This is a real time analysis of how I look at opportunities in the crypto market. Chainlink has consolidated since May, only recently has it shown some upward movement. Chainlink appears to be undervalued based on how integrated it has become in all crypto ecosystems.

What is Chainlink

We very briefly covered Chainlink (LINK) in early September during a consolidation period. This article can be viewed [here]. Chainlink is the largest oracle in the crypto market, oracles are important for data feeds including prices for tokens. Early oracles were faced with the decentralization problem, if they were to use a single exchanges price feeds, that single exchange could be the point of failure. Chainlink solves this problem by aggregating various centralized and decentralized data sources. This data is then brought to node operators who help validate the network and come to an average price consensus. The data is then provided to the network (Ethereum, Avalanche etc.). By utilizing this process, single points of failure are removed, and the process is decentralized[1].

By using this process, Chainlink can take outside data (usually token prices) and bring it on chain to your favorite smart contract networks. This also allows Chainlink to send on chain smart contract data to centralized entities. Imagine you pay for a rental car on a mobile application. Once the payment is received your selected car has the door open automatically for you. This can also be applied to banks for payment verification. Chainlink is also useable for NFT dynamics, such as changing of an NFT appearance based on the time of day. Games can use Chainlink for verifiable randomness of loot-box drops and more.

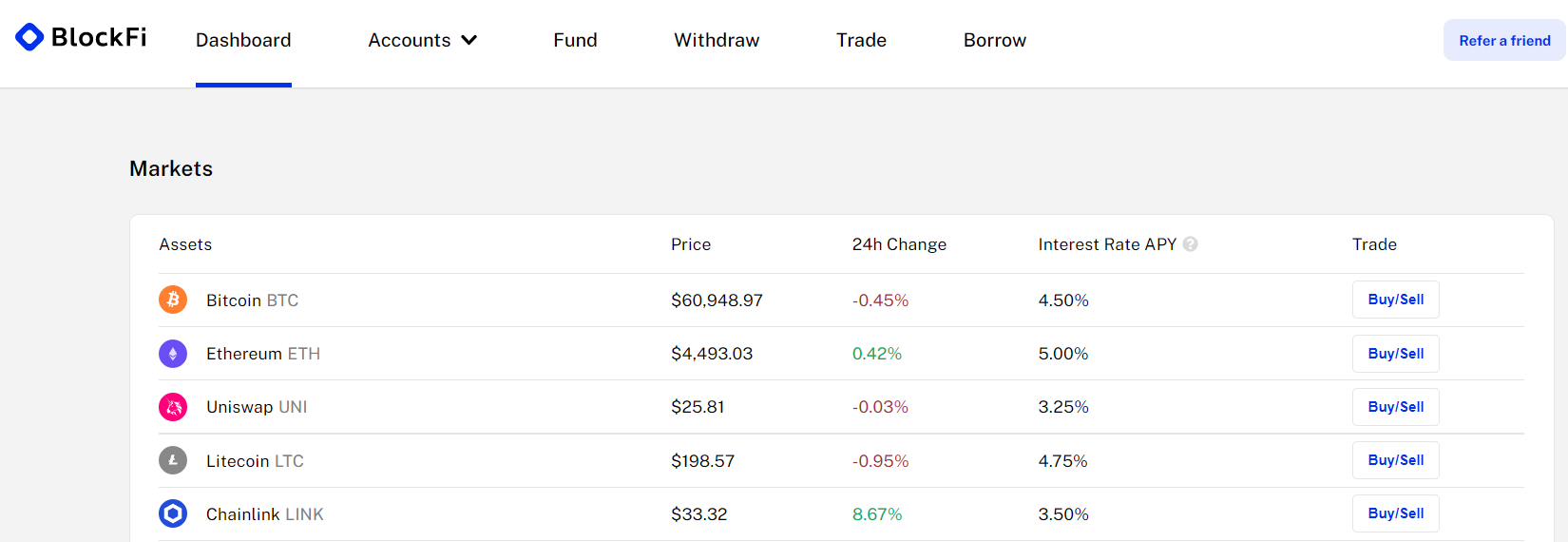

Chainlink recently surpassed 75 billion dollars in total value secured across the broad ecosystem. Almost all defi ecosystems rely on Chainlink and the services it provides. With Chainlink integrating into the NFT and gaming space for verifiable randomness and other features, the sky is the limit in regard to potential value. Check out our affiliate link for Blockfi here >> [Blockfi].

