2022 was a difficult year for the cryptocurrency market entirely. With prices plummeting, multiple industry changing events (FTX, LUNA, 3AC, etc.) – nearly every metric you look at screams that people are leaving the industry and cryptocurrency is dying. This is because the metrics we typically associate with stocks and other traditional assets – market cap, share/token price, etc. tell so very little of the story when it comes to complex ecosystems in the world of cryptocurrency.

At the end of 2021, Avalanche and its AVAX token were tearing up the industry. Pure unstoppable growth. Bitcoin was hitting all time highs and everything was great. Since then, it has been a rather… abrupt change. Or has it?

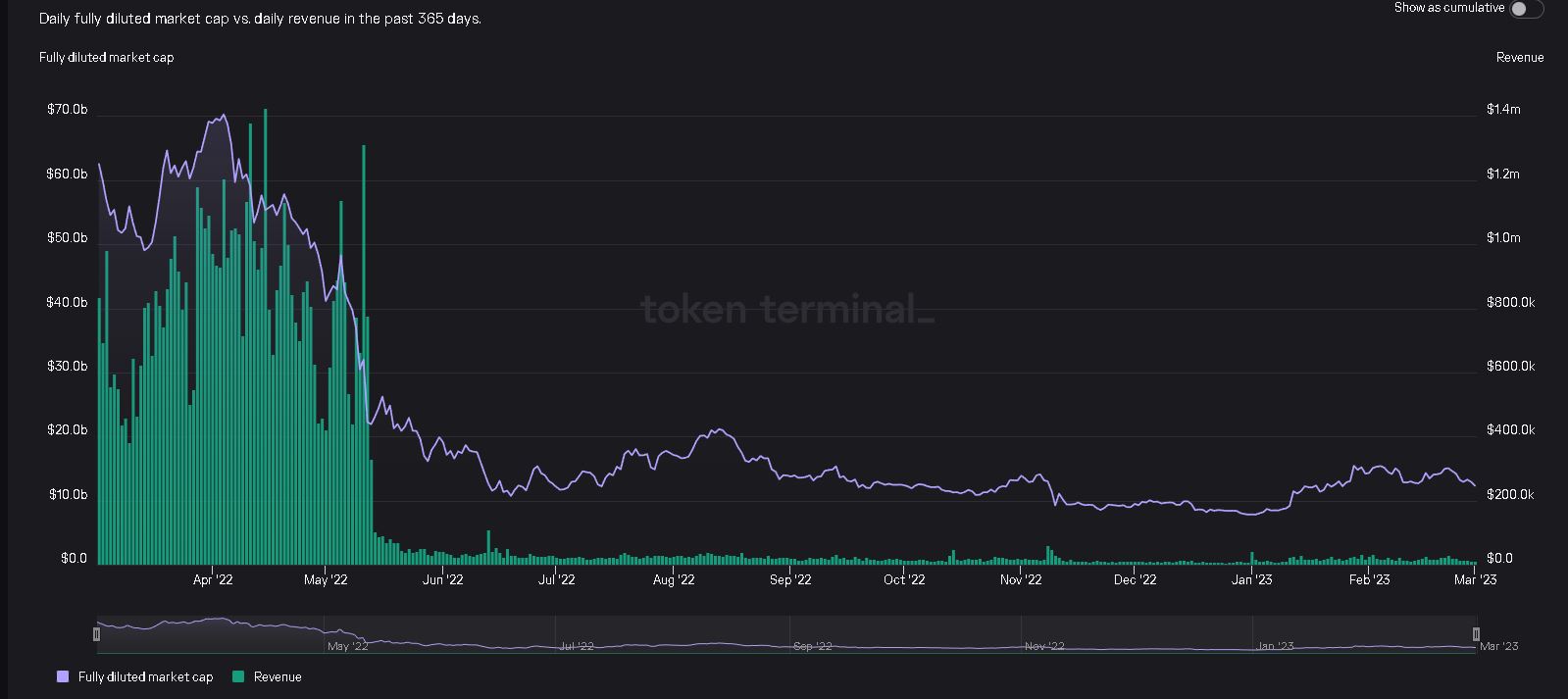

The simple metrics say that Avalanche isn’t doing well. Average Daily Addresses on the C-Chain are down nearly 49% YoY between Q4 2021 and Q4 2022 (Avascan). Average daily addresses on the C-Chain are down nearly 67% YoY (Avascan). Average transactions per second on the C-Chain are down 67% (Avascan). Avalanche’s quarterly revenue is down from $30,279,971 in Q4 2021 to $1,457,300 in Q4 2022 (Token Terminal). The Price-to-Sales Ratio (P/S) has gone from 91x to 846x in the last year, suggesting that the AVAX token is wildly overvalued compared to historical levels, even at these reduced prices.

So why would anyone invest in Avalanche and AVAX right now? There is clearly no growth in the network, right? Wrong.

Everything is going according to plan. Even with the enormous macroeconomic headwinds from looming regulation, the ongoing bear market, inflation – Avalanche is absolutely blossoming right before our eyes.

