Ethereum is currently the second largest crypto asset by market cap. Over the past few years, ETHE has heavily closed the gap between Bitcoin and itself.

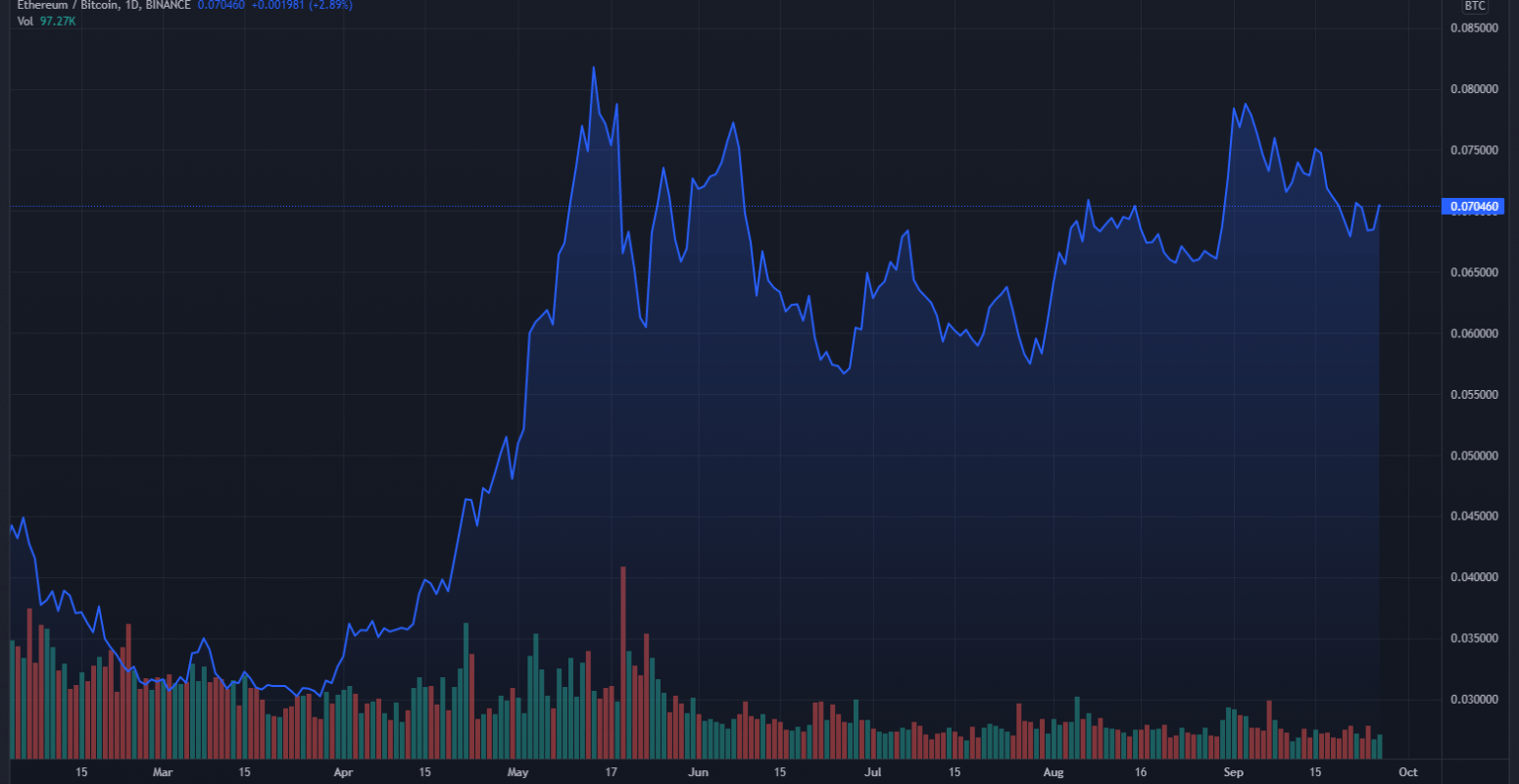

Below is a chart showing the Ethereum to Bitcoin ratio over the last 6 months. It is noted that Ethereum is closing on a 3x when this ratio considered. This means that Ethereum has outpaced Bitcoin, less Ethereum is required to equal 1 full bitcoin, this equates to a higher rate of return. During the last major bull run of 2017, Ethereum was close to .15 on this same ratio. Ethereum has at least another 200% vs. Bitcoin to reach this high. This opens the potential that Ethereum will continue to outpace Bitcoin by at least 200% for the rest of this next bull leg.

EIP-1559

Ethereum technically does not have a limited supply which previously made it an inflationary asset, like our us dollars. Since the recent upgrade of EIP-1559 an Ethereum burning mechanism has been added to every transaction, reducing the supply over time. In the future if the network usage continues to grow, this will make Ethereum a limited asset like Bitcoin, simple supply and demand economics. Over 100,000 Ethereum has been burning this month, at approximately 3.8 Ethereum per minute, this is very bullish.

Ethereum 2.0

Ethereum is currently a proof of work Blockchain like Bitcoin. The impending Ethereum 2.0 upgrade aims to change this to a more ecofriendly and cheaper mechanism known as proof of stake. Both of these concepts are explained in our intro series articles. Essentially proof of stake is superior because it requires far less computing power to validate and secure the network, this will bring institutional investors to the space because of the green energy outlook. Proof of Stake rewards people for locking Ethereum up over time with more Ethereum. This is superior to cash rewards because Ethereum is an appreciating asset.

90% Reduction in Sell Pressure

