We have written on NFT’s before, (https://www.coinbusters.io/learn/nfts-explained), but what is perhaps less of a focus in the current environment is the platforms we use to buy and sell NFT’s. OpenSea (opensea.io) has been the dominant platform for a while, but has drawn a lot of complaints from its users.

Opensea

The company has been valued at around $13 billion USD, but seems to be unresponsive to complaints, technical issues, and other such problems that have been brought up by the customer base. These problems seem to fall into a black hole. Customers have gone so far as to try to draw attention to the issues by tagging OpenSea on Twitter, only to be blocked by the OpenSea Twitter account. Ultimately, most of the issues are due to OpenSea’s inability to scale in order to support a market that has exploded over the last year. OpenSea transaction volume has gone parabolic, starting with less than $500,000 for all of 2018, increasing to $8 million in 2019, $24 million in 2020, and over $10 billion in 2021. 2022 is off to a hot start as well, with nearly $5 billion in January alone. OpenSea makes money by collecting a fee on transactions that occur on their platform. That fee is currently 2.5%, which means approximately $300 million in fees were collected in 2021. Not too bad for what is essentially a middle-man operation!

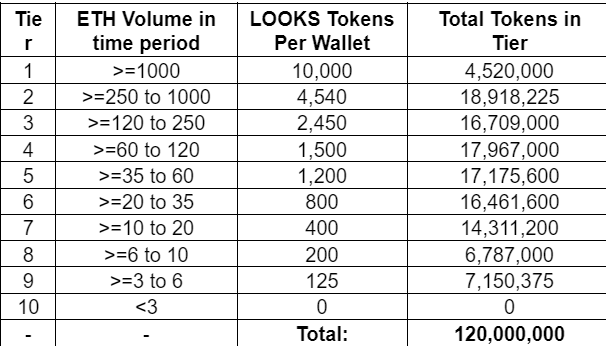

A little over two weeks ago, a new player to the NFT marketplaces made a splash by airdropping a new token to OpenSea users. They used the blockchain to identify wallets that were heavy users of OpenSea, and created a token these users could claim if they paid the gas (Ethereum fees). The number of tokens that OpenSea users were eligible for was broken down by total Ethereum volume traded by the users within a specific period of time, shown below. Also, anyone could list an NFT for sale on the newly created platform and be rewarded with a 400 token airdrop. The listing did not have to sell in order to qualify for the airdrop, but there were limitations on what listings would qualify. The period to claim the airdrop has been extended indefinitely due to issues with Trezor wallet integration, so check www.looksrare.org to see if you are eligible.

Looksrare (LOOKS)

The premise of this token is to be a means of investment in a brand new NFT platform called Looks Rare, (www.looksrare.org). The token trades as LOOKS, and is on the ERC-20 Ethereum network. Token holders can also stake their tokens or provide liquidity to the Uniswap liquidity pool directly on the website www.looksrare.org/rewards. The respective APRs are dependent on many factors, and as a result, varies by the day. However, those APRs are always reported in real time on the website.

What makes Looks Rare especially unique is their approach. They are collecting a smaller fee than OpenSea, collecting 2% of each transaction, but that 2% doesn’t go to the company. 100% of the fees are distributed to those staking LOOKS at www.looksrare.org/rewards. Those rewards are distributed as WETH (Wrapped Ethereum). The rate of distribution of rewards depends on a few factors, such as the trading volume on the Looks Rare NFT platform, and how many LOOKS tokens are being staked. Eventually, a DAO (decentralized autonomous organization) will be formed as well to give token holders a say in the operation of Looks Rare. This is essentially making the Looks Rare marketplace a Web3.0 operation, whereby the organization becomes decentralized and hands power over to the token holders. A full outline of the tokenomics and rewards distribution is available at https://docs.looksrare.org/about/welcome-to-looksrare.

Perfect Timing

What has been especially impressive for a two-week old organization is the responsiveness and transparency of the development team. They work tirelessly to improve the platform based on input from users through their Discord channel, which is public to all, as well as to issues that arise in the market. As an example, OpenSea was recently exploited by NFT buyers who took advantage of a flaw in OpenSea’s existing listing prices. Basically, NFT sellers are able to list their NFT at any price they wish, but can also cancel the listing by paying a small fee. However, the listings occurred on-chain, while the cancellations occurred off-chain, since OpenSea doesn’t put transactions on-chain until they are completed. Because of this, the listings were able to be accessed by interacting directly with the OpenSea API, or using other third party NFT marketplaces to recall the old listing prices. OpenSea users lost over $1 million, with one exploiter making almost $800,000 by re-selling the NFT’s near full market value. OpenSea was slow to respond to the matter, but has recently announced they will reimburse those that were exploited by the scam. However, Looks Rare developers responded almost immediately with a new update to the platform that allows users to cancel all existing listings on-chain with the click of a button, showing how quickly and seriously they respond to issues in the market. The developers have a public dashboard that shows the status of all open ticket items, and provide daily updates on changes to the platform.

The LOOKS token has experienced a significant pullback in the recent downturn of cryptocurrencies, but could be providing an interesting opportunity to begin buying. It has been building a tighter trading range of the last few days, and could provide a platform for higher prices. It has been in the top 10 traded tokens on UniSwap consistently for the last two weeks, even during the pullback.

Positives & Negatives

It is currently valued at $700 million based on the released tokens, but has only released about 30% of the total token count, which will be 1 billion. At full dilution, LOOKS would be valued at $4 billion at these token prices. As of January 26th, 2022, Looks Rare has collected nearly 58,000 Ethereum in fees since the platform was released on January 10th, 2022. The Ethereum fees would be valued at approximately $142 million right now. 100% of these fees were distributed back to staked LOOKS holders. Not too bad for two weeks. If that trend continued for the year, it would be $3.2 billion in total, but it is impossible to project 52 weeks of fees based on two weeks of data. However, many people expect the NFT market to continue its growth, and Looks Rare is positioning itself well to become a dominant player in the market through responsiveness and transparency.

However, Looks Rare is not wholly without risk. At this time, most of those fees are the result of “wash trading”. Looks Rare is seeking to draw attention to the platform by allowing buyers and sellers to be rewarded with LOOKS tokens if they use the Looks Rare marketplace, and some NFT’s do not charge a creator’s fee, which would give creators a pre-determined percentage of each sale. Large traders have been taking advantage of this arrangement by buying large quantities of NFT’s that do not charge a creator’s fee to essentially make money on buying and selling NFT’s to themselves through the use of multiple wallets. “How is this possible?” you may be asking yourself. For the first 720 days of the marketplace being open, buyers and sellers using the marketplace will be rewarded with LOOKS tokens depending on the size of the trade, as outlined in the tokenomics. Also, since the fees they are paying are returned to those staking LOOKS, these wash traders are earning rewards for that as well. In the end, these large traders are able to come out ahead by buying and reselling to themselves under the right conditions, such as current gas prices. These wash trades will not be sustainable forever due to the tokenomics of the rewards release schedule, but Looks Rare developers are using this time well to fund improvement initiatives, as evidenced by their daily updates.