One of my favorite ways to trade uses tokens compared to Bitcoin or Ethereum as a ratio. This strategy has aided in my decision to add Avalanche (AVAX) for massive potential gains this quarter.

What is Avalanche?

Avalanche is an open-source smart contracts platform where developers can build applications in a decentralized manner. What attracts people to crypto is decentralization, or lack of middlemen, no solitary leaders. Through decentralization, platforms can build an ecosystem focused on sovereignty with the security of blockchain technology. Avalanche can be compared to Ethereum in this manner, it deploys much of the same ideologies, however it is much faster and cheaper. Avalanche can even run Ethereum Dapps (decentralized apps) while providing those cheaper fees and faster transactions. Currently Avalanche is the fastest blockchain when using time-to-time finality of transactions[1]. Avalanche provides up to 4500 transactions per second, with a 2 second finality.

Avalanche also has the most validators of any proof-of-stake protocol, this increases decentralization. If you have read my other articles, you know I LOVE proof of stake blockchains. Proof-of-stake consumes less energy and allows validators and delegators alike to benefit from participating in the protocol. Avalanche uses subnets to allow developers to customize their blockchains, each blockchain gets its own individual subnet validator. This lowers the barrier to entry for developers, this causes more rapid ecosystem growth and adoption.

Avalanche is Usable and Growing

Avalanche ecosystem contains automated-market makers like Uniswap and has the Pangolin and Trader Joe decentralized exchanges for trading and decentralized financial services. Avalanche also has lending protocols similar to AAve and Compound (you can use these two with its bridge also). Avalanche aims to work with governments across the world to increase data security and compliance. They are currently partnered with the Mexican government of Quintana Roo to optimize transparency of legislation. “The initiative will guarantee the integrity and transparency of legislative documentation for citizens, entities, and deputies against the modification or destruction of the initiatives presented” [2]. Avalanche is also providing NFT services, proving ownership and allowing for trading with minimal fees. The Topps NFT market is working on animated comic book covers, and more original art[3]. Topps is collaborating with the MLB, Godzilla and Bazooka comics, all very well-known names.

Avalanche is partnered with Polyient Inc, Polyient aims to bring new utility merging defi with NFTs.Polyient has a large investment arm aiming to support new startups who are focusing on defi and NFTs in crypto. Polyient also has a digital investment arm to boost the funding of the corporation as a group. Polyient has a gaming arm that hopes to turn gaming wins into digital assets that grow in value along with size over time. They will have a digital marketplace that allows for moving NFTs between games, the beauty is that the owner can take their NFTs with them when they are done with a certain game. Users will be able to spend their in game rewards on NFTs and collectibles which will have intrinsic value associated with the games themselves. Imagine you buy a bunch of in game items on World of Warcraft over the years, when you are finally sick of the game, all the money you spent will go to waste. With Polyient you will be able to retain the sentimental and monetary value of your purchases.

Ecosystem and Team

The avalanche ecosystem has steadily grown over the past year. Since Avalanche can seamlessly integrate with Ethereum applications this has boosted their growth substantially. Users can still use their favorite Ethereum applications for far cheaper, with exponentially faster transactions. Avalanche also has many native applications built specifically for the Avalanche protocol. When investing in crypto, picking projects with expanding ecosystems, increasing total value locked, with high usability is the safe bet. Buying into projects that promise the world with no usable product heavily increases risk.

Emin Gun Sirer is the founder of Avalanche, he carries a PHd in computer science and engineering. Having such a well-respected and brilliant founder, especially in such a new area of technology is tremendously important.

The research team of Avalanche is known as AVA Labs. Ava labs has researchers from google, Microsoft, Cornell Univsersity, Nasa, and Consensys to name a few.

AVAX Thesis/Tokenomics

AVAX is the token associated with Avalanche protocol, it recently made it onto Coinbase Pro. I have begun dollar-cost-averaging into the project since it is now more accessible. Avalanche has bridged almost 5-billion-dollars from the Ethereum network so far, this number has been increasing rapidly. AVAX is currently staking 63% of the total supply, approaching the levels of Cardano, which is the most highly staked blockchain as a percentage. Staking currently provides 10% APY. AVAX has a limited supply of 720 million, currently 220 Million are circulating. With such a high staking percentage, less tokens are on the market, this can easily squeeze the price higher with a supply shock. All transaction fees on the network are burned from the total supply, this might eventually make the project deflationary. AVAX token’s initial allocation reserved a whopping 50% for staking rewards, with minimal seed and private sales. 10% is reserved for the foundation which means they will continue to have funds to build the project and ecosystem.