When you add the deflationary mechanism mentioned above, and the incentives of Ethereum 2.0 staking, this reduces the circulating supply. Hasu, a famous crypto researcher believes this combination will reduce sell pressure of the asset by as much as 90%. Hasu has coined this term the “triple halving”, reducing sell pressure threefold [1]. Famous investors such as Raoul Pal are extremely bullish on this asset for these very reasons. Raoul Pal is a famous hedge fund macro investor famous for retiring at the age of 36. Raoul states “Ethereum is the biggest, clearest bet of all time”. He believes Ethereum is one of the greatest investments in history and that it will become ultra-sound money. Currently it takes 32 Ethereum to stake directly on chain with the network, nearly 100,000$. With each additional 32 Ethereum, this money is locked causing less available supply for trade, the money cannot be withdrawn until Ethereum 2.0 rolls out.

Bullish on Ethereum

At the time of this writing Ethereum in only about 1/3 the market cap of Bitcoin. This gives Ethereum the type of potential runway we look for when choosing crypto investments. As time passes, Ethereum will likely close this gap, creating higher potential rate of return in the long run. Ethereum has many alt coins built on the smart contract blockchain, in fact, most alt coins we mention at this time are based on Ethereum (ERC-20). Ethereum protects billions of dollars dispersed throughout many decentralized projects. It is the most trusted and secure blockchain for this purpose among others. Many “less risky” portfolios in crypto have a large allocation of Ethereum because it has become such a trusted asset in the space. For myself personally I would rather hold Ethereum for the time being than Bitcoin because of the potential upside.

Investor Thesis

For these reasons I choose to hold Ethereum as my risk reduction strategy over Bitcoin. There is nothing wrong with holding Bitcoin, but I believe I will outpace my Bitcoin gains by holding Ethereum instead. We will always have the option to flip those Ethereum gains into Bitcoin in the future if we change our mind. Remember this is not financial advice, just a writing to explain my thought process and investor thesis on the asset. Most of my personal portfolio is an aggressive growth strategy focused on Ethereum and its direct competition. However I would love for all of the ecosystems we mention to work together and coexist which is also possible.

[1] https://decrypt.co/77511/how-will-eip-1559-ethereum-triple-halving-affect-eth-price