This article is a follow-up on the NEAR protocol. We discuss fundamental analysis, future outlook, and the NEAR token economy.

Fundamentals

If you have landed on the page, please check out our intro article on Near Protocol [NEAR]. Near Protocol is essentially a Solana competitor, they fight for the same set of developers since the underlying infrastructure and base code are similar. Near sets itself apart by sharding, which splits the blockchain nodes into many shards adding to efficiency, speed, and cost. Solana has chosen not to take this route. Near is also Ethereum compatible from the get-go which helps for onboarding users that are familiar with Ethereum.

Near brings these features to a blockchain that has not suffered tremendous downtime like its Solana competitor. The thing that attracts large investors to Ethereum, the leader of smart-contract hubs, is the inherent security. Near boasts intuitive creator toolsets that attract new developers to the blockchain ecosystem. With their model of developers first, the protocol rewards developers and creators with potentially lucrative incentives. Since Near is proof of stake it is more environmentally friendly than Bitcoin and the currently state of Ethereum.

Near also boasts the interconnectivity of Polkadot and Cosmos, two leaders for that niche of the market. Near furthers this by creating its own on chain version of Arweave. For those who have not heard of Arweave, it stores the history of Solana and other data/news in a permissionless and immutable manner. Since Near aims to complete this process natively, the developers have interwoven the tokenomics with this data storage model.

Tokenomics

Near Protocol is based on cloud infrastructure. The protocol is severless which promotes decentralization. The protocol itself is not only a hub for smart contracts, but a database that stores information permanently, this data cannot be tampered with [1]. Validators are incentivized to create a community cloud network, this allows for decentralized application use, and data storage. The supply side of the network comes from the validators who secure the network, using proof-of-stake which supplies a reward over time in NEAR tokens. The demand comes from developers that wish to build on the network, and end-users that participate as well.

The importance of storage being integrated into the underlying tokenomics cannot be understated. Imagine the smart contract data storage for USDT, the whitepaper states around 10,000 NEAR would be needed for just that one contract. Combine this with the NEAR that is staked by validators and delegators, and more NEAR storage demand from other contracts; a high potential long-term token price arises.

Nodes are awarded a 4.5% reward yearly for their locked tokens. Fees on the network are split into two types. The first type is short-term which is the general transaction fee, Near has averaged this data to provide a steady average fee that is implied. The second type is the long-term which involves the Near data storage. Storage costs are covered by holding a specified number of NEAR tokens in the interacting wallet address. This process removes some of the available supply for trade, as demand for development increases, so does demand for the data storage [2].

