This article reviews the token economy that Fetch.ai has created. Remember when investing in crypto, you are investing in the token, not just the project. Tokenomics play a vital role for any network token, and can make or break their viability as an investment.

Fetch.Ai Review

For a quick primer on why we believe AI exploded in popularity recently check out our [article]. In summary, ChatGPT added to AI image creation(article image was created using Midjourney), with added video software will allow artificial intelligence to perform a myriad of tasks very efficiently. Users can already create website landing pages, images for personal use, educational videos and more with a few prompts. Fetch.Ai aims to bring some of this technology to an open-sourced application for the masses.

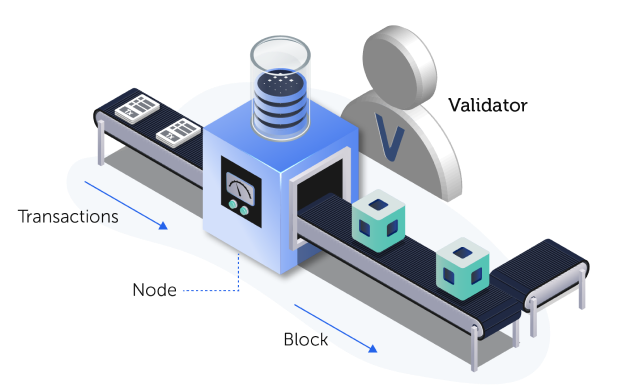

FET investors can stake their tokens with validators similarly to many proof-of-stake networks. For an article on staking, check it out [here]. The validator sets the fee, which in turn decides the APR an investor would receive. For example, a 10% fee would take 1 out of every ten FET tokens earned through staking. Validators are important because the double check the network for security and accuracy. Validators contribute to decentralization as well as the economic model of the network.

The other use for the FET token is as a medium of exchange for the artificial intelligence services provided on the platform [1]. Fetch.Ai provides all the tools for developers to build and deploy an autonomous product. Fetch uses agents to not only participate in machine learning, but to communicate amongst each other directly on the Fetch blockchain. This allows peer-to-peer development without middlemen that have a conflict of interest.

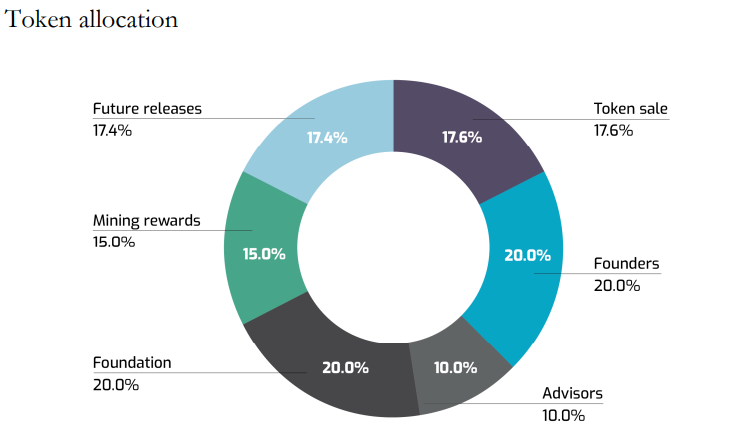

As usual we will use a systematic approach to evaluate the token. First, the FET use case has been discussed, next we will look at initial token allocations, token release schedules and other metrics comparing them to the crypto market. Tokenomics are tremendously important to the success and longevity of a project. Many tokens can explode in price by hype alone, but the mathematical ecosystem that is created is part of what keeps fundamentally strong projects surviving and thriving for the long-term.

Fetch.Ai & FET Analysis

FET has a concerning initial token allocation. 20 % is reserved for the foundation, another 20% for the founders. 17.6% is reserved for seed and private rounds, with another 10% for advisors. In total 67.6% of the entire supply will be impending sell-pressure as the tokens unlock. Only 15% of the supply will be used for mining rewards with the final 17.4% for future releases. Future releases are slated to be public sales which could help add some buying pressure.

Adding fuel to the already rather temperate flame, the token unlock schedule for private investors is only 3-6 months. The founders and advisors will see 50% of their tokens unlocked within the first year, another massive amount of sell pressure [2]. FET will need a very high demand use case in order to survive the sell pressure that is built into the token economy.

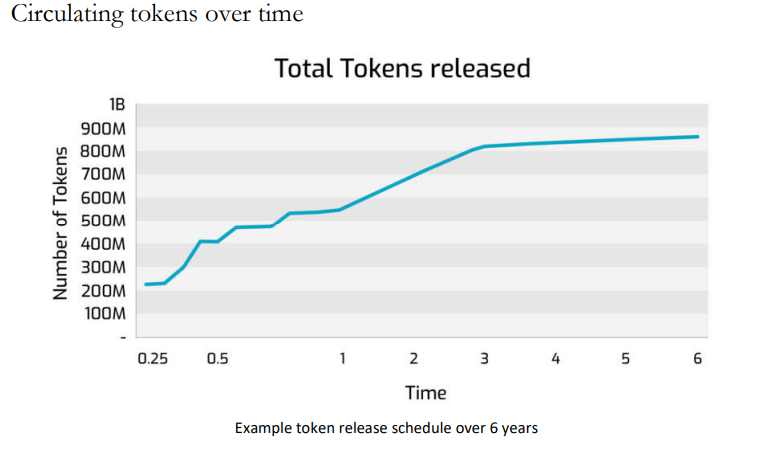

A positive metric is that a large number of tokens are already released into circulation, it appears the remaining nearly 15% is the mining rewards. This means that many of the initial tokens have already been sold. Couple this with exchange listings on Binance, Coinbase, and other large exchanges FET is able to push large volumes. Since crypto is open 24/7 volume can push into holidays and weekends when compared to the stock market.

FET finds itself at nearly a 300-million-dollar market cap today, with the token up 250% in the last 30 days. Giving that this is a bear market this is strong performance. I believe that FET is a rather obvious AI investment in crypto for the average altcoin enthusiast. The token has been trending and is mentioned very often on Twitter which is a major news source for digital assets/crypto.

Given the concerning initial allocations, lack of long-term rewards for validators and stakers, I would give FET a neutral rating. The utility for the FET token will need to cause massive buying demand to keep the prices up long term. A relatively low max supply is bullish. Personally, there are other AI plays with smaller market caps that I have my eye on, I will be avoiding FET. We give FET a 6/10 suffering from the emissions schedule and private rounds. That is not to say that FET is a bad play, hype and community can carry a token to unimaginable heights. Please remember this article is my personal opinion and not financial advice. Always come to your own conclusions, stay safe out there!