This article follows up on an update article regarding the impending Fantom Virtual Machine test net. Fantom has the possibility of competing with popular layer-2 networks such as Arbitrum, Polygon, and Optimism.

FTM Release Schedule

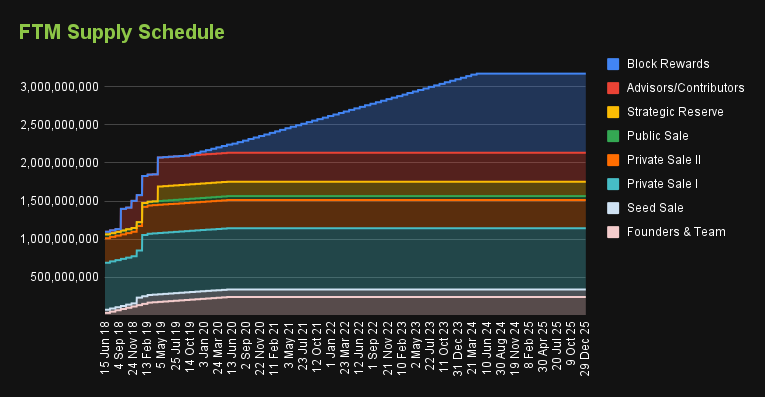

Let’s jump right into the meat of the discussion. For those who need a quick primer check out our recent update on Fantom [here]. Below is an image of the token release schedule for FTM. From 2018 to 2019 this was not a release schedule that we would enjoy. This heavily favors early investors and private fund raises. The rapid release for all categories during that time likely created immense sell pressure.

Fast forward to 2023, and we have a different picture. 87% of the max token supply is released, and the majority of these tokens will be released for those who stake the FTM token. The early venture capitalist funds have likely already sold many thousands of percent ago. The people who have stayed during the crypto market collapse will receive the remainder of the FTM staking rewards.

Token releases can tell you a lot about the economic setup that a project or network has decided upon. It is important to differentiate between the APY an investor receives for staking, and the token inflation that is coded into the economics. Next year the FTM inflation will be at a fixed rate until all tokens have been released. A minimum staking lock of 2 weeks will provide a 2% APR while a 1 year lock will provide around 6% [1]. At current rates, only about 20,000 FTM are being released per month until December of 2025.

FTM Utility

FTM can be used for several things within the Fantom network. First off, FTM like Ethereum is used to secure the network with the proof-of-stake mechanism. Validators will review transactions for validity, as transactions are approved some FTM is given as a reward. Validators also receive a portion of the gas fees from all activity on the network. Higher volume on chain gives more rewards to validators. Some of this fee is also reserved as reward for the most successful applications on Fantom.

FTM is used for token pairs, and on-chain payments. The token is also used for governance which is voted on by validators/delegators alike. The token like Eth, is finally used for transaction fees. According to [lookonchain] the top 30 holders of FTM held 68% of the supply last November. Looking deeper, most of these large wallets are exchanges, including Binance, Gemini, Crypto.com, and also the Fantom Foundation bridge.

This is a decent diversity of large holders; we can exclude the exchanges for the most part. Now if we add the impending virtual machine which is projected to increase throughput by 8.1 times the current Fantom Ethereum Virtual Machine, this is bullish. This is backed by a 98% reduction in storage needs. Reducing storage needs is very important because highly scalable chains will have storage bottlenecks if they are not actively building solutions from the base layer.

FTM Thesis

If you have read our articles over time, we have left small breadcrumbs about our bullishness on FTM and the underlying ecosystem. FTM during the last bull market was a very popular Defi based network with high volumes. With new promising projects building upon the DAG, and Andre back with bright ideas and a forward vision, we continue to approve of the ecosystem as a whole.

The token itself in 2018-2019 would have been a pass for us. But in 2022-2023 we are very interested in seeing where this technology takes us. FTM remains 85% from all-time highs with a local bottom around 20 cents. Many TA experts we follow called for the 60 cents move. If BTC behaves itself 1$ is in the cards in the next month or two. We are not here for FTM in the short-term, as I revealed in the update article, FTM is my largest altcoin holding. For the reasons listed above.

Not only will the virtual machine bring in new users, but the vested wallets that have been dollar-cost-averaging over time will continue to grow. Having a small yearly inflation, almost all of the tokens unlocked, and a seed round that has likely sold out is all bullish. Perhaps the most attractive thing about Fantom is the lack of a need for layer-2s and storage solutions. Even the ever popular Solana needs help with scaling because the storage solution was not built into the base layer.

Blockchains and DAGs need to store the blockchain history for various reasons including consensus, debugging, and analytics. Fantom aims to solve this problem head on by coding reduced storage needs directly into the foundation of the network. The Ethereum compatible network is already many times more efficient than Ethereum.

Do remember that the 8.1 times faster is scaling off of Fantom’s current network, not Ethereum’s. This will bring Fantom to near Solana levels of scaling, but without the downtime, institutional whales, and storage problems. If we could rate the FTM token economy on a scale of 1/10 it would receive a solid 9 points. Remember none of this is financial advice, always do your own research, and stay safe out there!