This article reviews the GMX/GML tokens using fundamental analysis. Make sure to read our initial article on GMX to fully understand the project before reading this article.

Tokenomics

Our first article on GMX can be located [here]. In summary, GMX is a decentralized exchange where users can swap tokens, stake for a yield, provide liquidity and more. GMX focuses on building a large liquidity pool run by protocol governance (decentralized voting). The pool focuses on safer, long-term investments for project longevity. When a user purchases the GMX token, they are able to stake the token for a split reward. Currently the yields provide a 7.4% escrowed GMX, and 6.2% ETH. Escrowed GMX can be staked for a GMX derivative token or vested for 1 year to become GMX tokens. The APRs on Avalanche are pretty similar currently, users would receive AVAX instead of ETH.

Having ETH as part of the reward reduces the potential inflation the project would have if only GMX tokens were rewarded. Since GMX has a capped supply, this is bullish for price action. The longer a user stakes GMX the higher their multiplier reward will be. When removing stake, more Ethereum will be rewarded. During trading, 30% of protocol fees are converted to ETH and or AVAX to feed protocol rewards. The higher the volume on GMX, the more fees are creating thus feeding a long-term financial loop.

GLP holds a different role within the protocol. GLP is the liquidity token for the network. GLP can be used to mint, and add liquidity. For example, 10$ in BTC can be used to mint 10$ of GLP. The GLP can the be taken and staked for rewards of 28% in Wrapped Ethereum (Ethereum that can be moved cross chain). GMX stakers receive the other 70% of protocol fees.

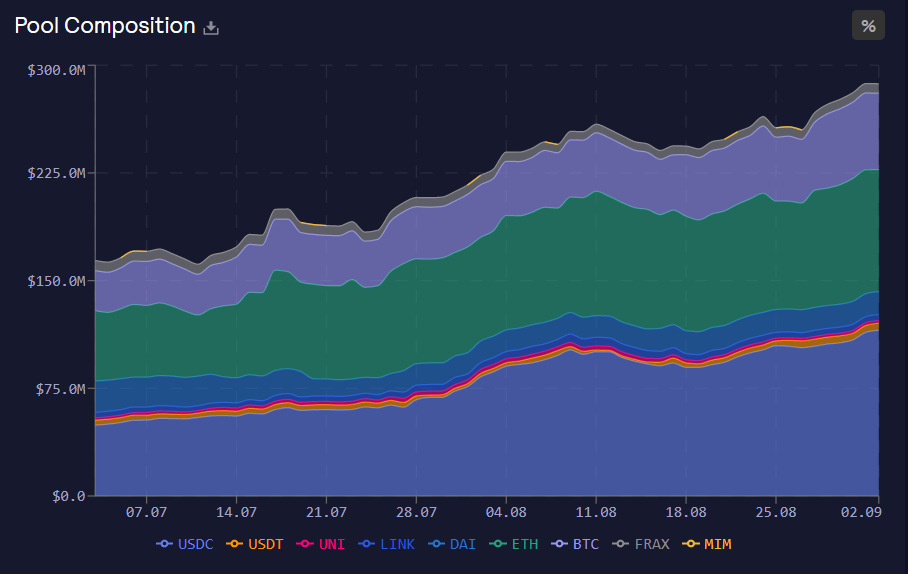

The beauty of this protocol is that users provide liquidity without impermanent loss, they are staking not adding and LP. The protocol owns the liquidity of the network and thus the trading pairs. GLP fees are taken and deposited into the “Floor Price Fund”. This fund focuses largely on GLP and Ethereum. For an immediate view of the pool, check out the [explorer].

This fund assists in providing long-term liquidity and rewards for the protocol. As the fund grows, GMX buybacks are likely to occur, these tokens would be burned, this is positive news for future price action. Currently the GLP pool has a value of 281 million dollars mostly in USDC, Ethereum, and Bitcoin. The total value locked on GMX is 636 million which is substantial for a bear market.

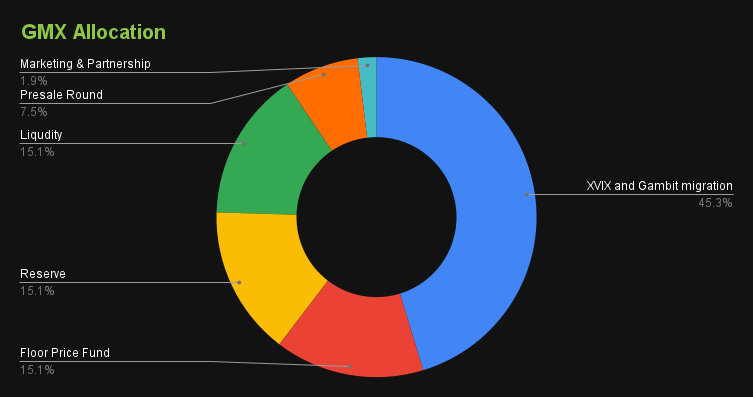

Initial Allocations & Merges

If you have been reading along for a few months or longer this allocation should jump out at you. Less than 10% of all tokens are reserved for the team and presale round. The rest is reserved for growing the liquidity pool, reserves, and the gambit migration. The presale tokens are unlocked over two-years. These allocations will allow the project to market, build massive long-term liquidity, and grow to other popular blockchains.

GMT and XVIX token holders were able to migrate their respective tokens to GMX last year. This allowed for a mass consolidation for the new protocol which took up almost half of the initial allocation of GMX tokens. Holders who kept their tokens until today saw 31x gain, a strong proposal indeed.

Potential Thesis

GMX has clearly made a massive update when they merged multiple tokens to combine GMX into a governance/utility token. The tokenomics are very strong. With a supply cap, burning mechanisms, demand, and volume, GMX could be prepped for long-term success. Being on both Arbitrum and Avalanche is great since they are two major blockchains. Having no impermanent loss risk is huge since suppliers of liquidity simply swap into GLP and stake.

Since rewards are largely in ETH or AVAX, less inflation of the actual network tokens is apparent. Inflation usually kills token price during bear markets. Since many users are using GMX to trade crypto and crypto perpetuals, the economy they have built fuels itself. Both Avalanche and Arbitrum are known for immense security and reliability reducing the likelihood of exploits and or scams.

GMX provides a no slippage (fee for swaps related to low liquidity) very low spread way to trade popular digital assets. As more assets are provided, the question arises, why would you trade crypto on a centralized exchange with high fees? Central exchanges also make it clear that you do not own the tokens you hold on the exchange. They retain the right to freeze your funds and or downright apprehend your crypto with little explanation.

The major potential negative I see for future price action is that the gambit early holders are up about 30x. Now one would assume many holders sold as the token price went parabolic, but there are likely a few whales that could crash the price in the future. This could be remedied if the project continues to grow in demand. I am bullish on GMX and GLP and am considering adding it to my portfolio (transparency). We give GMX an 9/10, only hampered by favoring early investors/whales. However I am waiting since the token has been pumping for weeks. Please remember none of this is financial advice, use this writing to assist in your own research. Stay safe out there!