This article fundamentally reviews Marathon Digital Holdings (MARA). In July we covered two stocks that trend with Bitcoin, Marathon and Microstrategy. Mara has become one of the most interesting ways to get crypto exposure without buying crypto itself.

Marathon

Marathon Digital Holdings is an American Bitcoin mining/holding company located in Las Vegas Nevada. We will refer to the company as Mara for this article. Mara allows investors to gain Bitcoin exposure without having to buy crypto assets. This is vital for many financial advisors and firms that are not allowed to invest in crypto currently. The extra upside to Mara is that they not only represent Bitcoin price action, but they hold a large amount of Bitcoin as a company and seek to increase energy efficiency/profit margins quarterly.

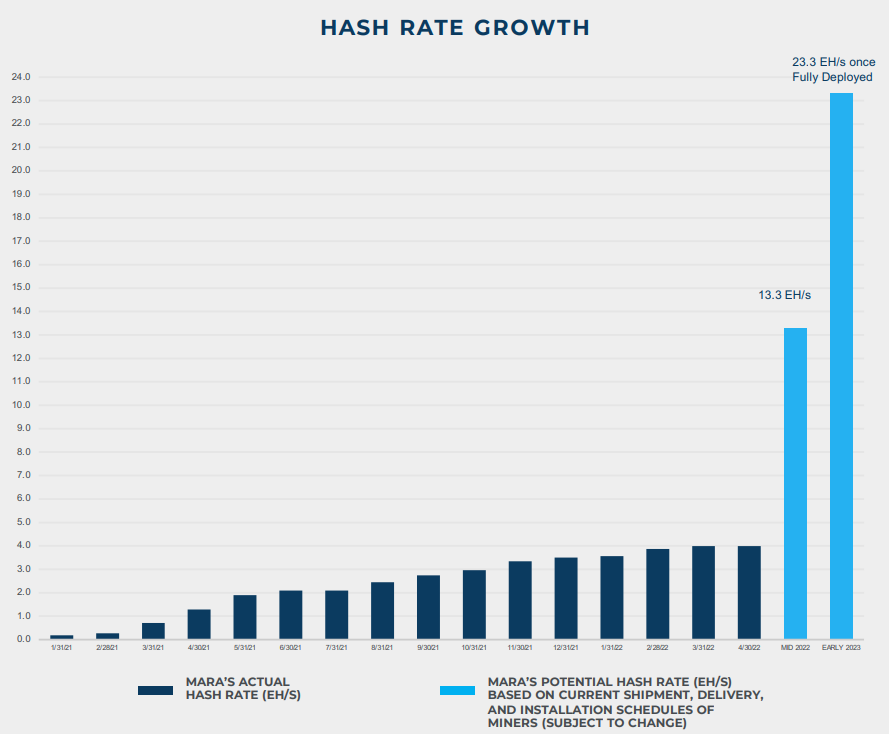

Mara aims to be the largest Bitcoin mining operation in North America, but also the most efficient [1]. With recent upgrades adding the s19 pro Bitcoin miners, the datacenter is expected to see a 30% increase in energy efficiency. Mara is focused on increasing the hash rate of their miners. Increased efficiency leads to lower energy costs which can increase net profit margins and treasury value.

Mara can complete large over the counter sells for Bitcoin weekly or monthly as needed to keep their overhead in check. Instead, they have been accumulating Bitcoin at their main facility which benefits from a partnership with an energy Generating Station nearby. Mara has entered a joint venture with Beowulf, a large energy generating company. This venture provides private stock to Beowulf as an incentive for the energy partnership.

Why Marathon?

Mara has an accumulation strategy unlike most mining companies, they are billed as a holdings company. Mara currently has 10,127 BTC in their treasury which is about 235 million dollars assuming a 23,500$ BTC price. Marathon Digital boasts a powerful team with a wealth of experience ranging from technology, non-profit management, chip development, and Defi. Their equipment alone is also worth hundreds of millions of dollars.

In the second quarter of the year, Mara was able to increase Bitcoin production by 8% year-over-year. Mara recently added a second massive Bitcoin mining operation in Texas. They were able to partner with a wind farming initiative that has successfully achieved the tax-exempt status. Mara was also able to increase their network hosting capabilities to meet their long-term goal of 23.3 exahashes per second (massive Bitcoin accrual per day).

Mara has a focus on reducing energy cost, increasing miner efficiency, and increasing Bitcoin holdings. As the price of Bitcoin rises, the company will gain value reflective of the Bitcoin price. With Bitcoin and most assets in a bear market, imagine a 100,000$ Bitcoin price in the next year or two. This could bring their prospective BTC holdings to above their current market cap.

Mara tends to move exponentially with the price of Bitcoin if both directions presenting an interesting options opportunity. Guessing a diretion of an options contract on the stock can be incredibly lucrative. Coinbusters started dollar-cost-averaging Mara at 5-6$ and also buying calls for January 2023. These two strategies have played out enormously with Mara sitting above 16$ today.

Although we are major crypto and Bitcoin advocates, the Mara exposure makes sense. As we get more bullish on crypto, we are more bullish on Mara because of the exponential price action. Mara stock is almost like using leverage without the added risk of liquidation. While Bitcoin has gone up 14% on the monthy, Mara is up about 300%. The company holds almost 100 million in cash to strategize for future directives of the American company. We are also excited to invest in an American owned mining company.

Mara boasts a cost of approximately 6,200$ per Bitcoin, this means they would only become unprofitable if BTC were to crash to this price which is incredibly unlikely. Mara aims to be 100% carbon neutral by the end of this year, with the renewable wind farms this is definitely possible. With the massively increasing hash rate, Mara is setup to have one of the largest Bitcoin mining accruals monthly. These are just a few reasons we are so bullish on the stock over the next 5+ years. Please remember to do your own research, none of this is financial advice, stay safe out there!

[1] https://marathondh.com/