This article introduces one of my value investments starting about a month ago. C3.Ai appears to be incredibly undervalued, the earnings report is bullish along with the recent Ai momentum. Ai stocks have taken a massive hit during this bear market presenting a possibly massive discount on the sector.

C3.Ai Applications

Artificial Intelligence is growing and advancing whether we like it or not. Those who do not embrace, or least educate themselves on the topic may fall behind in the next few years. If you have been reading along, we have been covering Ai digital assets a lot lately, that is because we believe Ai as a trend will dominate this year. C3.Ai offers a suite of artificial intelligence based applications and products.

C3 offers applications for customer relationship management, ESG consciousness, law-enforcement, cybersecurity and reliability/availability management. These services allow managers and business owners to work more efficiently [1]. Efficiency increases profits and reduces losses over time.

The applications will point out shortfalls in business plans which allow managers to correct issues early and proactively. As an example, the closing of a business deal can be completed more quickly depending on who the sales representative speaks to in the target company. Said sales deal before the end of a quarter could be the difference between lay-offs and company wide bonuses.

Another application assists law enforcement officers in analyzing trends of crime in specific areas. The case management page allows officers to view evidence, they can search aliases, tattoo descriptions, cars and more. This allows officers to quickly find suspects and tie all relevant data together in a fraction of the time. This is a real-world product that has massive implications for quality of life. Officers being able to solve crimes more efficiently greatly effects the quality of life of their respective neighborhoods and cities.

Value Investing with C3.Ai

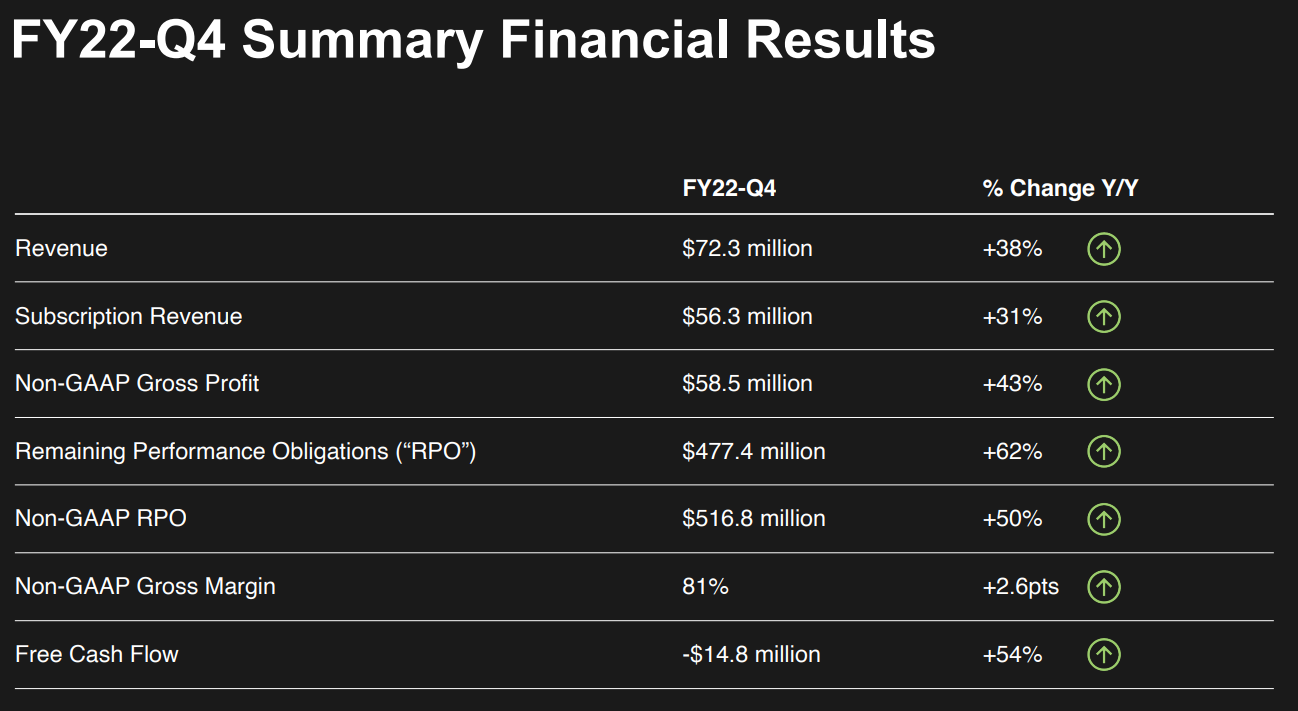

Now that we have products, how has the company performed recently? The image above shows outstanding growth for Q4 of 2022. The C3 report further goes on to state that the total revenue for like companies in Ai is projected to surpass 596 Billion dollars by 2025 [2]. Considering that the initial stock offering of the company in Dec. of 2020 was at 42$ per share we can set that as our first metric [source].

As a second metric we will use the all-time-high of around 180$. Given the absolute destruction of tech stocks, the company saw a 52-week low of 10$. After starting to average into the stock between 10.5-13$ I realized a few professional traders/investors were doing the same. A gem youtube account I found is great for some assistance with technical analysis which is not my strong point. [Royce Jakob] points out a possible gap price of 16-18$ which has already been reached, he called this move 10 days ago. Here is a link to the specific video [gap target], go to 20 minutes to see the chart he has created. In other discussion he calls for a long-term price target of 5-10 billion dollars.

At Coinbusters we believe the Ai trend will ramp up this year due to ChatGPT, Midjourney and other popular products. We covered a popular Ai digital asset a few weeks ago [here]. Since our Fetch.Ai article, users have requested more Ai based articles through a poll we held on twitter. We want to focus on giving our readers a mixture of our projected trends as well as requested content. If you have not read our article on rendering we highly recommend that as well, not financial advice of course.

I have a very bullish price target for the stock because they have real growth in revenue and subscriptions, yet the stock price does not reflect that. After this pump the market capitalization is 1.9 billion dollars. That is at least another 200-500% gain for this year. This also opens up the possibility that another larger company will acquire C3.Ai. If you have ever owned a stock during an acquisition, they generally pay you far over the current share price to buy out the company which is a nice cherry on top.

Do remember that tech investing during times of uncertainty is risky, do not over allocate if you are just getting started with your investing journey. Although I am very bullish on their growth for the next quarter and all of 2023, I keep my allocations as a fraction of my stock/cash net worth for risk-management. On Monday if the stock does not pump too much I might be adding more to the bag as I do not like to purchase pumping assets. Please remember none of this is financial advice, this is my opinion on the stock and its future projections. Stay safe out there!