Avalanche’s core mission has been the development of subnets within its network. These subnets are essentially mini-blockchains that allow significant customizations, token economics and rules, but still leverage the overall security through validators afforded by the Avalanche blockchain. This is incredibly important for two very different reasons.

Growth in the Avalanche Ecosystem is Happening Even if the Price of AVAX is not Increasing

With the boom in use of Avalanche subnets happening throughout 2022, it would seem like the price of AVAX should have been more resilient than it has been. The statistics listed above seem to point towards C-Chain losing users, less activity, lower revenue, etc. The issue with these metrics is that they are for the C-Chain alone, and do not include subnets.

Before subnets launched, Crabada drove the vast majority of daily transaction volume on the AVAX. Defi Kingdoms was not far behind. The transaction fees accounted for a large portion of the Avalanche revenue. When Swimmer (Crabada) and DFK Chain launched, these transactions no longer occurred on the C-Chain network, reducing the physical activity, and revenue, on the C-chain. This creates downward price pressure on AVAX token value.

Avalanche burns 100% of its transaction fees (in AVAX) – so C-Chain revenue directly influences AVAX market value. The average transaction fees in USD dropped >80% in 2022 (due to the price of AVAX), and the decline in number of transactions due to subnet migration strongly contributed to the major reduction in AVAX price. The scarcity of necessary resource (AVAX, here) has been a value driver for the token price. For more AVAX token economics, please check out our previous article here: https://www.coinbusters.io/avalanche-avax-crypto-fundamentals/

There are many subnets currently out. While each subnet technically (as described above) stands to reduce AVAX C-Chain revenue, there are enormous benefits to this boom in subnets. This keeps the main AVAX network fast and with low gas fees due to reduced network congestion.

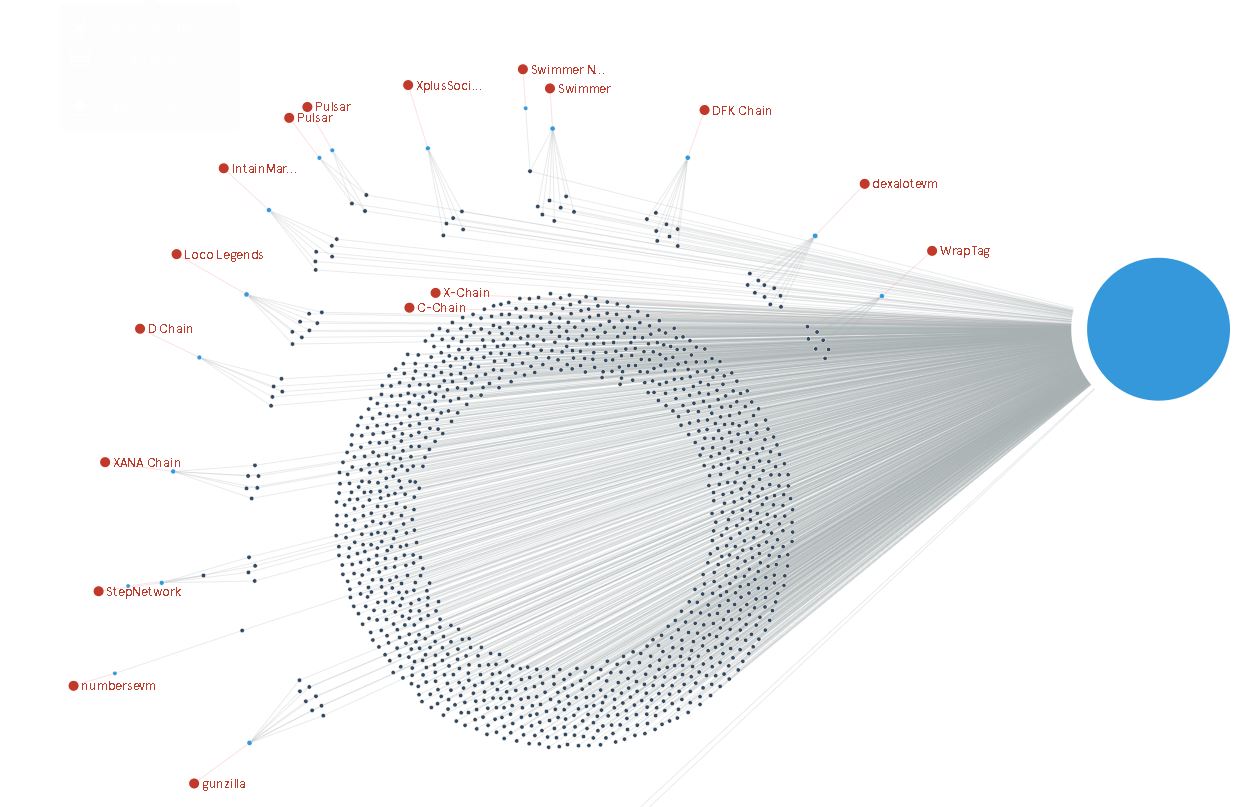

Currently, on the Fuji test net there are nearly 2000 active subnets in development:

Avalanche is nearly infinitely scalable. The mainnet still sees major usage for everyday users for DeFi and other applications. The subnets all run on their own and don’t bog down the main net, but are required to incentivize AVAX validators for their consensus mechanisms.