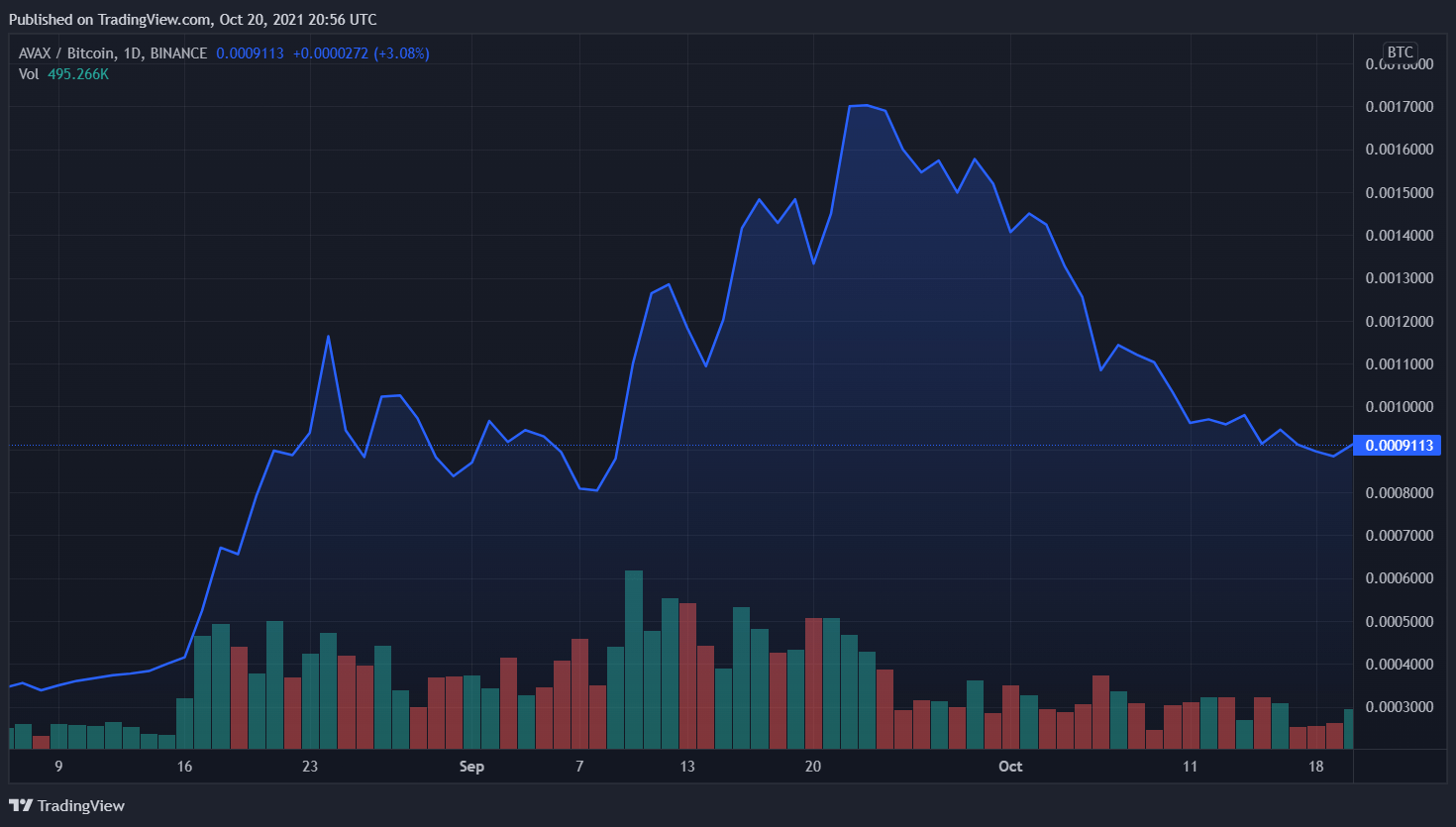

Today the market cap is around 13.3 billion, with the token price around 60$, this is a 36x from Ethereum, a large upside. If we use the AVAX/BTC chart we will notice that AVAX is at a tremendous discount compared to Bitcoin today. I like to purchase alt coins when they are weak vs. Bitcoin and Ethereum, this ratio helps me realize potential relative discounts. As the market becomes stronger in crypto, less investors will compare tokens to USD, they will compare them to BTC and Ether. I am extremely bullish on AVAX, I believe it is highly undervalued, it is a safe network, with great tokenomics and foundation built from the ground up. The relative price compared to Bitcoin and Ethereum, and its general popularity in the crypto community, make it a buy for me today and going into this quarter. As always please do your own research, I could write a dissertation on the inner workings of the protocol, but that content is better left for other websites. Thank you!

[3] https://toppsnfts.com/