Tokenomics

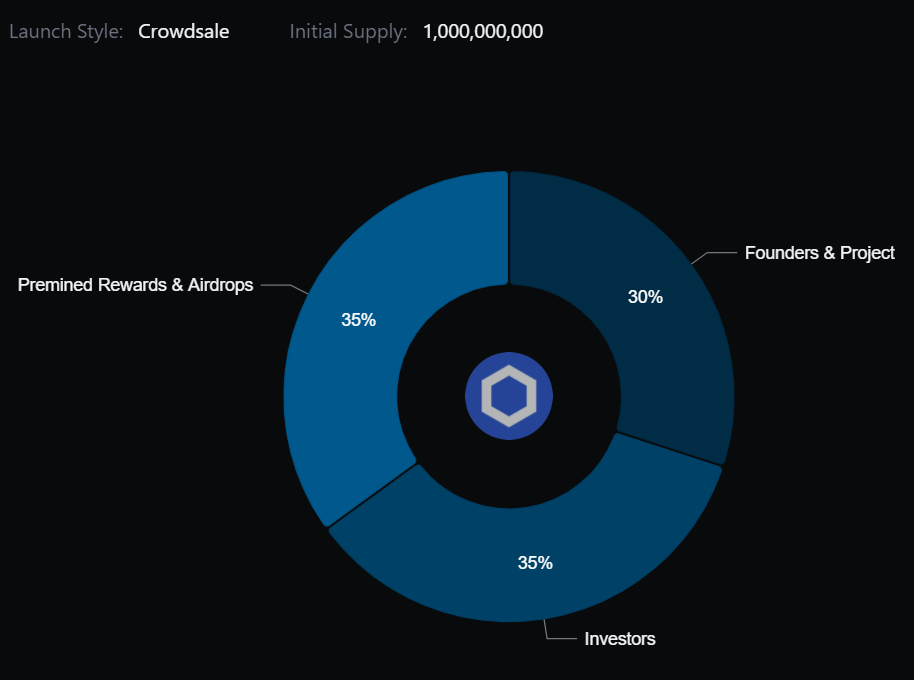

LINK has very straightforward initial allocations viewable in the image below. Since LINK launched in 2017, most of the initial investors have likely sold since the presale price was 9 cents (about 500x return if sold at recent ATH) [2]. This fact makes price dumps aside from BTC market corrections less likely. LINK has been in a long consolidation phase since the spring and is starting to set higher highs and higher lows. LINK has a total supply of 1 billion and the circulating supply is released as incentive for node operators. LINK can also be used as payment for services of the node operators using Chainlink. Chainlink now offers staking and the process is like other staking incentives we have covered on our website. LINK is also a popular choice for lending services for a relatively stable APY, Blockfi currently offers 3.5% to lend Link. Our affiliate link for Blockfi is right here >> [Blockfi].

Thesis

Since Chainlink secures so much capital throughout multiple chains, I believe it is very undervalued. Projects like Cardano which do not yet have a fully functional product are valued at tens of billions. With the NFT and gaming ecosystems just getting started, LINK will play a major role for the long term. Chainlink has solidified itself as the king of oracles for a reason, it has 4 years of building to prove itself. LINK is also available on most popular exchanges including Coinbase and Binance making it easily accessible. Having a limited supply is bullish for price action. Readers know how we feel about staking also. I am eyeing LINK as a safe place to store some capital for a few months. I am not married to the project, but can view it as both a quarterly opportunity, and a long-term investment, and argument can be made for either side. The real question is how large can the king of oracles get. 15 billion is definitely undervalued but is 100 Billion? As always stay safe out there, this is not financial advice, do your own research, and thank you for reading.

[1] https://chain.link/education/blockchain-oracles

[2] https://messari.io/asset/chainlink/profile/launch-and-initial-token-distribution