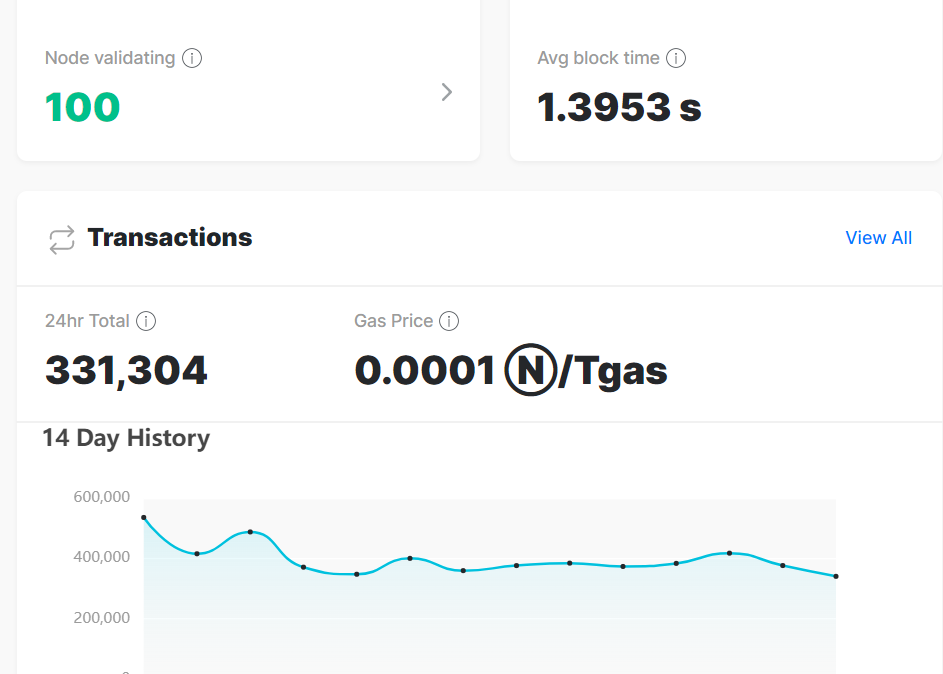

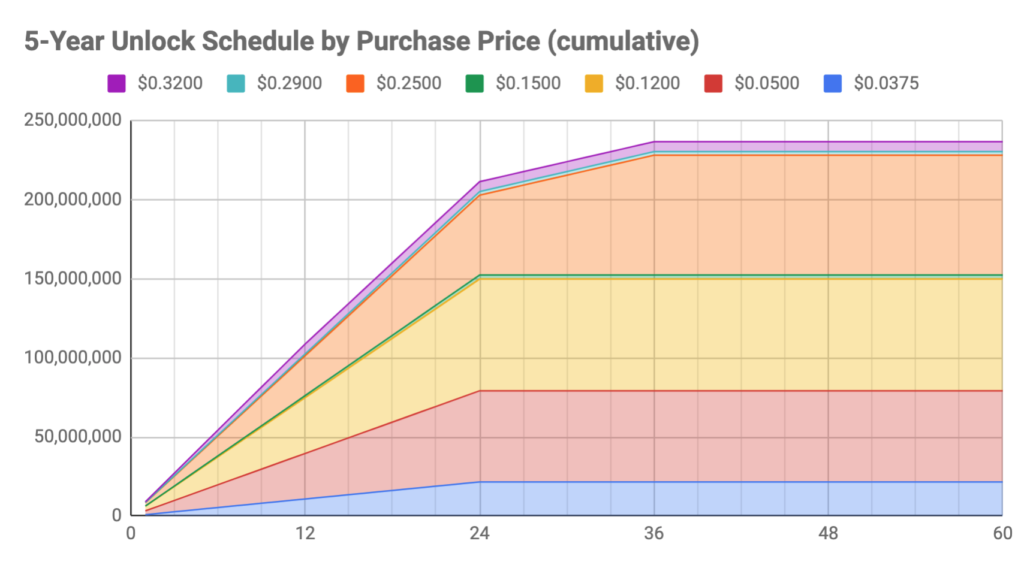

Near does have a burning mechanism similar to Ethereum which eliminates some Near token supply with every transaction. With increased burning, Near can potentially reach a deflationary supply over the long-term. Near token gas costs are smoothed out by using the long-term average, much more attractive than Ethereum gas volatility. 10% of the total token inflation goes to the Near treasury for future development of the ecosystem and product. Below shows how far Near Protocol has come, and this data was from January. Below is the release schedule which is typical to entice early private investors. You will notice the sudden ramp up and then flattening of the emissions.

Future Outlook

The NEAR whitepaper has a lot more information about token economics and the fundamentals of the project. NEAR has a total supply of 1Billion tokens and over 70% of those are already unlocked. High percentages of unlocked tokens is generally considered bullish since there are less to dump on the market. With a yearly inflation maximum of 5%, NEAR does not overdo it with the rewards. The minimum stake for NEAR to become a validator is currently around 67,000 NEAR tokens. This number is subject to change through governance since there are currently 100 validator seats.

Near has a very intricate technology known as dynamic sharding. This process allows validators to split their processing nodes into several shards when the demand increases, splitting validator strength. This process also allows shards to merge when validators are inefficient due to low volumes or other situations. This technology allows NEAR to adapt to the current demand and environment throughout the day maximizing efficiency. Add this to the 30% fee reward developers receive from their smart contract use and you have a strong set of tokenomics and fundamentals. If a process calls on two smart contracts from two different developers, the 30% reward is split 50/50 and so on.

With increasing developer activity, and a decent number of daily transactions during a bear market, you have a powerful recipe. I will be transparent stating that I have begun my NEAR DCA as my thesis leads me to believe it is a stronger project than Solana. Near is a safer bet than aggressive lower maket-cap layer-1 projects since it has already some what proven itself. Venture capitalist funding can only take a project so far, the rest relies on what is under the hood, who is building, and what attracts users to the layer-1. Remember the NEAR token is the investment, yes the network itself is part of that, but the tokenomics are key.

Mixing the storage component, validators, delegators, fee burns, fee rewards to developers, I believe the NEAR token passes the test. I would rate the token economy a 8/10 assuming it can continue to attract volume. The score is reduced from inflation, and lack of true utility other than storage. Remember none of this is financial advice, do your own research, and stay safe out there!

[1] https://near.org/papers/the-official-near-white-paper/#how-near-works

[2] https://near.org/papers/the-official-near-white-paper/#economics