A big factor in the success of any investor or speculator is quality of research. This article will be a list of sites and services we use to get reliable information and how we meld it together to make our choices.

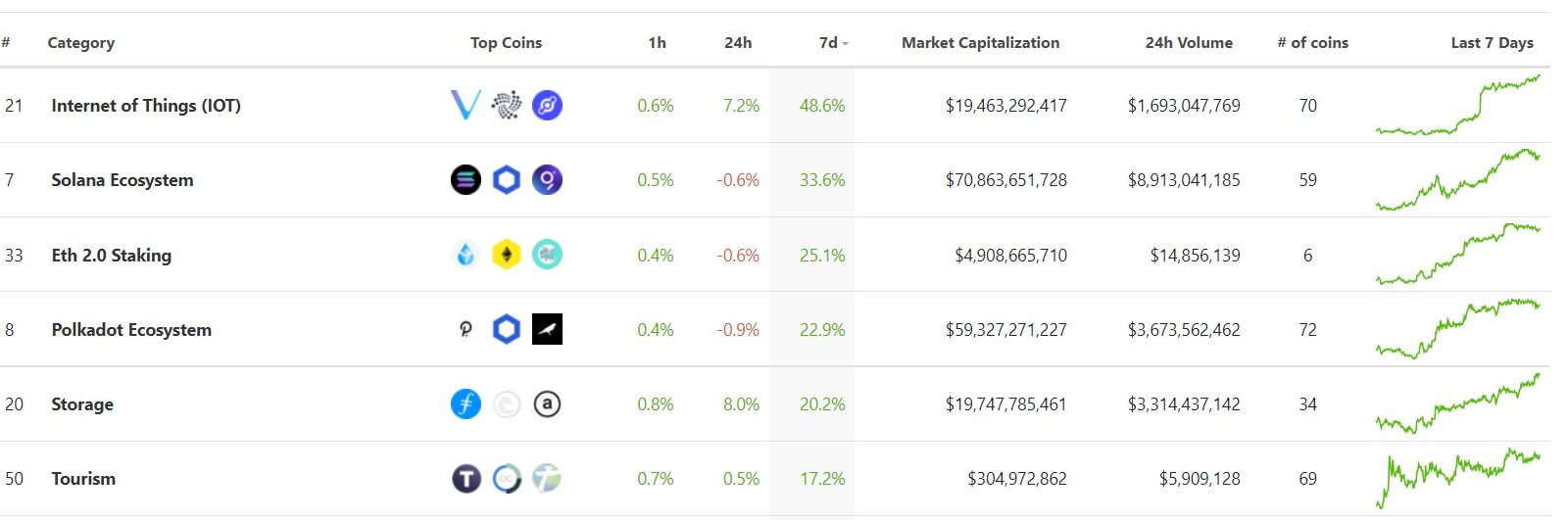

A big factor in the success of any investor is quality of research. The longer I am in the space the more I view myself as a speculator who will also swing trade narratives/news. This article will be a list of sites and services we use to get reliable information and how we meld it together to make our choices. It will also include applications we use for quality of life and other reasons. Perhaps my favorite tracker that I use daily is [Coingecko], Coingecko is great for tracking prices of tokens and visualizing trending themes. Below we have the categories section filters for the top 7-day performance within each category. This is a rather easy way to see what people are buying as a narrative. For example, I was mentioning Luna and Avalanche ecosystems about 30-40 days ago as possible explosive ecosystems to our pre-launch followers. I also use coingecko to manually track my crypto net worth, you can add your trades to track cost basis also, this is great for quality of life since most exchanges (decentralized or not) do not offer this tracking. Coingecko also has daily reward of gems which can be used for discounts on other products, I used this to buy my Trezor T hardware wallet. Here is a link to [Trezor].

Coinmarketcap

If I cannot find a project on Coingecko or want a second opinion I use [coinmarketcap] as a reliable option for price data. Both coingecko and coinmarketcap offer trading view images to see better chart information. They also both have sections on news, airdrops, and education in the space. Coinmarketcap has a free airdrop section where users can track the next airdrops occurring for projects. Both websites offer watch lists which can be great for categorizing projects you are looking at. For example, I have a watch list for Cardano projects that will be integrating shortly after Cardano goes live in September.

