This article discusses a different approach to add cryptocurrency exposure to your portfolio via the stock market. Use this research to assist in building your thesis, and to help form your own unique opinion.

The Stock Market?

One of the main reasons the stock market is (generally) viewed as safer than cryptocurrency is the regulatory oversight provided by entities like the SEC (Securities & Exchange Commission). Publicly traded companies get audited, have filings that are made public, etc. While the myriad benefits that cryptocurrency affords us are clear, some may still prefer the perceived safety that the stock market provides. In that context… Did you know you can have cryptocurrency exposure through the stock market?

A number of publicly traded companies (two of which we will talk about here) are highly correlated to the price of Bitcoin or other major cryptocurrencies. This is an entirely different way to gain cryptocurrency exposure without physically purchasing or owning any cryptocurrency assets. Unlike tokens in the crypto space (whose value is derived from current and speculated future utility), buying stock in a crypto-correlated company is really the best of both worlds: Cryptocurrency exposure but physically owning a piece of the company while being protected by SEC regulations. Two companies in particular are interesting in this space: Marathon Digital Holdings (MARA) and Microstrategy (MSTR).

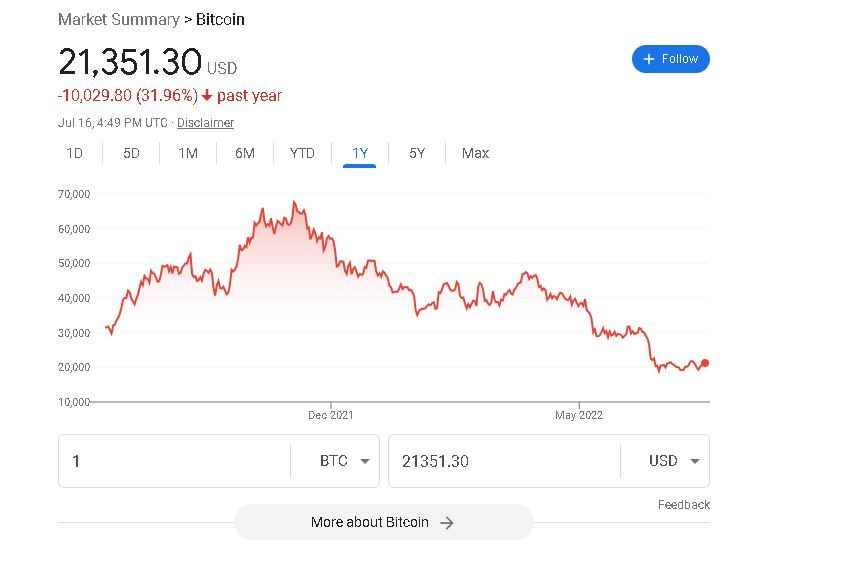

In both the stock market and crypto market there has been significant price churn. Inflation, the war in Ukraine, and a variety of other factors have contributed to this. The overall outlook of Bitcoin has not changed during this bear market cycle. This means that layering in (dollar cost averaging) can yield some pretty significant returns. If buying Bitcoin scares you, MARA and MSTR are great ways to get BTC exposure.

MARA

MARA is a company that exclusively mines Bitcoin. Some miners exclusively sell their mined Bitcoin for expenses and profit. MARA has a good balance of selling versus holding as evidenced by their large pile of BTC holdings, which is up to almost 10,500 BTC (worth >$500million). MARA has also invested heavily into adding additional mining power, which will allow them to mine faster and obtain more Bitcoin per month. These upgrades caused MARA to increase their mining output by 556% in Q1 of 2022. With the next BTC halving slated for 2024, miners like MARA will be seeking to accrue as much as possible until that time. MARA also has shown itself to be smart with buying and selling BTC.

MARA has a strong cash position and significant assets all tied to BTC and its mining rigs. If you believe that Bitcoin is going to rebound, MARA is a great way to gain exposure to that via the stock market. From July of 2021 until the peak of the last rally in November of 2021, BTC’s price increased a staggering 234%. Over that same period MARA’s stock price increased by over 330%.

With both BTC and MARA’s stock price being down, this presents an interesting way to add BTC to your portfolio. With MARA’s stock price around $8 as of today, if BTC ever sets a new all time high in price, MARA will see significant price growth (even more than Bitcoin). MARA is not likely to increase if BTC does not.

MSTR

MSTR is an even more interesting BTC exposure play. MSTR is an extremely successful analytics and business intelligence software company lead by Michael Saylor. Saylor is one of the largest supporters of BTC in the entire world and has lead MSTR to purchase a jaw dropping 130,000 BTC worth over $4billion. MSTR has become intertwined with BTC because it is out and open about its holdings, purchases and feelings in the space.

What makes MSTR interesting is that its value is a combination of its software (etc.) revenue and its BTC holdings. MSTR brings in about $500million in software revenue per year. Material changes to MSTR’s line of business will impact its price in addition to the value of its BTC holdings. Since MSTR holds so many Bitcoin as a company, if Bitcoin rallies, MSTR’s price will too.

Options exposure, while extremely risky, can be an interesting way to bet on the price of BTC via MSTR and MARA. Because both MSTR and MARA are publicly traded, this makes purchasing their stock possible in IRA’s and investment accounts (etc.). For some, this may be an avenue to consider if BTC is something you’d like in your portfolio.

Risk isn’t for everyone. These are two of many ways to gain exposure to BTC without needing to get heavily into crypto directly. Both MSTR and MARA are publicly traded companies which means they must abide by the rules and regulations of the stock market and SEC. This information is not financial advice and seeks only to help you in your own research.