This writing expands on our introduction to Oraichain article. In this second part we analyze the token economy that Oraichain has built with the Orai token. For part one check it out [Part I].

Orai Token Economy

Token economy, or “tokenomics” is the underlying mathematically derived economy built when a network token is introduced. There is an infinite number of ways developers can implement a token and its associated use cases. The Oraichain team has decided to focus on long-term staking incentives as well as tying the token to the network products and services. This is a great starting point because real world use cases that generate network revenue are how a project survives long-term.

At a quick glance you will notice that ORAI is far different than FET. Orai only has 4 million of the eventual 19 million tokens currently in circulation. This is because they have taken the staking reward strategy to build out the economy. Validators are required to stake Orai in order to be able to secure the network and produce new blocks. As blocks are created the fees from the network go to the Validators, and thus the other stakers who selected that validator. Newly created Orai tokens are split between the validator and their delegators.

New blocks are only created when a transaction with associated transaction fee occurs. While this is an inflationary model, this makes it so that inflation only occurs with network usage and it is not simply on a set inflation schedule [1]. Since the transactions will occur when one of Oraichains services are used, developers and validators alike will mutually benefit from this cycle. This creates a community of builders and investors alike that strive for network success.

Given that Oraichain will have between 6-12 products/services, the network adoption has potential for massive volume. The product I am most interested in is the one stop shop for Ai services. Like an NFT marketplace users will be able to shop for what they need all on one platform. Eventually they will pay for their service with Orai tokens likely on that backend without noticing they are using blockchain.

Many of the Oraichain services include smart contracts and products that assist in scam prevention, avoiding fake news and internet security. All of these products after the last two years full of scams and shams are highly needed. Currently inflation rates for Orai are about 10%, this provides about a 29% APR with a 3 % commission fee according to the [explorer].

Piecing Orai Together

So, there are many use cases, a long-term incentive for both investors and builders, but what about the initial allocations and release schedules? I would like to add that when projects have a tokenomics section on their main page this is bullish. I often have to go digging through whitepapers and documents to find what really happened with the fund raises.

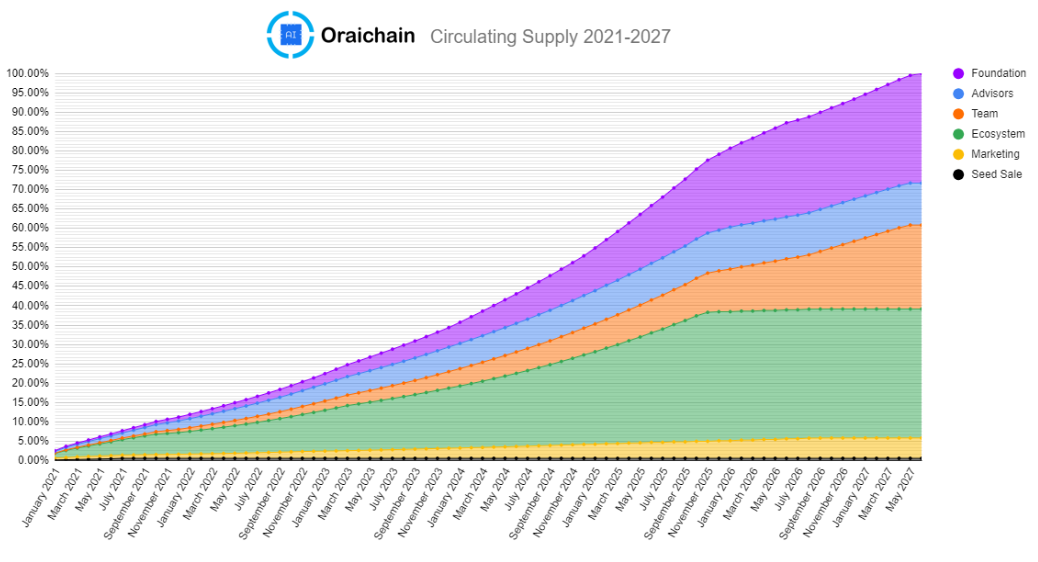

The Orai seed round was only 0.65% of the supply, and a generous 37% if reserved for community rewards. 35 % is reserved for the team and advisors with a release schedule that frontloads ecosystem rewards. This is designed to reward community early and only a few years from now the project developers and early investors be rewarded. This is the “money where you mouth is” for startups.

Oraichain has its own wallet based on Keplr, a very popular Cosmos wallet that is tried and tested. The wallet works on android, iphone and desktop. Since the native token was built on Cosmos, users can bridge to Binance Smart Chain and Ethereum as well. I am generally bullish on projects that main net on Cosmos for this very reason. Many developers have stated they enjoy building on Cosmos since it helps them save time and money.

Comparing this project to a larger competitor Fetch.Ai is a good place to finish the analysis. Orai is currently at a 14-million-dollar market cap, with an all time high over 100 million. Orai is 1/20th the size of Fetch but with seemingly more to offer. Orai will potentially suffer from inflation over time if the demand for its services does not grow. Since Orai is opensource and Ai is trending I am betting on increases for demand.

I am currently dollar-cost-averaging the token along with c3.Ai in the stock market. Since I like to hold a combination of defensive stocks as the majority of my portfolio, I like to add speculative value plays into the mix such Ai token exposure and other tokens found in our portfolio section. While there certainly is nothing wrong with FET per say, I find that the token economy for Orai is more attractive for retail investors and builders. While risky, we rate the token economy a 7/10, only suffering from a lack of major exchange listings (only Kucoin) an unfavorable released supply vs. max supply.

If you can find where builders will go, the money will come soon after in many cases. Remember none of this is financial advice, please use these articles to assist in your own research. Hopefully we help you save time and offer a unique perspective.