Social Media

The holy grail of crypto news in my eyes is Twitter. I never used twitter before my interest in crypto, but by following the projects I am interested in, I can get very early news, before it hits the news sites. I follow every project I own on Twitter and check daily; this is also used for possible future investments to see how developers handle situations and learn more about the project. You can see which influencers/investors follow projects also which can be useful. Facebook can be semi-useful, but I prefer Twitter as it is much simpler and to the point. Youtube is also a great avenue for audio-visual reviews, and I have a list of trusted pages that I listen to for information and perspective.

Crypto News

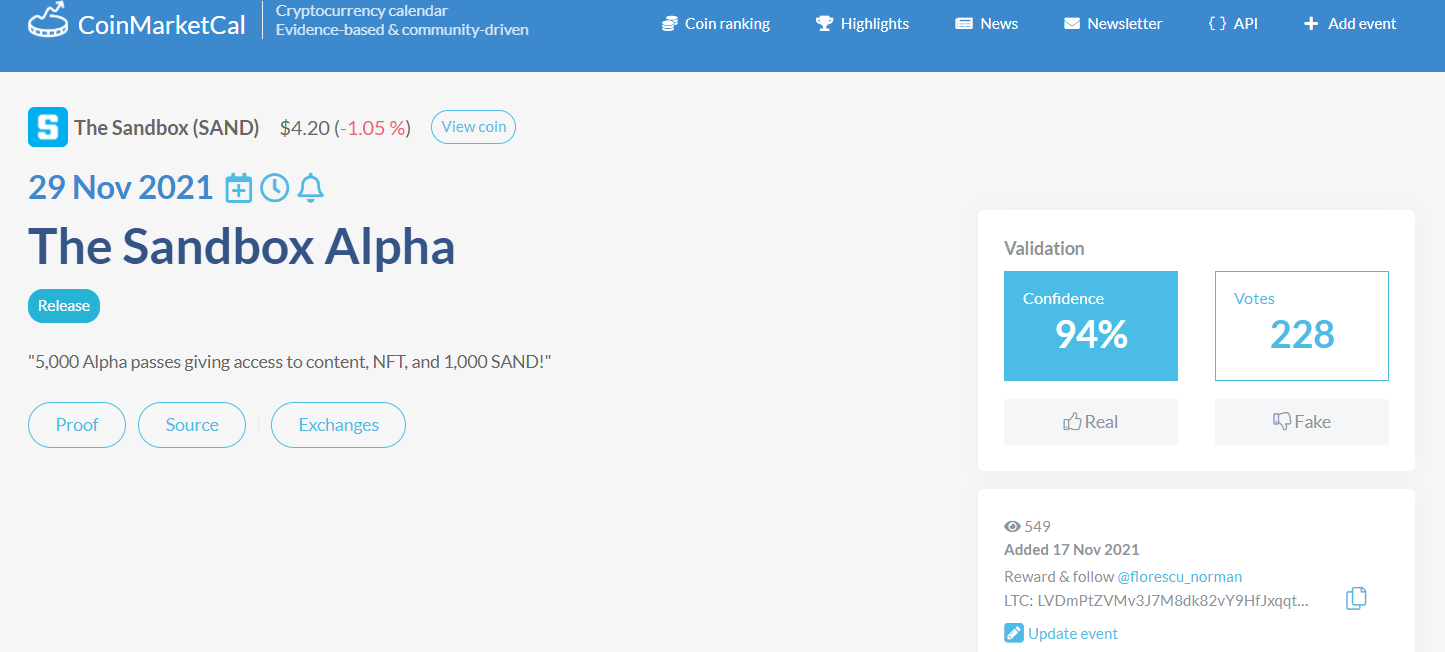

Perhaps the most trusted news website in crypto with the largest following is [cointelegraph], which has great art for their article headings, and quality news. Cointelegraph has the typical layout of a news platform but also offers a market analysis section and a cryptopedia for learning about projects. [Decrypt] is another great news site that offers a wide array of crypto news. Another important news website is [coinmarketcal], this website is a simple layout showing when projects have certain developments occurring. This can be helpful for news-based trading to stay ahead of the herd. I use this website and twitter for most of my news based moves. Each news event has a confidence score and a proof section for reliability. An example below is a major milestone for SAND, nearly 4 years in development. SAND will be launching their alpha of the game/metaverse on Nov. 29th.

