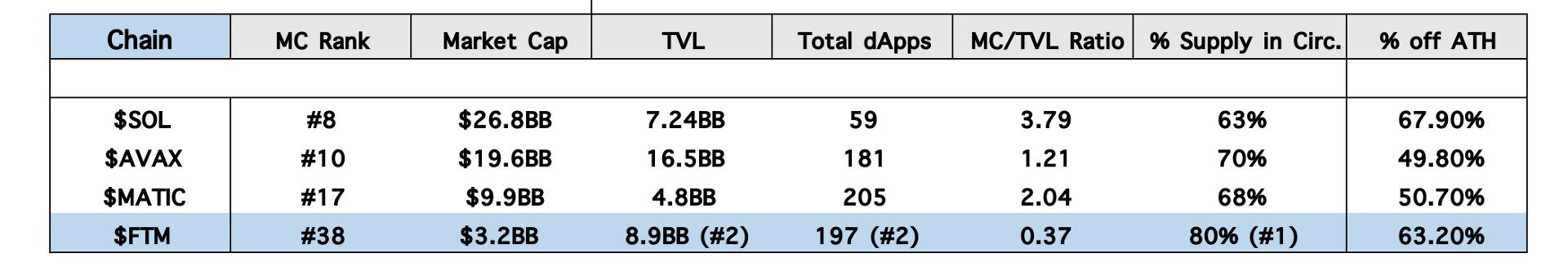

Below we have a table comparing FTM to other popular networks. FTM has the best market cap to total value locked ratio AND the highest percentage of supply in circulation. Supply in circulation, as a percentage, is an important metric because this reduces the sell pressure from the initial round investors and team. As tokens unlock over time, the team along with private investors sell since they are usually up many multiples. The network foundation also sells because networks usually use their own tokens to fund developer growth and ecosystem expansion. By increasing the value of the ecosystem with actionable tokenomics, network tokens grow in value.

Value Investing

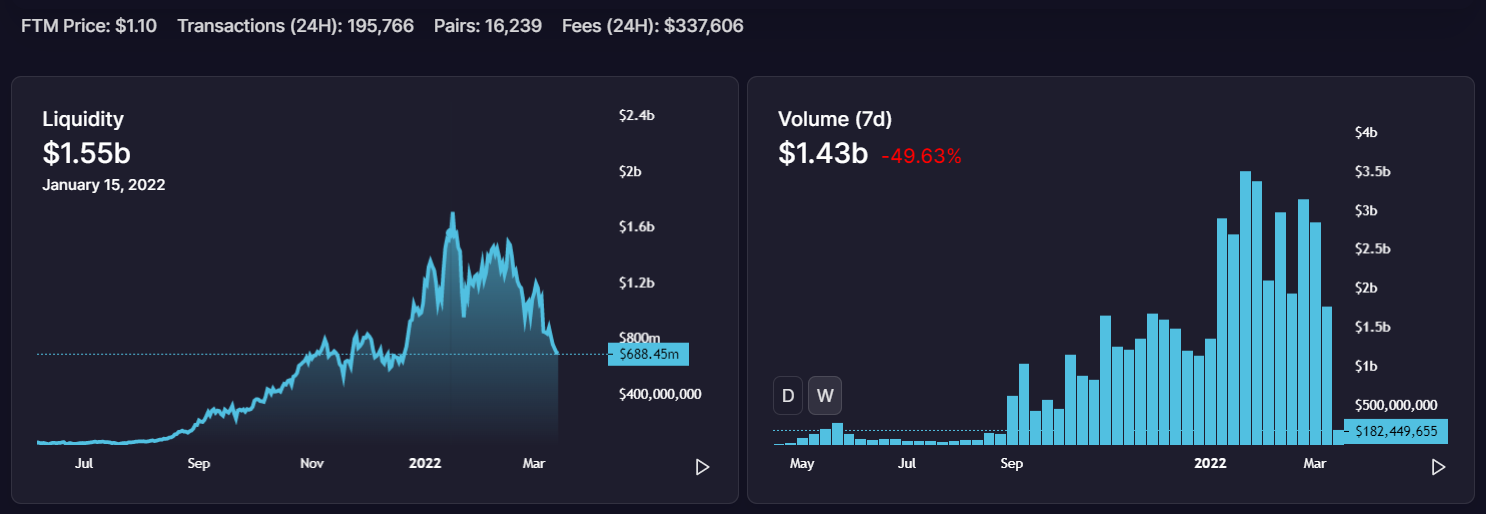

Fantom users can swap Ethereum based tokens with ease for 1% of the average price on the Ethereum network. Fantom has some of the hottest decentralized finance (defi) action in all of crypto as well. Spookyswap, their main dex (think Uniswap on Ethereum) has some metrics listed below. Since there has been some FUD (fear uncertainty and doubt) around the Fantom team, the FTM token has taken an extra downturn on top of the worldwide market fears. Generally, if a token’s fundamentals remain the same during times of FUD, a possible buying opportunity is presented. FTM appears tremendously undervalued compared to its competition. Many projects are moving to FTM because the community and the way the foundation treats its developers.

The famous Warren Buffet made most of his enormous wealth using the value investing strategy. Value investors “look for securities whose prices are unjustifiably low based on their intrinsic worth” [1]. A large part of our strategy in crypto uses this philosophy. If a network has more users, total value locked, developer interest, than a competitor with 10x the current value, there is a thesis building before our eyes. What is even more important is that FTM does not have to grow to the size where it can compete with Ethereum to make the average FTM investor plenty of gains. FTM could grow 10x in size and still find itself another 10x smaller than Ethereum at its current price.

Bullish on FTM Right Now

As FTM approaches the 1$ range the urge to buy in is compelling. FTM boasts an all-time-high of around 3.5$, around a 350% gain from here. Once Bitcoin and Ethereum decide to solidify their reversal, tokens like FTM will enter price discovery. This is where the sky becomes the limit for price action, 3.5$ is only around a 10-billion-dollar market cap. AVAX is sitting corrected around 20 billion today. Since I am comparing FTM to AVAX, I would say the theoretical price action for FTM would be between 4$-8$ per token this year.

Just one great game or defi protocol can really pump the price of the token. The downside risk is also minimizing over time as FTM corrects further with the FUD news event. In fact, the number of FTM wallets increased from 12,000 new wallets per day to 16,000 per day two days after the news that the main developer was leaving. I believe that the fears of war combined with this FUD event will provide an opportunity for massive growth this year. In this case I will put my money where my mouth is and start taking my Moon River farm stable coins into FTM slowly and daily. I also plan on adding more when the Moonbeam integration is added since I am enjoying having funds on Moonbeam, the network is so easy to use. Please remember none of this is financial advice and stay safe out there! Check out our final part of the series Part III.

[1]https://www.investopedia.com/articles/01/071801.asp#:~:text=Buffett%20follows%20the%20Benjamin%20Graham,at%20companies%20as%20a%20whole.