AVAX is also a hard capped asset. If 200 subnets go live in 2023, for example, this would require a minimum stake of 400,000 AVAX across the networks. With Warp Messaging now active, subnets can now communicate directly with one another, further increasing the possible applications of the subnet technology.

Amazon has chosen Avalanche’s subnets for its Amazon Web Services (AWS) operations. Each subnet, if extremely active, will eventually suffer from network congestion. This brings in the need for new subnets that can leverage warp messaging. See where I’m going with this? Think about how massive AWS without this scalability. Each company using AWS could in theory be operating within a secure subnet. Each subnet requires an additional 2000 AVAX to stake. The total supply of AVAX isn’t increasing, it’s hard capped. There will eventually be a resource scarcity challenge on AVAX as time goes on, which is likely to supersede any “loss of revenue” (and token value) these subnets cause. A great resource for some additional information on this partnership can be found here: https://cointelegraph.com/news/ava-labs-and-amazon-s-partnership-could-expand-the-pie-for-blockchain

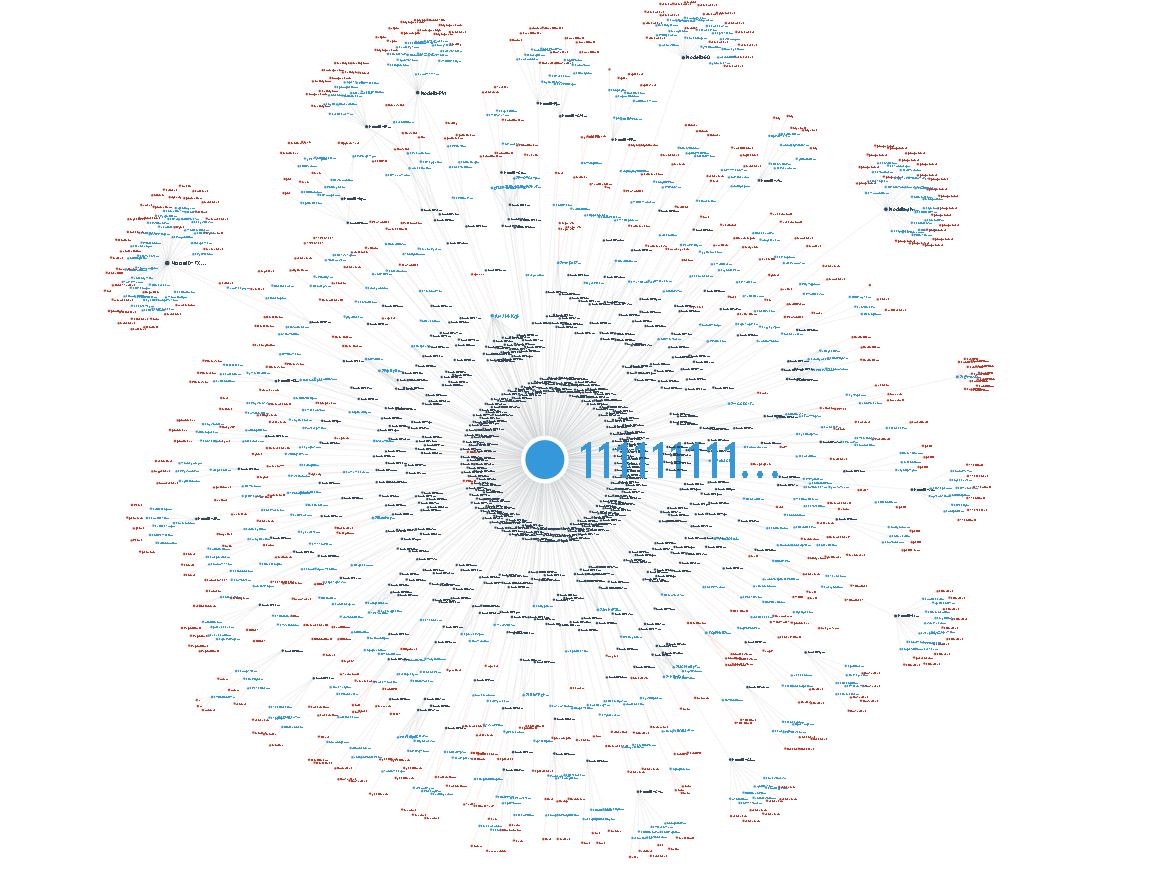

The subnet narrative is not new. It has been the network’s calling card since pretty much day one. The impact on token price that this blossoming narrative has caused may have been somewhat overlooked. Despite this, the ecosystem is absolutely roaring. As more and more of these networks go live through new use cases, web3 growth, and additional industry partnerships – will there be enough AVAX to go around?