Defi Llama

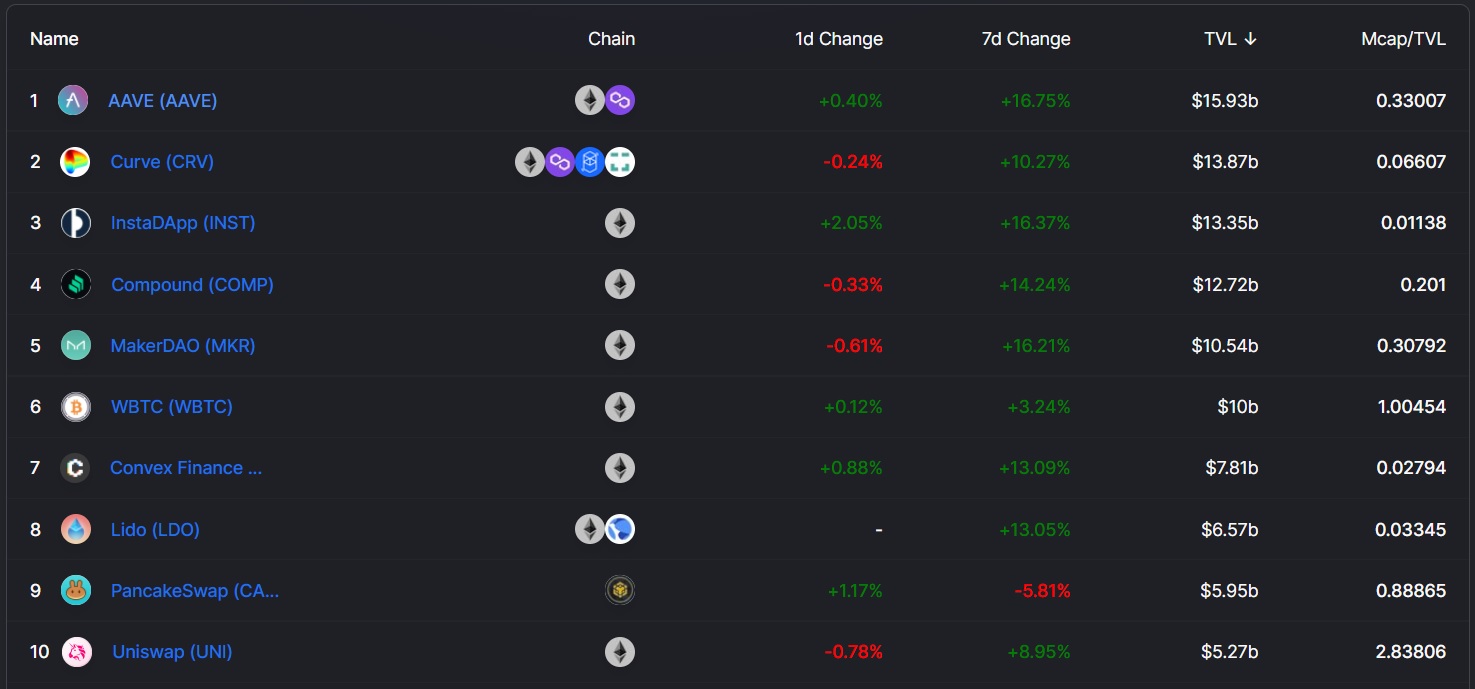

A great website for tracking decentralized finance projects is [Defi Llama]. You can track the total value locked in crypto and also categorize the data based on blockchain ecosystem. This site is a simple and useful way to track value of crypto locked on projects. If a project has a low market cap but a high value locked, it may be undervalued. Perhaps the most important metric on the site is the total value locked to market cap ratio. If a project high ratio it could be considered overvalued if it does not have other things to offer, the opposite is true for a low ratio. A great example of this is AAVE has a ratio of 0.35 meaning its market cap is around 30% of the total funds locked on the platform, this is bullish for AAVE.

Putting it all Together

These are just the websites I use at the current time, MoC uses some other techniques for analysis. The hard part of the research is putting all of the different website data together and forming an investor thesis. The longer you are in the space, and the more you see trends and narratives, the more successful you will be. Hopefully this was helpful, at the very least I recommend using a website to track your total crypto portfolio to see cost basis and net worth, this will put all trades and holds into perspective. Please keep an eye out for part 2 of this article where I discuss which technical tools I use to make purchases. This will also review which tools I use to spot impending market tops or bottoms. As always stay safe out there, do your own research, and none of this is financial advise!